Price is forming a bullish channel,a break above the trendline and a retest should give us enough confirmation to join the bullish trend

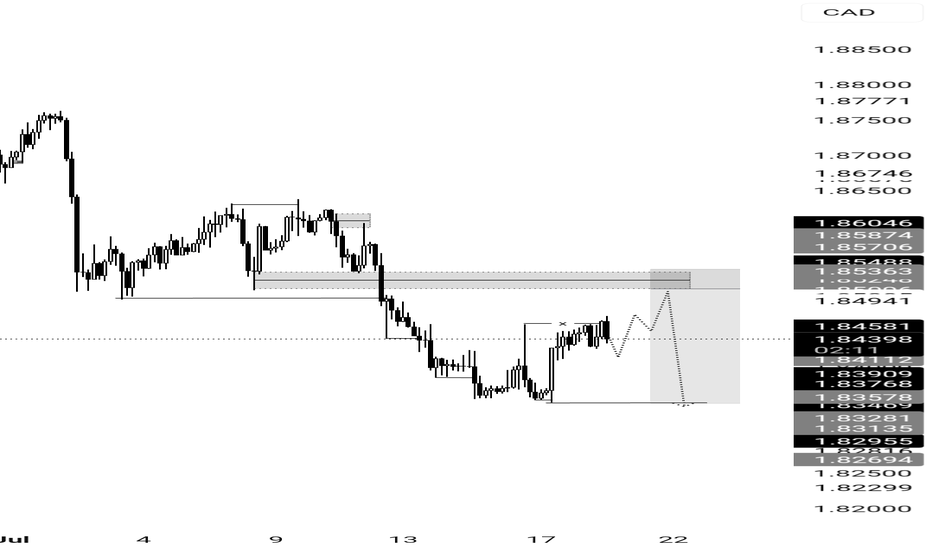

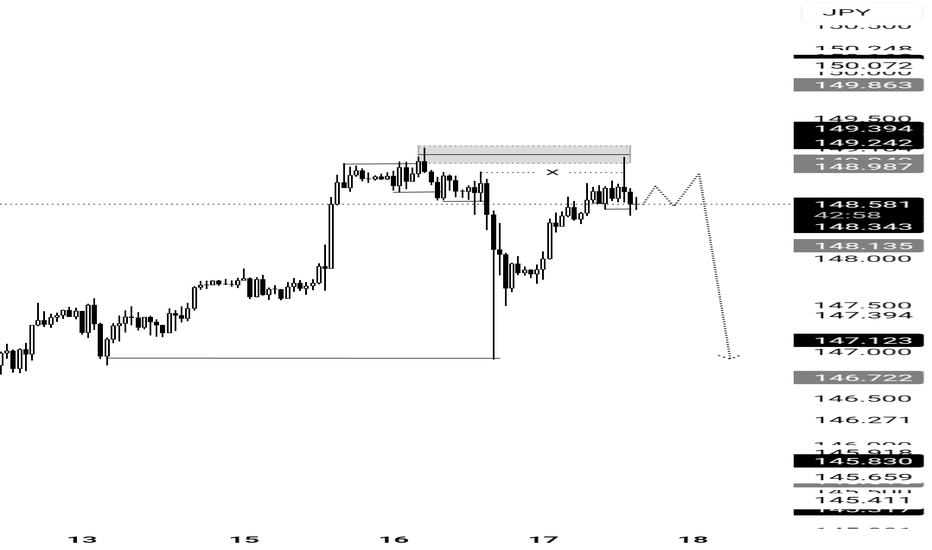

Fundamental:to cut rates thrice this year, in August, November and December. Money markets are pricing in a total of 48.6 basis points of BoE rate cuts by the year-end, with a 77.3% probability of a 25 basis point move in August. Technical:A classical Breakerblock entry type to continue move lower

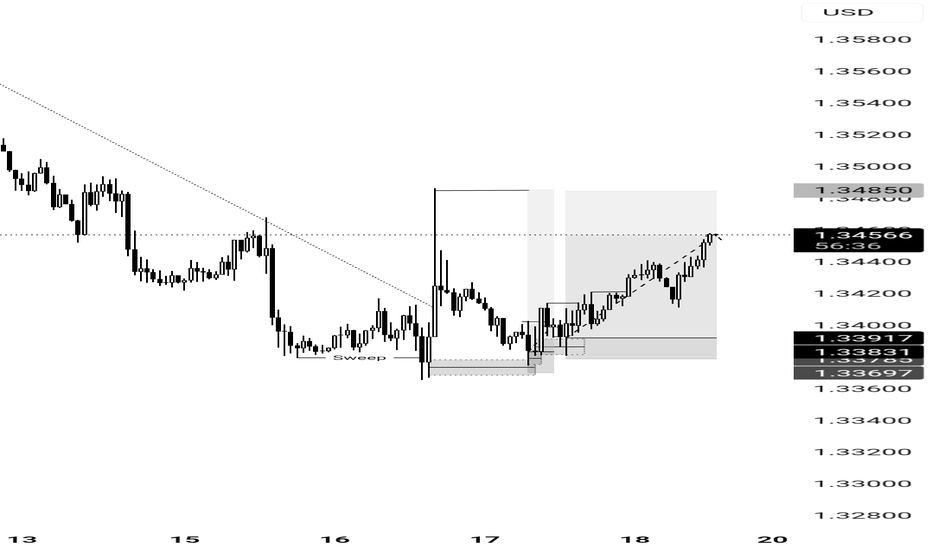

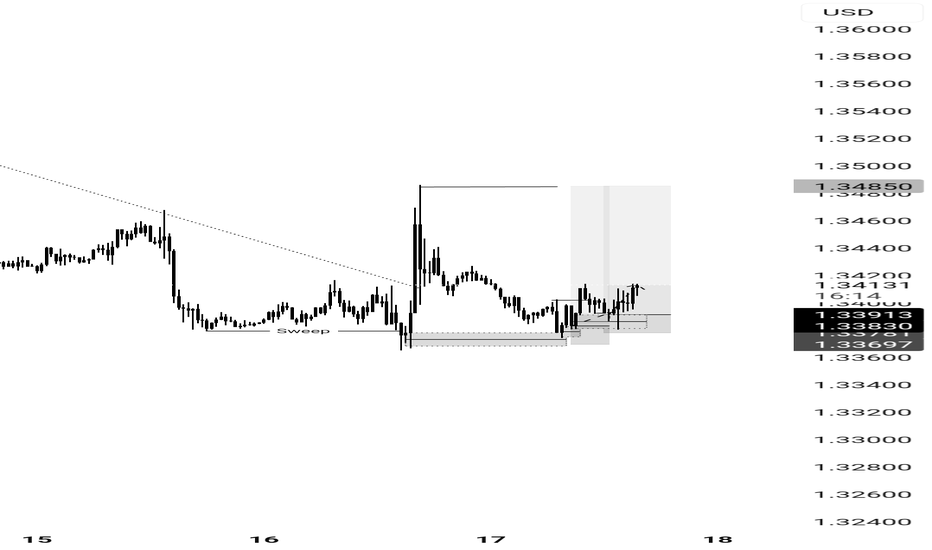

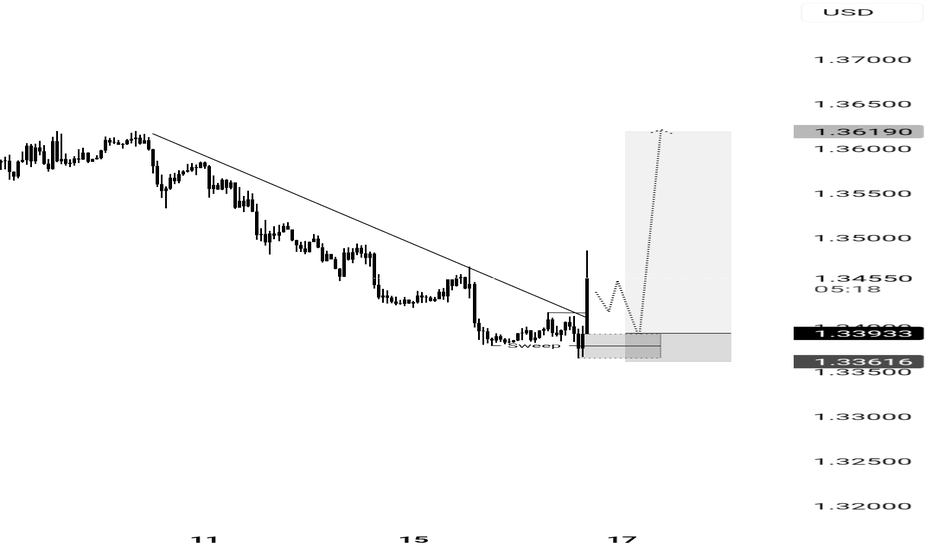

As projected Post CPI The pound is responding against the greenback and we can see price pushing upward.

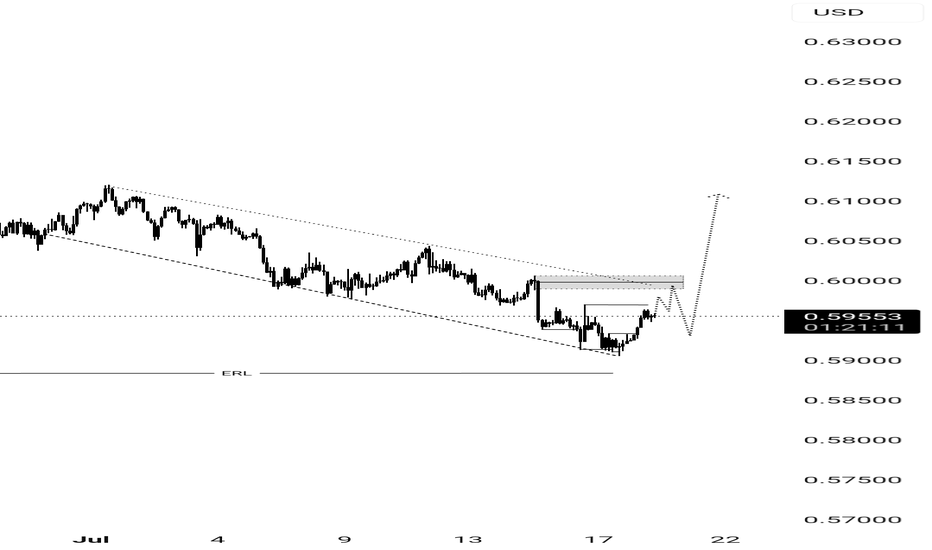

Nzdusd has been responding positively after CPi data and we can see price reacting to close imbalance caused by Trump-powell power tussle. We expect more bullish move in the future.

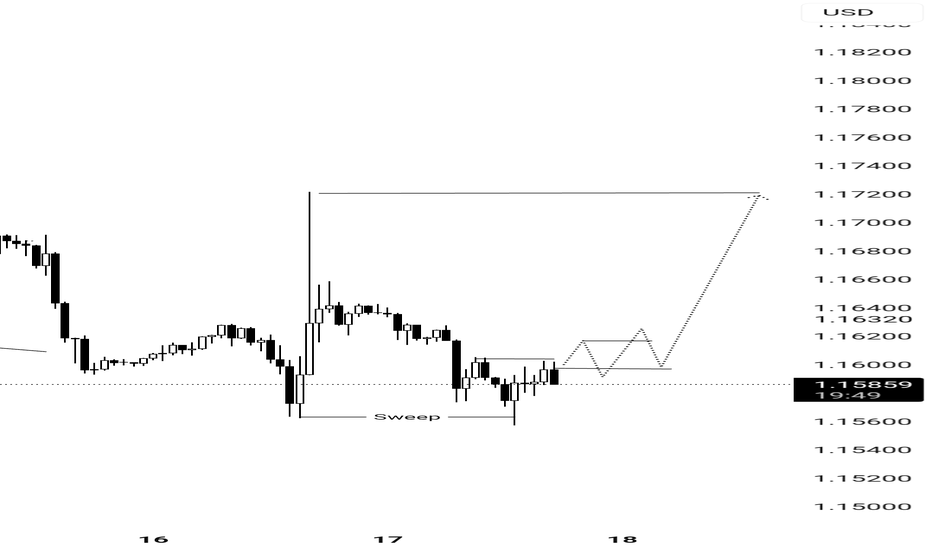

We can anticipate buy setup on EURUSD to close up those imbalance caused my yesterday's news.

After yesterday's spiky move caused by d.trump Market should correct some of those imbalance soon Target at the ERL

On the H4 we have a clear unmitigated fvg+KL just blow a valid level as inducement which price might come to raid. There has been series of military attack between iseal and Syria and also Fed cutting the rate will also be a key factor

We can only anticipate sells if price breaks out of the trendline,there has been rejection already on H4 due to a reaction from breakerblock. EURAUD still looks bearish internally and if you look closely you will notice price is forming an expansion But if price keeps keeps the bullish run which I doubt,we can anticipate the bullish move to continue as it has hit...

I am anticiting for a stronger bullish move after a break in the trendline+c change in market structure. On the financial standpoint,Dxy might start dipping as a result of the fed decision to cut rate plus Trump rift with Fed chair,Jerome Powell. This is not a financial advise

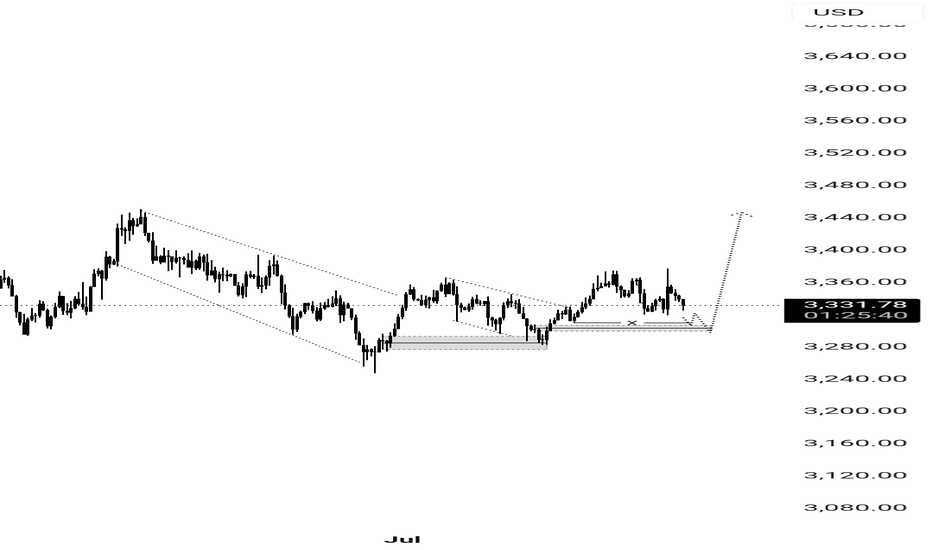

Here’s a detailed structure on how gold has performed in previous weeks

Hi Guy Happy weekend,I’m anticipating a potential buy to sell setup on the yellow metals,as price is Gradually getting closer to a H1 key-level Alternatively GOLD remains bullish as we have seen in recent weeks,but looking at the CPi and FEd report coming up this week and hopefully next,they should serve as ideal catalyst for the move

GBPUSD structure is bullish and we can anticipate more buy moves in the future

looking for more buys on Audusd as price is forming HH and HL

Due to recent usd crash we should expect some more buys on GBPUSD as the greenback is facing a lot of economic challenges and things might get worse in the coming week ahead of CPI and FOMC report

Hope to continue the trend downward as the Aussie keeps on declining due to some fundamentals

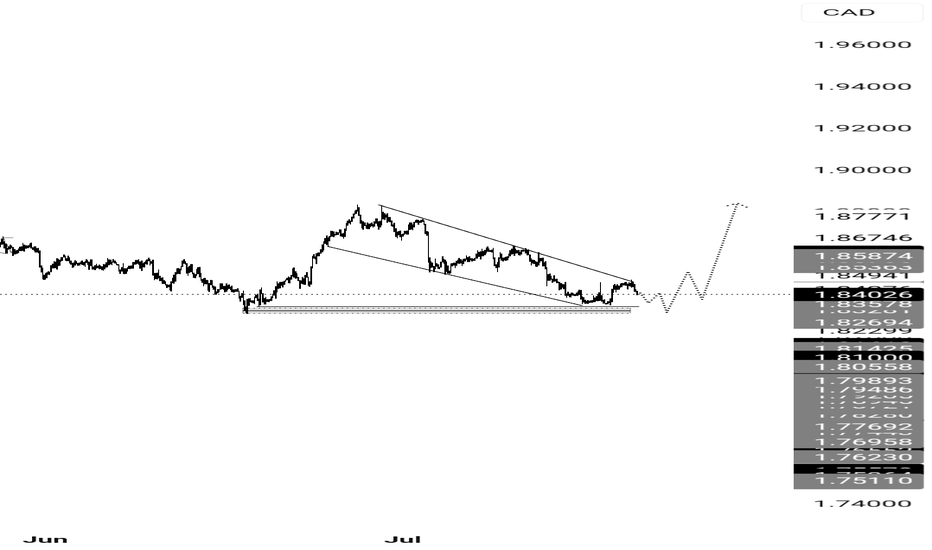

I expect more bearish move on the DXY, thereby giving me a bearish bias on the usdcad, FED planning on cutting rate, stock crashing and hopefully more woes for the greenback if things keep going this way

AUDUSD: A simple break and retest on Aussie dollar Hopefully price take all those highs before we can anticipate a dump All in all,this is not a financial advise