chokambaya

PremiumPalladium has experienced a significant drop since the highs reached last month. The price is now approaching a key level that previously acted as strong resistance before being broken during the last rally. I’m expecting this level to act as new support, which is why I’m looking to take buy positions from here.

I'm bullish on Duolingo stock overall, and right now it's at a great buying level. The price has pulled back to the same area where it was consolidating in April 2025, which gives a solid support zone. This retracement offers a good discount, so I see it as a strong opportunity to buy in.

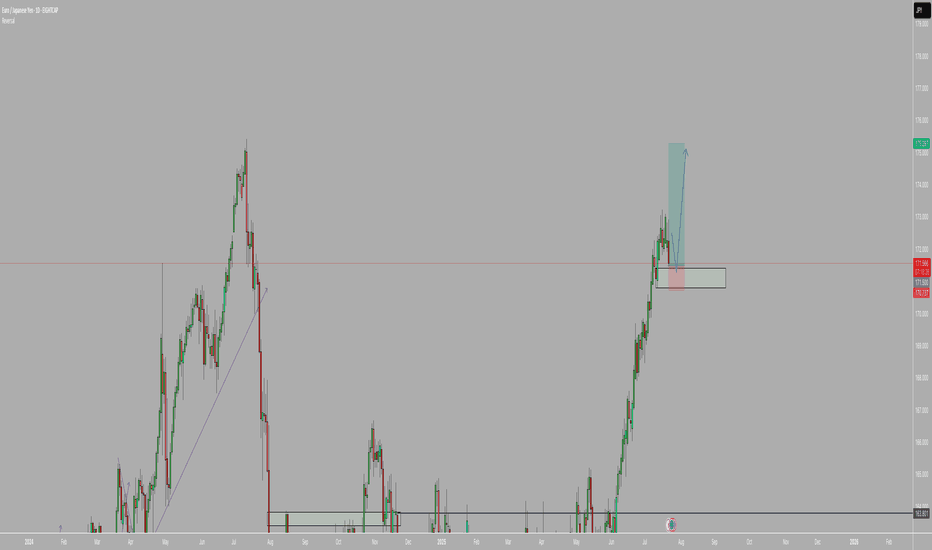

I'm still strongly bullish on the Euro, and this current pullback on EURJPY appears to be a healthy retracement within the larger uptrend. It offers a good opportunity to enter long positions with the expectation of a move back to retest the highs reached in July 2024.

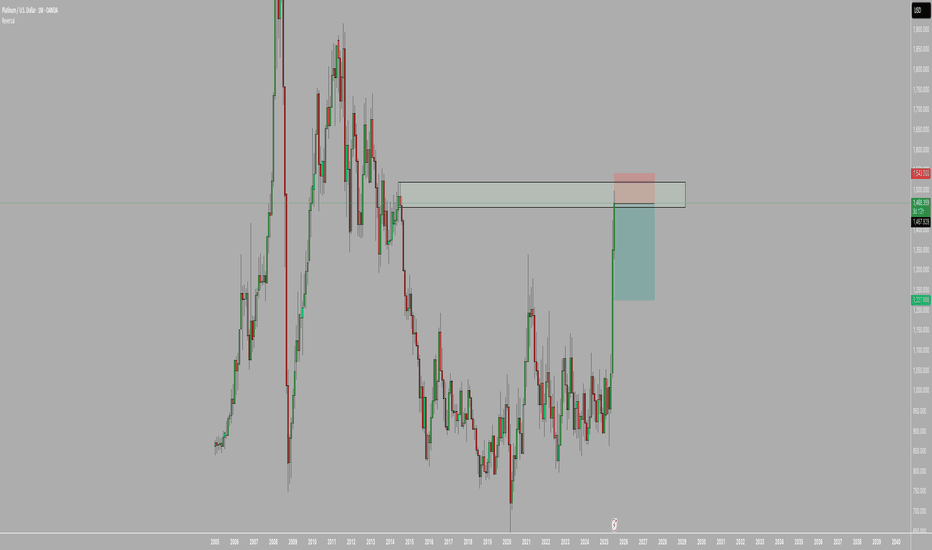

I'm taking this sell trade on platinum because, after a strong three-month rally, the price has now reached a key resistance zone that has historically seen significant selling pressure—most notably back in August 2014. Given the extended bullish move and the fact that we're approaching a major supply area, I anticipate potential profit-taking or a retracement...

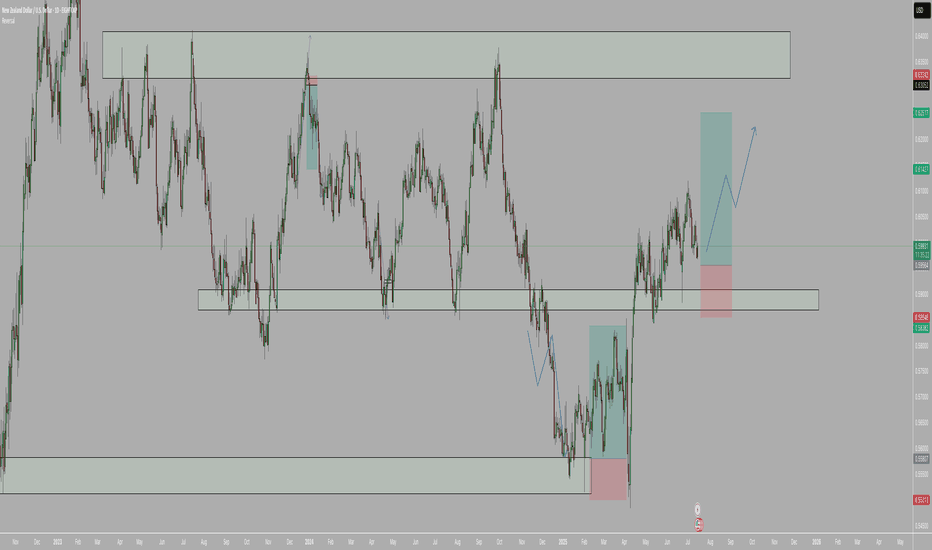

I’m looking to take buys on NZD/USD because the overall trend remains bullish. We’ve reached a strong technical level, and the new monthly candle has retraced into a key discount zone, offering a favorable entry. This pullback aligns with the broader upward momentum, so my bias is to the upside. That’s why I’m entering long from here—buying the dip within the...

I'm still optimistic about US30. It recently pulled back to a strong support level and is now showing signs of heading back up to retest last year's highs. As long as that support holds, my bullish outlook remains intact.

USD/CAD Trade Analysis • Overview: Since the end of September, USD/CAD has been in a strong uptrend, with a significant rally that continued into October. The pair is now approaching a key resistance level that has been in place since 2022. • Weekly Timeframe: A large rejection candle has formed at this resistance level, indicating potential selling pressure...

AUD/CAD Analysis • Daily Timeframe: The pair is currently in an uptrend, following a trendline that has been respected so far. This indicates overall bullish momentum. • 4-Hour Timeframe: A pullback appears to be underway, suggesting the price may retrace and test the trendline again. Recently, the pair formed a higher high, and I anticipate the formation of a...

On the USD/CHF daily chart, the pair has been in a downtrend since mid-May, reaching a strong support area in mid-September. After consolidating at this level, we saw a breakout on October 4th, followed by a retest of the previous resistance, now turned support. Yesterday’s daily candle closed bullish. On the 4-hour chart, the pair is respecting an uptrend line...

On the monthly time frame, GBP/CAD appears to have tapped liquidity and is showing signs of reversing upwards, indicating a potential bullish trend. A rising trend line, respected since April, has been touched more than three times and is currently reacting positively on both the weekly and daily time frames. The last two daily candles have closed bullish, and...

If we break support... waiting to see a retest before going down.

If the GBPUSD breaks the support it will go down to the key area where im looking for buys.

Downtrend on the HTF. Price retraced to a major resistance zone.

Looking for a pull back in most of May before we make a new high on the summer time towards end of the year.

Daily, 4hour and 1 hour zones yellow daily red 4h blue line 1h