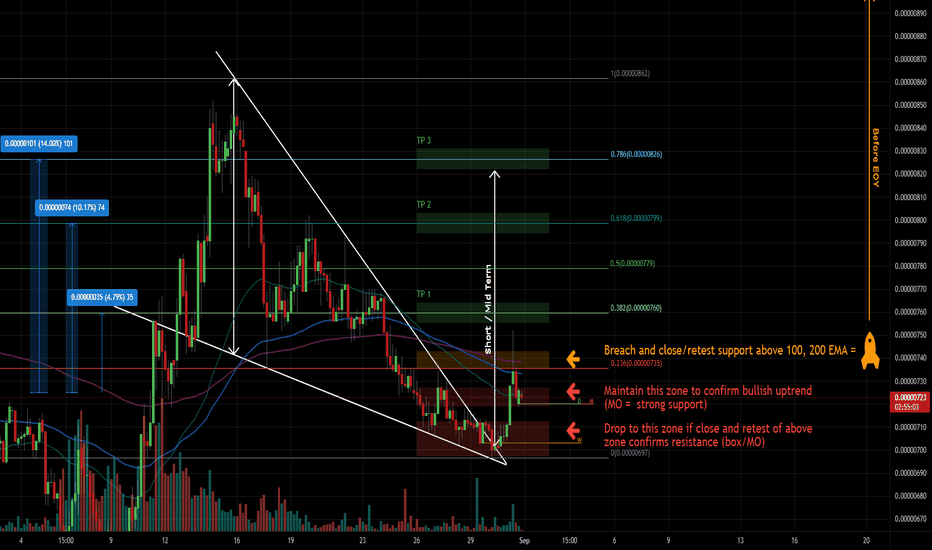

In my humble opinion, XLM/BTC has broken out of a descending wedge. This is a bullish formation and is seemingly confirmed - could this be an early sign of an impending impulse wave to the upside? Regardless, decent long opportunities for the short/mid-term assuming we see continuation. XLM has a strong correlation with XRP, which has been showing signs of a...

Some potential routes based on previous S/R, MA/SMA, weekly open, monthly open, and chart patterns. New to this game so any/all feedback is welcome. Not financial advice. DYOR. Just my 0.00000002 Sats.

We may see a pullback to 35-33 sat range as a healthy result of this resent uptrend. I would say in the next week or so. So many little green candles. Short-mid term: Establishing confluence: Price action, Volume, RSI, MACD, BTC Hashrate, BTC/Altcoin Dominance We've tested 41 sats 3 days in a row (-1). We haven't seen any significant volume increases that...

If we can break here at 0.00000071 sats and the stars align.... potential 125 sat range incoming. Need that 4-hour MACD to cross zero and the volume to continue flowing. Not financial advice. Just my 0.00000002 sats.

Considering the current bullish flag formation (considerable spike up followed by a pullback and down trending consolidation), this is my estimation of what we can potentially expect with an impending breakout. It's important to note that once we've broken resistance, you will need to look for higher than average trading volume to confirm the breakout will...

New to the game but wanted to get your guys' opinion. In 2017 we saw something very similar to what we're seeing now. SC spiked to 90+ sats in late April 2017 then pulled back and consolidated for about 5 days before rocketing past 100 sats. Current SR lines seem to be showing a wedge that I believe will result in another pump around Apr. 21st sending us to...