People are excited about AI but it is going to be even bigger and more shocking than anyone can imagine. Here is another buy opportunity for NVDA approaching, an AI leader.

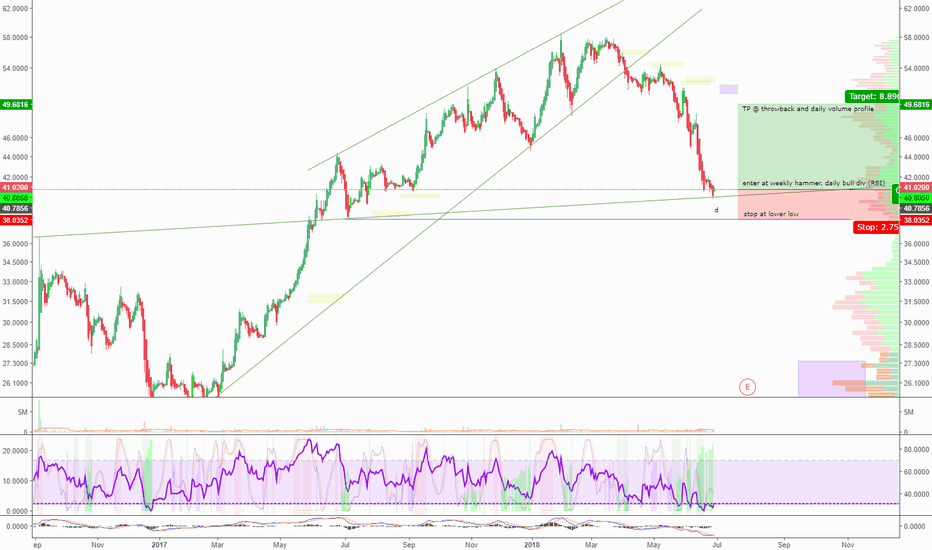

This set up isn't isolated to MU but I believe MU will be the best buy on this set up. Here are two other examples: VISA S&P 500 MU is chosen because we are at weekly volume profile, 2 over sold indicators on weekly, strong fundementals. Entered @ 41.61 (end of day).

Opening a BTC long at support area. Entry @ 6565.99 Point and Figure i.imgur.com We have a new small column of X's confirm at yesterday's close. The long pole of X's from July 18 has been resolved. That means we have no long poles going all the way back to October 2017. That is almost a year of consolidation. We are very close to Support Levels These are...

Good R:R for AVX short with a tight stop.

2 part bull div on daily RSI shows us a buy opportunity on PIVX. PIVX is a good alt-coin, way down from ath just like the others. Several altcoins have set up like this right now so there are other buying opportunity on the crypto space. Unlike other coins, PIVX has good fundementals: a devteam still making releases and active on github, and a good use case:...

DIS is poised for break out of trendline going back to august 2015. Decent chance it will happen, but risk:reward is on shorter side as we can risk our short off a higher high.

CNC is a very strong, parabolic stock that can be used as a hedge against your long portfolio. Do not enter position until weekly close below parabolic trend.

Watch for H&S to play out and confirm on the 1 hour before taking a short position.

Bullish divergence on the daily RSI confirmed 20 minutes ago: Here is a cheat sheet on divergence: i.imgur.com Here is a historical look at daily divergence since we reached ATH 6 months ago: As you can see, they all played out at least for the short term giving bulls some relief. Point and Figure Chart i.imgur.com Yesterday we confirmed a column of 14 O's....

After a big pullback and a bull div on yesterdays close, NTDOY is set to move up.

We were watching PEP a few days ago when we had a bear div on the daily during a weekly downtrend. Didn't take a short at the bear div because was concerned about R:R and where to take a short. At yesterday's daily close, the pot sweetened for a PEP short as we moved up without invalidating the bear div and closed with a long upward wick (but green). There's...

CMG: we still in downtrend on weekly. 3 part bull div on daily is probably related to weekly trying to make a higher high (it hasnt yet). This could be a sell opportunity with stop if we break higher high. The target would be the gap fill and weekly volume profile node. Because its a short, on a daily-weekly timescale, and the r:r isnt great, this is not a...

Here we have a short set up for SOGO,which has gone up a whomping 75% in the last 2 months on speculation. Yesterday we had a high volume shooting star, a common reversal pattern, and arguably a 'blow off top'. Today we retraced along the wick of that shooting star, creating a short opportunity for brave traders. I believe win probability is below 50%, but a...

A tight stop could be set here but I went with a bit looser one that would confirm a break down from trendline. Could be held long term or short. Good risk:reward. The topic of genesiology/eugenics may be ignored and considered morally reprehensible in modern society, but appears to be inevitable. I will ignore moral argument for this discussion. The film...

Here's a hedge against the market, today SIVR broke symmetrical wedge going back 2 years. If it closes above the wedge that is a confirmation of the break. Especially true if it breaks 16.91 (higher high) and holds that near tomorrows close. If that happens, best time to buy is sometime tomorrow afternoon. If we can't stay above wedge and make higher high, it...