Spot gold closed yesterday with a 1.5% loss at 3239, marking its third consecutive day of decline. However, the market opened today with some buying activity. Since the full impact of the trade war has yet to materialize, weak economic data from both the U.S. and China—combined with a statement from China’s Ministry of Commerce indicating it is considering a...

Spot gold ended yesterday’s session with a loss of 0.8%, settling at 3317, and started today with a further decline of 0.3%. Upcoming U.S. data—including GDP figures, the PCE index, and employment reports—are expected to play a critical role in shaping price movements. On the Chinese side, weaker-than-expected PMI data is being interpreted as an early effect of...

Spot gold closed yesterday with a 0.7% gain at 3344, but started today with a nearly 1% loss. The easing of trade tensions continues to support risk appetite to some extent. Statements related to these developments, along with key U.S. economic data set to be released today, could influence gold's price action. Technically, if the support level at 3300 is broken,...

Spot gold started last week strongly, reaching its all‑time high at 3500, but ended the week with a slight loss of 0.2%, closing at 3320. This morning, spot gold has declined by nearly 1%, mainly due to reduced demand for safe-haven assets following an easing of U.S.–China trade tensions, along with a strengthening U.S. Dollar Index (DXY). On the geopolitical...

Recent developments regarding U.S.–China trade tensions, along with macroeconomic data, have had a generally positive impact on the markets. The potential easing of trade tensions and dovish remarks from Federal Reserve members have reduced demand for safe-haven assets. Gold had tested the 3500 level earlier this week before undergoing profit-taking, but managed...

After touching the 3500 level earlier this week and setting a new all‑time high, spot gold underwent profit‑taking as optimism grew over a potential U.S.–China trade deal. A more conciliatory tone from President Trump toward Federal Reserve Chair Jerome Powell also helped calm markets. While Trump’s comments about easing tariffs on China boosted risk appetite,...

Rising uncertainty and weakening confidence in global markets are pushing investors away from high-risk assets and toward safe havens. U.S. President Trump’s criticism of Federal Reserve Chair Jerome Powell, along with uncertainty over whether Trump will interfere with Fed policy, has further fueled the shift toward safe assets. In this context, investor appetite...

Spot gold continued its rally yesterday, closing the session with a 3.5% gain at 3343. This morning, the precious metal reached a new all-time high at 3358 but is now facing profit-taking following news of potential trade war negotiations. At the moment, as long as the price remains below yesterday’s closing level, we may see a pullback toward the 3300 level. On...

Spot gold ended yesterday’s trading with a 0.6% increase, closing at 3231, and continued its upward momentum this morning, reaching a new all-time high at 3292. As the U.S. imposed a ban on the sale of Nvidia chips to China, global markets are seeing declines this morning. Additionally, Trump’s proposal to impose tariffs on precious metals has intensified the...

Amid growing global uncertainty—especially following statements by Trump—demand for spot gold remains strong. However, with the start of some negotiations with certain countries, the precious metal experienced profit-taking, declining by 0.8% yesterday to close at 3211. Meanwhile, trade war-related news, which continues to weaken markets, remains a key focus for...

Spot gold ended last week with a strong gain of 6.6%, closing at 3238 and recording a new all-time high at 3245. This morning, gold is witnessing profit-taking activity. These pullbacks are likely due to President Trump’s retreat from his previously hardline stance on tariffs, which boosted risk appetite and prompted some investors to take profits. On the other...

Spot gold continued its rise yesterday, gaining 3% to close at the level of 3176. This morning also opened with buying momentum, with gold recording its highest historical level at 3220. The decision to delay tariffs, its failure to curb the rise in U.S. bond yields, and the decline in the Dollar Index (DXY) to 100.5 are seen as supportive factors behind gold’s...

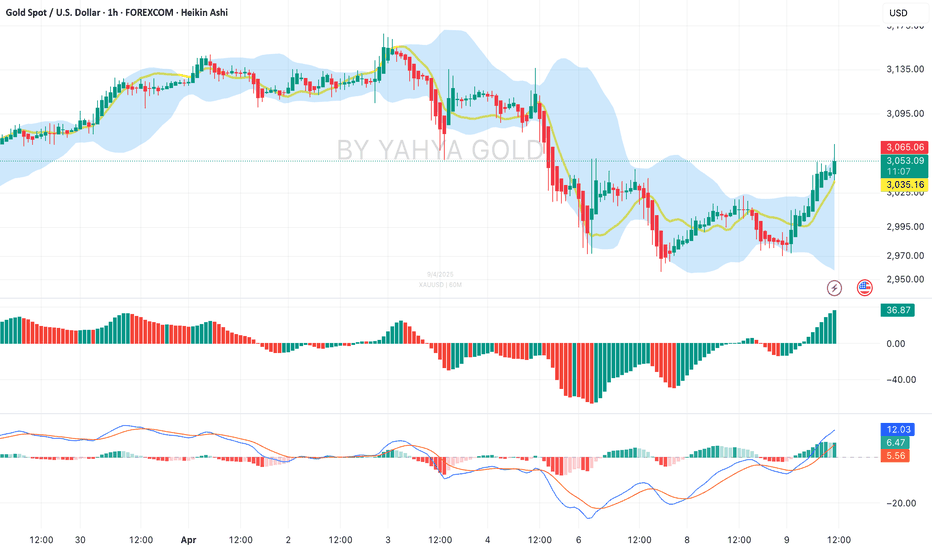

Yesterday, although the ounce of gold rose by more than 1% during the day, it ended the session flat at the level of 2983, affected by the decline in global stock markets. This morning, despite falling stock markets and a sharp rise in U.S. bond yields, gold is experiencing buying demand. The ounce of gold has increased by approximately 1.5%. From a technical...