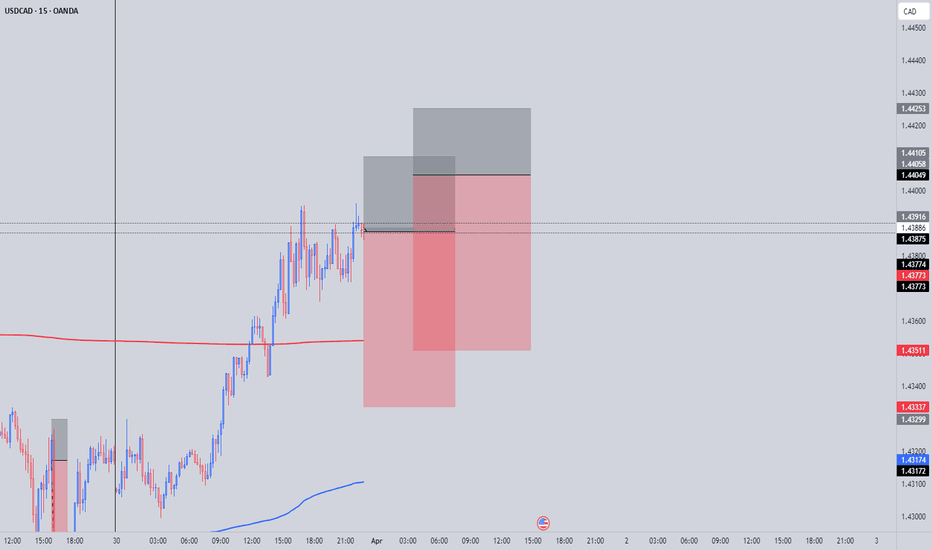

🍁 USDCAD has experienced a strong bullish trend, with an aggressive push to higher prices. However, key fundamental indicators are signaling weakness: - **Inflation** – Negative - **Employment Change** – Negative - **Unemployment Rate** – Negative Despite the current uptrend, these bearish fundamental factors suggest that momentum could shift. At the...

Fundamental Overview: We’re seeing several bearish signals from the fundamental side for USD/CAD: Retail Sales: Negative, indicating weaker consumer spending and slowing economic activity. Inflation: Bearish, as high inflation may lead to tighter monetary policies, slowing growth. Employment Change: Negative, suggesting a contraction in job creation, signaling...

A confluence of fundamental and technical factors supports a long position on Nasdaq. COT data, retail positioning, seasonality, GDP, SPMI, inflation, and interest rates all align with a bullish outlook. Technically, price is in a discounted zone relative to the monthly low’s anchored VWAP, presenting an optimal long entry within the overall bullish trend. My...

I have planned a short entry on USD/CAD around a key level that aligns with a high-value VWAP from the second week's low of this month. This VWAP has consistently acted as a strong reference point, showing Rhythm being tested and reinforcing its significance. Given its role in attracting liquidity and providing structural resistance, I see this as a...

I have planned an entry on GBP/JPY around a key level that aligns with a high-value VWAP from the second week's low of this month. This VWAP has shown strong Rhythm being tested, reinforcing its significance as a key reference point. Given its ability to attract liquidity and provide structural support, I consider this level to be a high-probability area for a...

I am looking to enter a position on AUD/USD at a key level that aligns with this month’s discount zone. Since there are no significant fundamental factors influencing the Australian dollar or the U.S. dollar at the moment, this setup is based purely on price action and technical confluence. Trade Setup: Market Context: Price has retraced into the discounted...

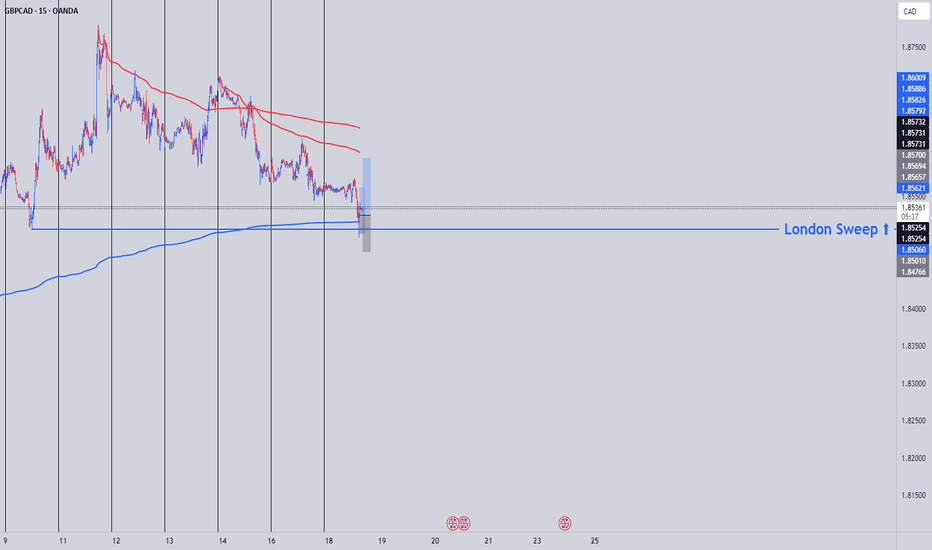

GBP/CAD has shown a strong reaction at VWAP support, with aggressive momentum and precise institutional buy-ins. Price has also swept a key London session low, which could act as a liquidity grab before a potential move higher. Key Points: VWAP Holding as Support – Price bounced off the two-day anchored VWAP with strong momentum. London Low Sweep – A clear...

Technical Setup: EURCHF is rejecting Asia high, aligning with the two-day anchored VWAP, which reinforces this level as a key area of interest. Fundamental Outlook: Several factors support a bullish bias: CO2 data, retail positioning, seasonality, GDP, and interest rates all indicate strength for EUR. The combination of these factors suggests a continuation of...

Technical Setup: GBPUSD is in a strong uptrend but has made an aggressive pullback. Price has now reached a key support/resistance zone and the two-day VWAP, with an anchored VWAP from the low of two days ago providing additional confluence. Fundamental Outlook: The pair remains bullish based on key data points: MPMI, retail sales, inflation, employment change,...

Trump Crash + Rebound strong US economy with discounted prices

Analyzing GBP/JPY based on current market conditions. Watching key levels... Using price, volume and time to assess potential trends and price movements.

Just a quick guess on how this one will play out. Analysis paralysis, not for this setup

TA Price is in discount according to last AVWAP rhythm Reversal POIs a. Immediate VWAP reaction b. LV node below recent low POC c. Taking Liquidity ... Fundamentals + COT - Seasonality - GDP - Inflation N/A Employment Change - Unemployment + Rate Interest Rates

Just wanted to draw some S/D and share some random analysis

If price reaches it I'll have my eyes ready Lets see what price does

Good old light sweet crude oil A very aggressive market compared to FX. Now definitely close to be shifting into pullback or reversal after this momentum

US Economy keeps going up Alarms set, waiting for lower prices to enter again. If price gets to a Premium and starts showing some Aggressive action I'm in short for a shorty

TIP: Identify key VA's that reject price in low value / low volume areas. These price areas (not lines*) will reflect true entry areas where the ones that entered before either quickly moved price away from the current direction (reversal) or very aggressive through it. Price reacts and develops new rithms over a certain time, but one thing will always be true....