c_c

BTC looks like it is creating a falling wedge on the daily time frame. Every time BTC has been rejected from the lower wedge trendline it did so with a decent, above-average volume leading to a price increase. Although BTC did create lower lows for the past weeks, RSI made higher lows, which can be understood as bullish divergence. Medium-term, BTC might print a...

It looks like BTC is about to complete its bear flag after the 50% drop from previous highs. So far, signs of a bullish price reversal are lacking: price shows lower highs, RSI shows lower highs and no clear divergences, low volume, price initially pulled back to the 0.618 Fibonacci level but did not surpass it. All in all, it does not look too promising for a...

Like other coins, EOS just broke its descending trendline. Successful retest could mean major price increase with a good RR ratio at the moment. Comments are welcome. Please like & follow for more TA. DISCLAIMER: This is neither a trading nor a financial advice. You are responsible for your own actions so do your own research.

BTCUSD broke out of its decending channel and retested successfully. At the same time, it looks like BTCUSD is finishing an inverse head and shoulder pattern and the retest formed the right shoulder. If validated it could mean around 25% gains from neckline. However, immediate resistance between 41.8-42.5k ahead. Comments are welcome. Please like & follow for...

BTC is still moving in the falling wedge. The lower wedge trend line currently coincides with major support (blue box), golden pocket Fibonacci level and on top there is a bullish divergence on the 4h TF. Interestingly, the daily 200-ema sits right below the blue support box providing even more support... Thus there is a lot of confluence here and a decent...

Greetings, I do not really know why everyone is so bullish on BTCUSD . Reasons for NOT being bullish are: - The recent big green candle can be considered as retest of the previously broken ascending trendline . Importantly, BTC got rejected, which suggests a downward move in the near future. - Funny enough, this broken trendline coincides with the descending...

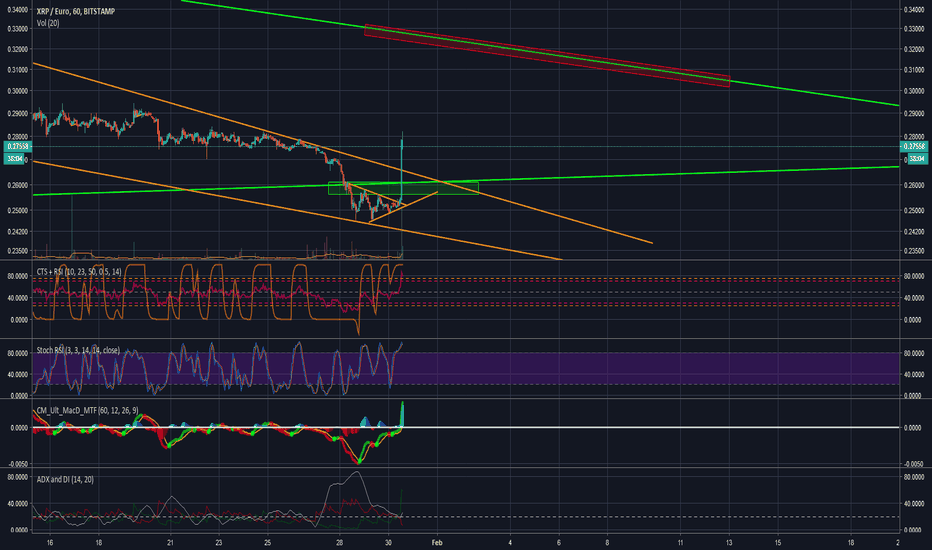

Hi all, This is just a quick update on XRPEUR. What an amazing previous 1h candle! Good volume, no upper or lower shadow and most important: green! XRPEUR pair seems to have created a double bottom with the low around 15 december 2018. Thereby it exited from the falling wedge and made its way back into the big green triangle. If price does not make a sudden and...

Hi all, clear descending triangle pattern (usually bearish). Price got rejected at 0.618 Fib level, which I would consider as normal pullback. RSI is in uptrend, but Stoch RSI (which I would consider more appropriate in ranging markets) is in overbought area. MACD crossed bullish but is still below midline. Volume is low which could mean another bearish impulse....

Hello everyone, We are looking at the XRPUSD pair on the daily TF. It seems that XRPUSD is forming a bullish Gartley pattern, which may lead to a rise in price in the short term. Point A is not equal to the long upper wick of that candle because I think it was just a reflection of FOMO and does not accurately reflect price (and was basically due to only a 1h...

Hello, BTCUSD on bitfinex seems to be in a falling wedge and forms bullish divergence on the 1h and lower timeframes (not on higher timeframes yet). The apex of the falling wedge is around 5300 USD, which also corresponds with the long term log-trendline dating back to 2015. I expect a reversal around this level (+- 100 USD) at the latest. MACD on 1h shows a...

Hello all, hope you are having a great day. This is a quick post on XRPEUR -0.51% which seems to be forming a bullflag at the moment. Once .464 EUR is broken, the next short-term target is around .486 EUR. The medium-term target is around .526 EUR and dependening on the momentum the price may extend to the 1.618 Fibonacci level at around .55 EUR, where I expect a...

Hi all, just taking a quick look at the XRPUSDSHORTS, which seem to be at a decisive point. If XRPUSDSHORTS convincingly fall below the yellow ascending trendline, the next medium term target would be the green box. Correspondingly, XRPUSD may be up for a new rally (3rd Elliot wave). * Note that I am using the Log-scale. --- DISCLAIMER --- This information...

Hello, A lot of people on here call for lower prices for the XRPEUR pair. In my opinion, however, XRPEUR builds a textbook bullflag. Actually, within that bullflag, price already touched the 0.382 Fibonacci level, which is thought to be the normal (maximum) retracement of the second wave of a new Elliot waves Cicle. Once XRPEUR breaks the triangle upwards,...

Hi all, this is an update of my previous post (see link below). As predicted, BTCUSD hit the 0.382 Fibonacci retracement of the 3rd Elliott wave pretty much on point and the 4th Elliott wave should be completed (supported by indicators such as RSI). Moreover, BTCUSD is about to break (broke) out of the falling wedge and in my opinion the next mid-term target...

Hi all, first and foremost: this is an ATTEMPT to look at BTCUSD using EW theory with Fibonacci levels (I am still learning). At the moment we are retracing from the 3rd EW. According to the EW theory, such retracement typically reaches the 0.382 level of the previous wave, which will be around 7580 USD. Funny enough, this price level (7580 USD) corresponds with...

Hi all, a quick update on BTCUSD. On the 1h time frame we can see a bearish divergence, which aligns with a rising wedge and a MACD bearish crossover. This points towards a short term price pullback. I do not expect a very major pullback though; potentially to the 1.272 Fibonacci extension in the chart. What do you think? * Note that I am using the...

Hello all, As pointed out in a previous post (see below), the inverse head and shoulder pattern is relatively complete. Given that the RSI shows that BTCUSD is overbought, a short-term pullback is to be expected (and has actually begun already). Some people here claim that the pullback will follow a triangle-pattern with a pullback to 6300- 6400 USD and then a...

First and foremost: I am a noob, still learning and have a very limited understanding of what I am doing here. This is my personal interpretation of the current situation: BTCUSD is at the 0.618 Fibonacci level which aligns with the lower bound of the falling wedge (reversal pattern). The RSI is oversold and my gut feeling is that many people have put their buy...