bharatbulls

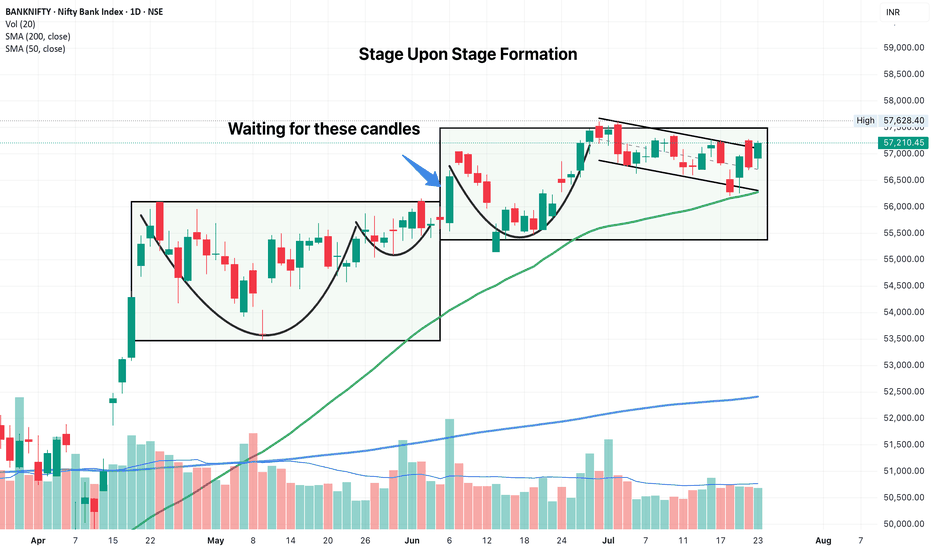

EssentialWe had an inside candle forming today. A small shakeout below today's low would be ideal, but we might move up in a straight line tomorrow if opening is strong. You can play this with options if you like. But do buying and not selling. Max loss should be capped at 1% of your portfolio and reward should be taken at 2-3x the risk

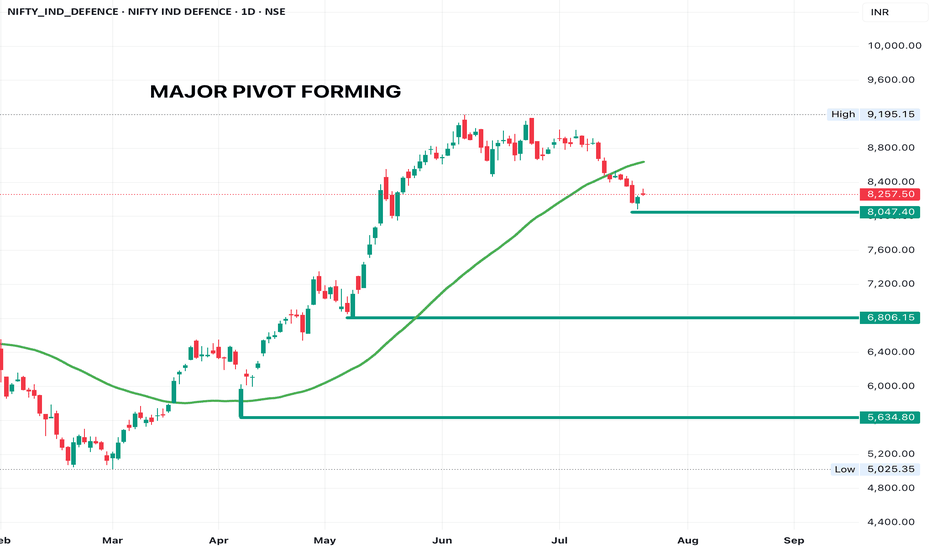

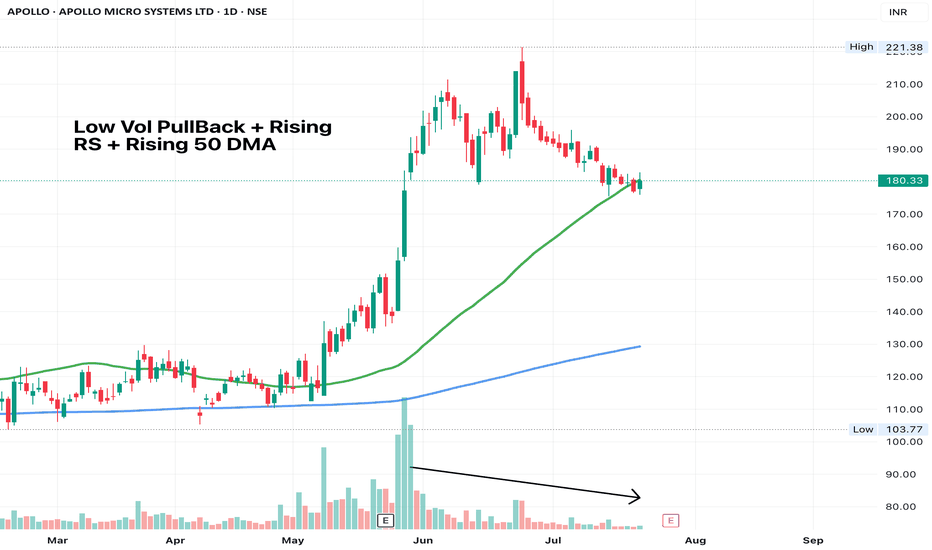

Missed the rally in defence stocks during Apr-May? Make use of the pullback now! People who came in late are getting thrown out. Start nibbling in stocks that are still near ATH. This is a decadal theme. Stocks I like - MIDHANI, AXISCADES, APOLLO What stocks are you tracking?

Wait for one good wide-range candle to take entry. Price often cuts below 50 DMA, forms a small base and gives a breakout candle. This might do that. SL - Low of the pullback

Contractions within a flag is such a beautiful thing to see. SL - Low of todays candle. End of day candle should have minimal wick ideally. Choose a progressive exposure method of entry

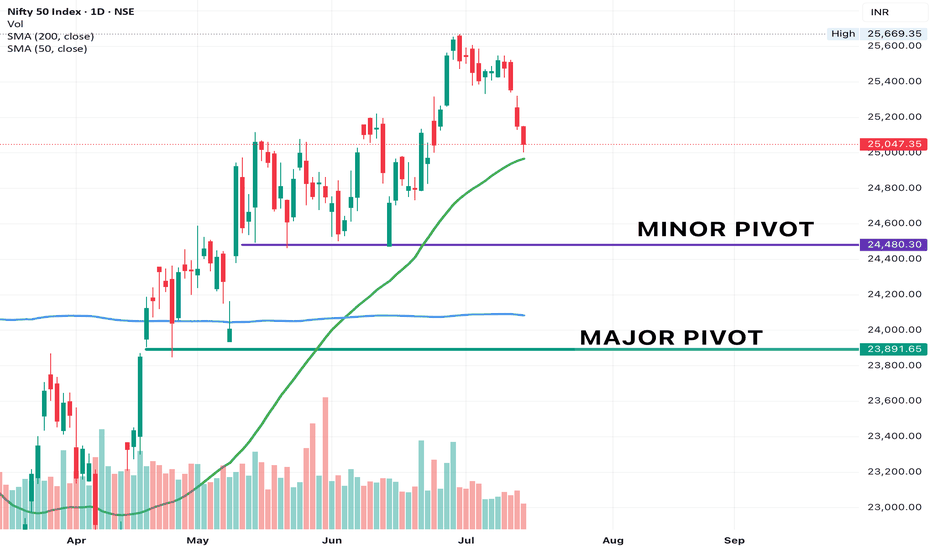

Precious metals have had a dream rally. Time for equities to catch-up. Sectors on my radar - Banks, Finance, Hotels, Defence, Insurance, Capital Market Look to add on every pullback on these names till Nifty500 pivots are intact. This is a routine pullback in a bull run. Don't let the news flashes throw you out of your positions. Nobody made their...

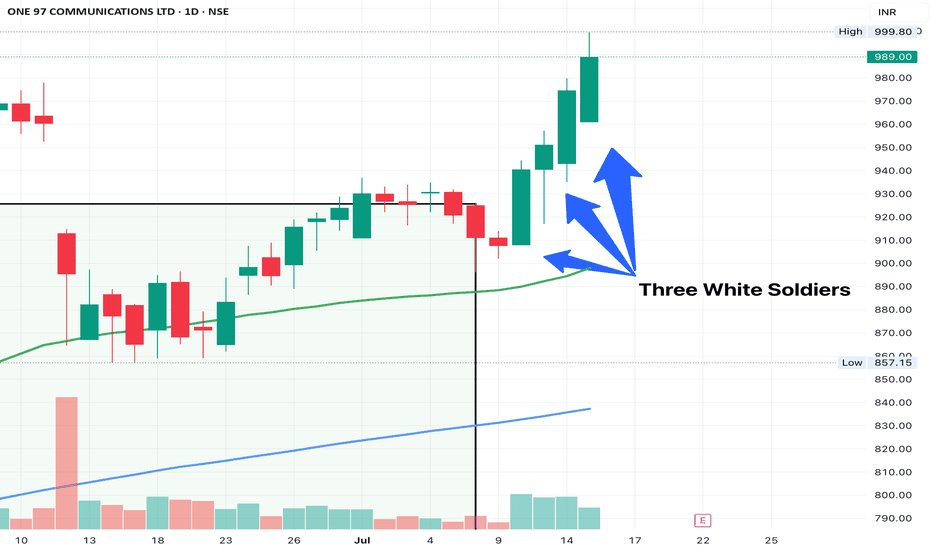

No. of Candles: 3 Trend Context: Appears after a downtrend or consolidation (best) Body Size: Long real bodies (bullish) Wicks: Small or nonexistent lower wick Volumes: > avg of 10 days My criteria for spotting 3 white soldiers - Each candle needs to opens within or slightly below the previous candle’s body and closes higher than the previous candle. The...

Tighter the consolidations, better the breakout. A solid base has formed. Moving with the index, sector tailwinds in play

Structures like this deserve a place in every portfolio. Buyers are ready to pounce on any shares available. This is why having sector tailwinds is so important. SL - 101

Good candle today, valid entry for a swing trade. The volume candle on earnings day is hiding the high volume candles printed in the last week. Keep today's low as SL

Golden Crossover and a new ATH. Simple things can make you money. You don't need fancy indicators for it. Most will ignore a simple template, but those who see the beauty will mint. SL: 441 (Low of Breakout Candle)

Should be a long term play, looks strong from the medium term. Beautiful Chart. MCap less than 10K Cr, poised for growth, strong fundamentals, strong technicals. How to build Positions - Gradual scale in is your answer. Do not put in money blindly at open, good thinks take time to build and so should your portfolio. SL - 480 (roughly 11% away, slow...

Not all charts are perfect, but in my experience, shorter the contraction duration, higher the momentum. Lets see this in action on this trade! Breakout has happened, would love to get a close near the day high.

Flag and Pole Breakout (needs to sustain till EOD to confirm) Great Relative Strength and Good volumes. SL - 170 (partial exit can be done at 180)

We are less than 3% away from the ATH. This is a healthy market pullback. 50 DMA is above 200 DMA and is trending up. This could be a short term pivot and we can touch (or slightly undercut 50 DMA) and continue moving up. My portfolio is infact rising during this pullback - this implies the strongest stocks are actually still leading, there is no profit...

After setting up a nice base, CarTrade is finally looking to move up. Good consolidation in the last few months. Breakout looks clean and the volumes are excellent too! SL - 1650

Thoughts mentioned on chart. It can attempt to fill the gaps it made while moving down. Good Risk reward on offer

Another set-up in the metals space. After Welcorp, LloydSME and APLApollo, this could be another favourable trade. The stock is attempting to breakout of the base today. Volumes have been good and the trend is already in place. Our job as a trader is to sit tight on structures till the trend lasts.

Within the FinServ space, this is a lagging stock, but because the sector has tailwinds, I am inclined to go behind it. Birla is a household name and such stocks do well over a long period of time.