broughro

Significant downside risk in the VERY short term to long term with very limited ultra short term upside potential...that is what I see in the EW analysis... Place your bets!!

Earlier EW analysis foretold of an impending significant sell-off that has, as of yet, not materialized.... But look at the huge current RSI divergence at the current peak compared to the relatively small RSI divergences that led to smaller, but still significant, sell-offs... I wouldn't be long here....just saying...

Has the ending diagonal 5th wave of the post expanding diagonal thrust come to an end? Today's low peeked below the lower diagonal support line... Look out below?

The market really struggled to basically tread water with a slight loss today... Listen for all the "melt up" chatter...and watch for the ending diagonal!

Is the "thrust" after the expanding diagonal now ending in an ending diagonal?

Just food for thought...but what if this interpretation is correct? Run for the hills?

Gold topped August 2011 completing an intermediate level 5 way advance ending at 1,923. It has been correcting ever since in intermediate (Green) (A)(B)(C) with (A) in 5 minor waves and (B) in 3 minor waves (with red B as a running triangle which I believe was followed by a quick thrust C that just finished at yesterday's high of $1,454). Minor wave (B), where...

This leading diagonal ended as called earlier appears to be making an ABC correction that should end when C = A at 1.75 Then, the longer term upward correction should continue in a third wave, which I think will be a C wave ending this sub-minuet level correction of the larger minute correction of the larger trend. C should be equal to A as measured from the end...

The second wave correction ended at the .618 retracement of 1 and 3 appears to have started. Prices on USD based assets should increase on an accelerated pace as the dollar loses value. This should be a sharp drop over the next few months to at least 1.6 times the drop in wave 1.

The ABC correction is near complete having completed the Triangle and now nearing completion of the quick "thrust" Elliot calls for after a Triangle. C equals A about where it is now. Corrections often end at a previous forth wave, which could be now or up to 145 (1,450 cash). Then look for the longer term bear to continue with a complete retracement, and then...

What if I've been wrong on equities, unlike gold or currencies, because I thought we were in the wrong phase of the Elliot Wave? This analysis shows that whatever wave we are in is nearing a 1.6 Fibonacci relationship to the initial large wave (viewing in monthly scale). If that's the case, then expect today's down-turn to be temporary and for the market to...

Looks like the first 5 down is complete and we are ready for a 3 wave corrective rally...time will tell!

Those of you whom have been following me know that I've had some really great calls in gold, EUR, and USD but have unfortunately called the top too early for equities a couple of times...and this one could be wrong, too, but the waves over the past two weeks are clearly impulsive to the down side and if you look at the detailed analysis on the chart it looks like...

This is an update to my long-term forecast for EURUSD. It is completing the first minor correction off of the first minor impulse up; this should be the first of a series of impulse waves upward following this current short term correction. Then, expect weaker dollar and stronger EUR...I know, not what the talking heads are forecasting...

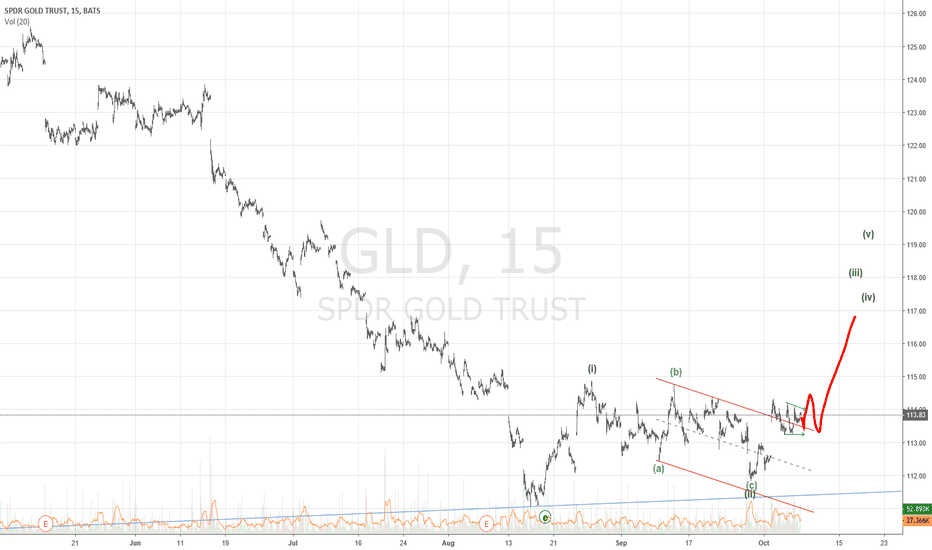

Looks like GLD is forming a 4th position small triangle so expect a small spurt up soon, followed by a small retracement, followed by a 3 of 3 strong rally as record shorts are covered...as treasury rates rise...and equities fall significantly...

The minute leading diagonal has clearly broken the larger downward wave, which ended in a larger ending diagonal... Expect a short term pullback to the wave iv level and then a continued rise at least 1.618 times the length of this first leading diagonal wave... Short term pullback would be consistent with a modest recovery in equities early next week before a...