brownian

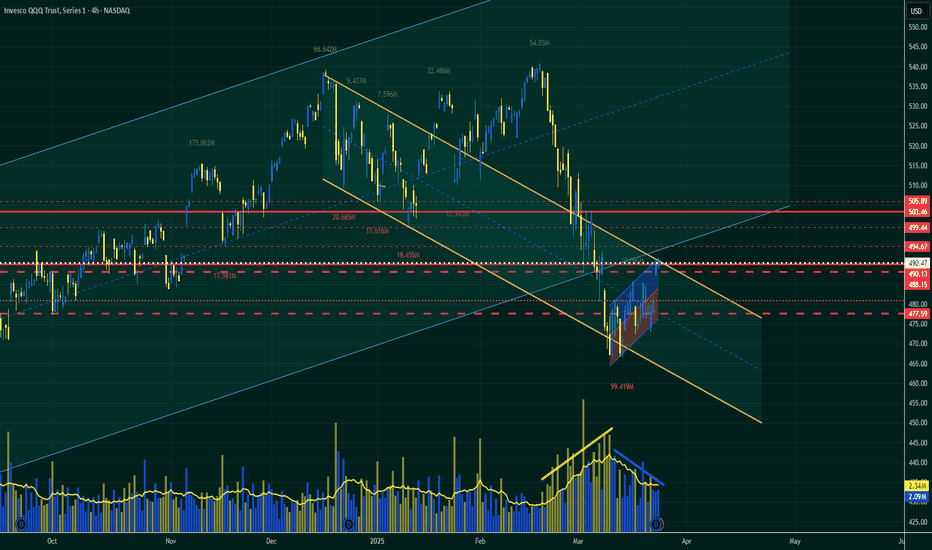

PlusSummary: We now have alignment between two key charts: 🔹 VIX has broken major resistance with large institutional call buying 🔹 QQQ is facing trendline resistance with weakening momentum. The setup points to a potential volatility surge + tech pullback over the next 1–3 weeks. 📉 QQQ Technical Breakdown: QQQ is stalling under descending resistance from the...

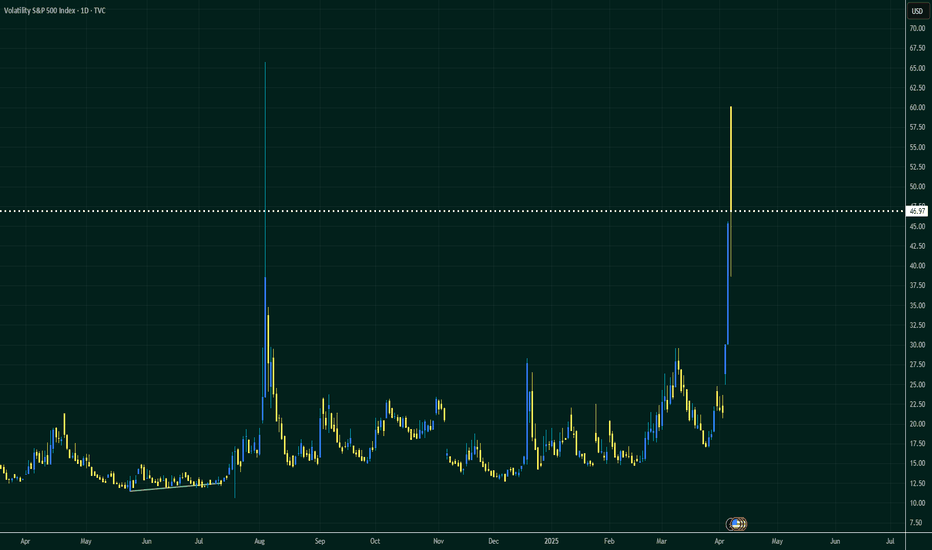

Summary: The VIX has officially broken major resistance, and institutional players are making large bets on rising volatility over the next 1–2 months. The combination of the technical breakout and heavy call buying strongly suggests a potential VIX surge toward 30–35. 🔥 Technical Analysis: Key Resistance at 23.50 (red line) was cleanly broken and is now acting...

A massive wave of institutional option activity is pointing toward an upcoming surge in volatility—and likely a pullback in equities even more. Here's what the VIX flow is telling us: 🧠 Key Takeaways: 🔺 Aggressive Call Buying on VIX Heavy blocks on VIX 22–42.5 calls, with most trading at the ask, signaling urgency. Standout trades include: 1,407x April 22C @...

QQQ may be setting up for a bearish reversal, as several technical confluences suggest the recent rally is losing steam. Despite a short-term bounce, price is approaching a critical decision zone, and buyers appear to lack conviction. 🔺 1. Price Testing Upper Boundary of Descending Channel QQQ has rallied into the upper boundary of the descending channel (yellow...

In the previous post, I indicated that the boundaries of the blue channel which is based on a previous trend act as supports. As it can be seen, the price bounced of the upper boundary of the channel. I believe that there will be an accumulation around this upper boundary before the next move up towards $2.45 which is at the 1.618 Fibonacci extension. Again,...

BITFINEX:ADAUSD COINBASE:ADAUSD $2.45 seems to be the next target (Fibonacci level) if the movement breaks out of the coil. Also bear in mind that there was a rejection at 2.25 multiple times.