On the chart, we have consecutive trigger lines that have been broken, and after the SW L, we see a bullish iCH and higher Ls, which are bullish signals. However, considering the Bitcoin dominance chart, buying altcoins or taking long positions on altcoins is risky. It is better to look for short setups on altcoins instead. Targets are marked on the chart. The...

If we look at Bitcoin on hourly timeframes, we expect a rejection from the red zone. However, this rejection must be strong because if it is weak, Bitcoin may not be inclined to correct further or might at least enter a choppy corrective trend. The substructure is also bearish, a trigger line has been lost, and ultimately, we have a bearish iCH on the...

After forming a 3D pattern at the top, wave E of a higher-degree pattern has completed. A new leg has formed from the point marked by the red arrow on the chart. It seems that wave E will end in the green zone, followed by a strong upward reversal. Truthfully, there are other support levels above our marked zone, but we have identified the most important one....

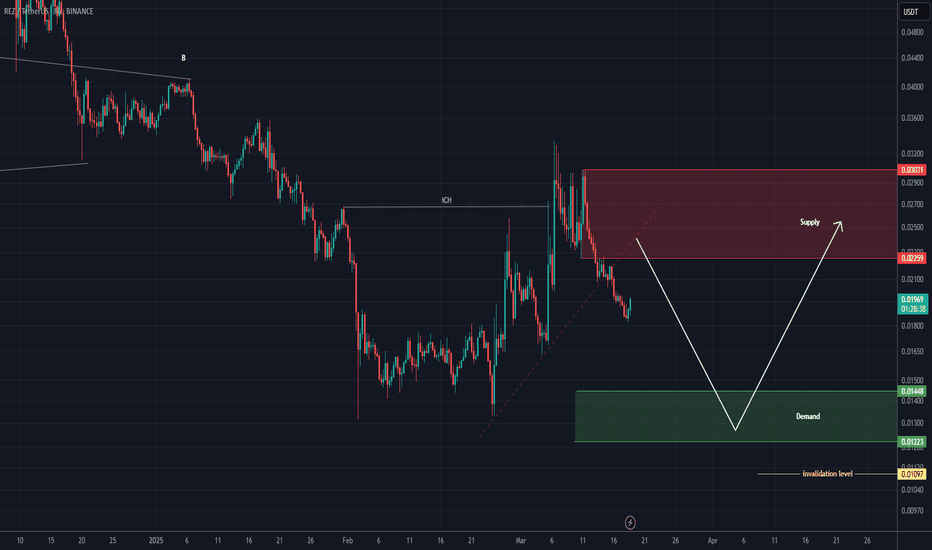

This analysis is an update of the analysis you see in the "Related publications" section It now appears to be in the large wave F of a Diametric pattern. Currently, it seems to be in wave C of F, which is a bullish wave. We expect it to move from the green zone to the red zone and then get rejected downward. A daily candle close above the invalidation level...

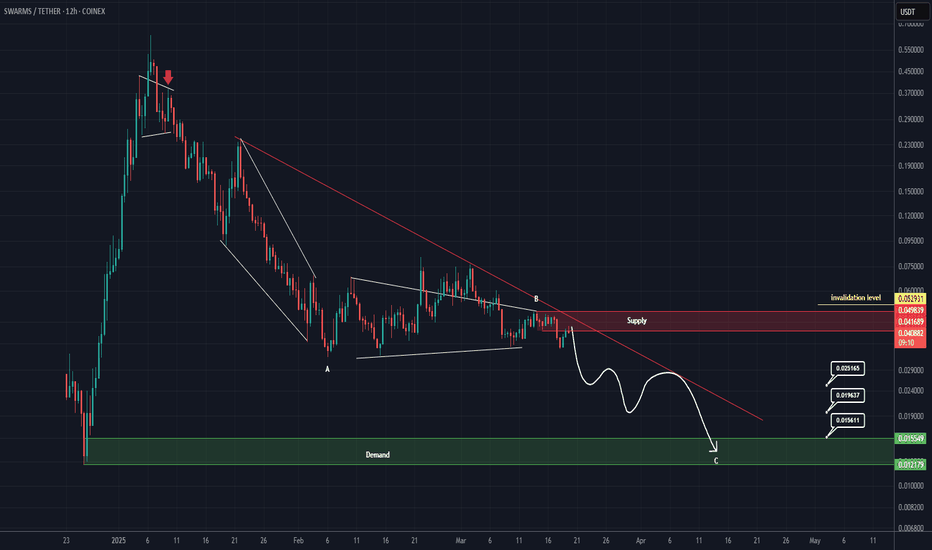

The correction of SWARM has started from the point where we placed the red arrow on the chart. It appears that wave B has just completed, and the price is currently forming a pivot for another drop. We expect to enter wave C soon, with the price moving towards the targets. The closure of a daily candle above the invalidation level will invalidate this...

From the point where we marked start on the chart, MEW appears to be forming a bullish QM. As long as the green zone holds, it can move toward the targets. A 4-hour candle closing below the invalidation level will invalidate this pattern. For risk management, please don't forget stop loss and capital management When we reach the first target, save some profit...

It appears that the NEIROETH diametric pattern started from the point where we placed the green arrow on the chart and completed at the point where we placed the red arrow. Since the bullish pattern has ended and the price is below the descending trendline, sell/short opportunities can be considered in the supply zones. The target could be the green...

The smaller structure of CRV is bearish. It is expected to reject downward from the red zone, with our rebuy zone being the green area. Given that the internal structure is bearish, it is ultimately expected to reach the green zone. Closing a daily candle below the invalidation level will invalidate this analysis. For risk management, please don't forget stop...

IMX appears to be in a large wave B, which is forming a triangle. It is currently at the end of wave d of B. It is expected that upon touching the green zone, wave e of B will begin, pushing the price into a bullish phase. We are looking for buy/long positions in the green zone. A weekly candle closing below the invalidation level will invalidate this...

After the iCH formed on the chart, it seems we are in parts of wave C, which, after absorbing liquidity from lower areas, could push the price upward and complete the bullish segments of wave C. We are looking for buy/long positions around the green zone; however, reaching this area might take some time, so this asset should be kept on the watchlist. A daily...

From the point where we placed the red arrow, it appears that the bullish MORPHO wave has ended, and the price has entered a corrective phase. This phase could be a diametric or symmetrical pattern. Wave G is expected to complete within the green zone. We anticipate a return of 30% to 50% from the green zone. A daily candle closing below the invalidation level...

This analysis is an update of the analysis you see in the "Related publications" section Considering the strength of the wave and the status of Bitcoin and other key indices, we have slightly lowered the support zone, as this coin may form a deeper correction for wave C. We have also updated the targets. Let’s see what happens. For risk management, please...

The MUBARAK correction seems to have started from the point where I placed the red arrow on the chart. The pattern could be a symmetrical, diametric, or expanding triangle. A strong demand zone lies ahead of the price, where we can look for buy/long positions. Targets are marked on the chart. A daily candle closing below the invalidation level will invalidate...

ONDO appears to be in wave D of a larger pattern (possibly a triangle). Wave D seems to be a diametric or symmetrical structure. This diametric may complete in the green zone, leading to an upward reversal. We are looking for buy/long positions in the green zone. Targets are marked on the chart. A daily candle closing below the invalidation level will...

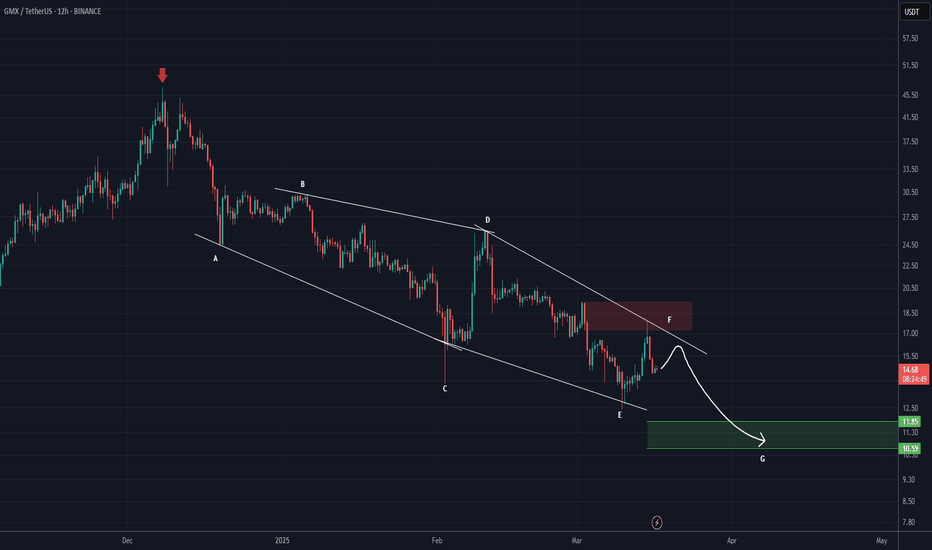

From the point where we placed a red arrow on the chart, it appears that GMX has entered a bearish diametric pattern. It now seems that wave F is nearing completion. The target is marked on the chart. it could be the green target box. If a daily candle closes above the upper red box, this analysis will be invalidated. For risk management, please don't forget...

From the point where we placed the red arrow on the chart, the RED correction has begun. It seems to be inside an ABC structure, and we are currently in wave C, which is bearish. A demand zone is visible on the chart, which could temporarily reject the price upward. Since wave B did not retrace more than 0.618 of wave A, it is expected that the low of wave A...

This analysis is an update of the analysis you see in the "Related publications" section The previous analysis scenario has expired, and this update's scenario is valid. Given the time correction of recent waves and the absence of sharp drops, this scenario for RED is valid, and buyers' footprints can be seen on the chart. We expect a strong rejection to the...

The correction of NEIROETH started from the point where we placed the red arrow on the chart. This correction appears to be a diametric pattern, and we are currently in wave f. Wave g could complete in the green zone, leading to the start of a bullish wave. The closure of a daily candle below the invalidation level will invalidate this analysis. For risk...