Looks like it is against a big resistance again. On the right, as long as we stay below that red resistance, it suggests the high is already set as well. I am going to do 2 trades here, a scalp (chart on the right) and a day/swing trade. Both different stops but almost the same. Both have a good R/R, especially the bigger trade so worth the risk at this...

This index made a big rally the past week or two, while the rally was much weaker the first 5 weeks of this year compared to other indices. With this rally of the past 2 weeks, it looks like it is slowing down in the form of a bearish wedge. Seems a break has already happened so normally the high should be set already. The target of the wedge is around the yellow...

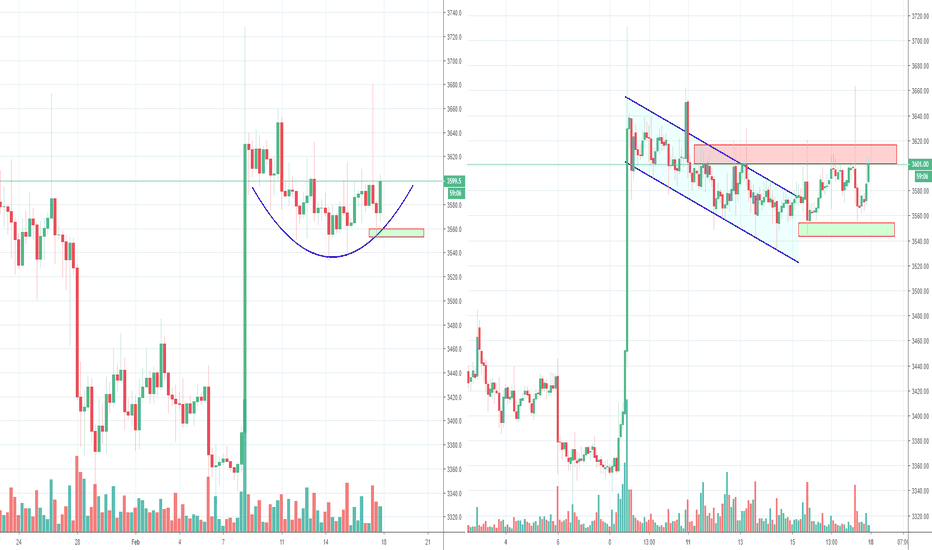

Looks like a real strong inverse H&S here with a V shape low. On the daily we can see a strong candle as well confirming this. A break of that green zone would invalidate it. Previous analysis:

It looks like momentum for the bull is decreasing and already close to breaking that support line on the right. Previous analysis:

So far it's up around 20% since the start of the fractal, but to be honest, it has been very disappointing so far. I expected much more of this one, but it is still following that blue line quite well. It could still happen of course, simply don't know, but i will be using the blue and red zone as a stop level now. If we do see another move up from Bitcoin' above...

Yesterday (12 hours ago) i showed some thing in my channel, since i did a bit more research, about who these spoofers prob were in this case. You can read it there if you want to see it. That we saw a Bart move happen, is no surprise, since the volume dropped to like 35% of what it was the days before, making it easier again to make these moves. Anyway, it looks...

It's moving against the resistance of the channel now and on the lower time frame it is moving in what looks te become a wedge. Also below that resistance on the left as well, so a good R/R play here. The rest of the things you can see on the right, was an educational post i showed in my channel, where i showed what a likely start of a trend change on that time...

I posted this wedge a few days ago in my US indices analysis. Looks like this wedge might brake today. If we see a good push down below the wedge, it could be real and that the (temp) high might be set now

This one made a big rally the past weeks, even getting above that green zone on the left without hesitation. Now it has some resistance from that channel, but because the move up was so strong, it is becoming more likely that it will break sooner or later. Normally we should see it make a healthy correction first the coming week or so. On the right we can see a...

Yes dammit YESSSSSSSSS, finally this market is alive again. Sorry, i had to get it out of my system :) Volume is a rare thing in crypto the past 6/8 months so i think we need to celebrate it when we do have it. We have finally started the next leg up after i started this ABC analysis from the 3200 lows in December. There were some moments where the extreme low...

In my previous analysis i showed a bullish wedge, which was playing out almost perfectly in the blue circle, but in the end it dropped below the support line and made a small crash even. Now usually when a bullish wedge fails, we see a big fast dump happen. But instead we saw if move sideways and even a small countermove up. The past week, XLM' seems to be dead...

Looking very good now, XLM' bulls have been waking up again and finally seeing some volume and real movement again. So we broke up from that small triangle on the right and are following the blue line scenario since we broke up strong through that red resistance. Since we are back in the channel chances are increasing that we might test the resistance of that...

Wow, i am a bit amazed to see how ETH' got pumped so much so fast. It reached the target of that inverse H&S within a day, which took 35 days to form. And look at the volume at Bitmex, it's almost 3 times the volume we had in Dec. This strong rally could be a sign for the bigger picture, but it will depend on the coming week or so. Going to do a bigger picture...

Fractals or not really a thing in this market, but i just had to show this one because it looks so similar. I remember back in Sep/Oct that the last big wave up was just to bully out the bears before it would drop. This last move of the past week gives a similar feeling to me. So i took a closer look and i remembered the movement of 2018 and seeing these...

I was about to write a big analysis on Bitcoin', but i hope you understand me when i am saying it's just a waste of time. I think that curved pattern on the left is legit now. On the right we are turning slightly up, we just need a candle close above the red resistance zone. So no more Bart moves or whatever nonsense. The past 2 hours it seems something is going...

So far XRP' is moving quite identical to the fractal i showed in the previous analysis. We even did that fake breakout (blue circle) and now moving inside of that channel (orange circle). XRP' is still one of the weakest alts out there, for several weeks already. Based on the fractal, we should see it drop more coming weeks. But i will ignore the fractal for now...

On the left it looks like a legit fractal. We can see the yellow H&S zone, both failing. Because the current one is also taking a lot of time, like it does not want to drop. That trend line on the right looks legit as well, but i think the horizontal zones might have more value. Ideally it moves up from here, so that this trend line does not need to break. For a...

Here we can see the September high and the current high, both times the Nasdaq was having a very hard time to make new highs at the end. My previous post on the Nasdaq, where i showed a potential double top, has not been invalidated yet. This is because that double top has formed into a bearish wedge. So unless we see a strong break up coming days, we will get to...