choochoohiggins

Just a simple , not-guaranteed way. but usually profitable of trading Chainlink according to the phases of the moon Buy on the Full Moon, Sell on the New Moon. Thats it nothing else to it.,

This is weekly $SPY chart as you can see there's a trend line that whenever we hit we fall for about 8 weeks. And it just hit the trend line on Friday . I lm thinking 2 months from now we should be around $350, but to play it a little safer , I'm gonna grab a Feb 17 Put for the $335 strike , and I plan on selling the PUT around the second week in January. .....

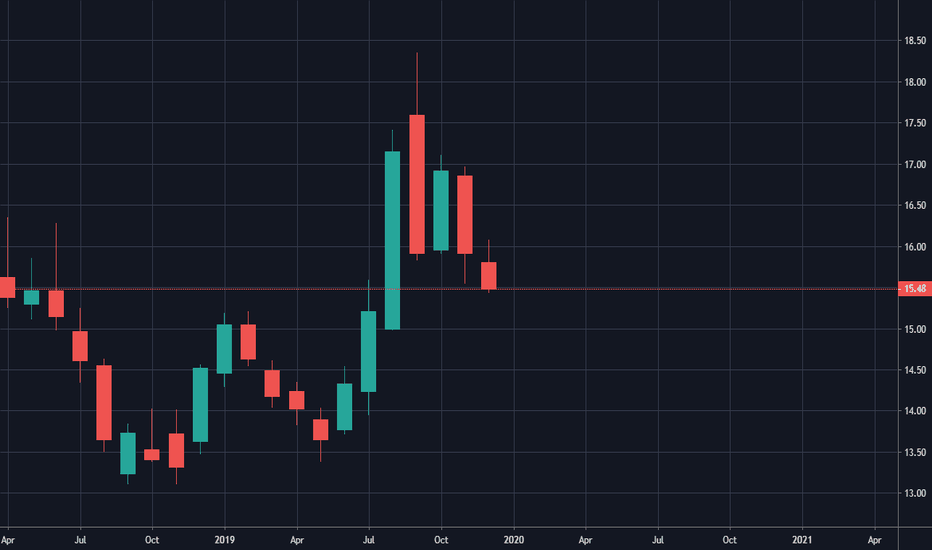

A; local favorite around here .. the JM SMUCKER company is paying a nice 3.0% yield on their div and has also formed a cup and handle pattern on the daily and looks like it's about to take off to break ATHs soon It had trouble breaking $135 last week, but it didn't crash like the rest of the market After reporting earnings on the 23rd and beating expectations in...

I'm watching for Silver to put in a green bar below the bottom Bollinger, for the RSI to fall below 30, and for the Blue line to cross the Red one on the MACD.. then I'm buying call options at the 23 Strike 2 months out.

Looking back at 2008 Silver fell along with stocks during the recession..reaching all the way down to $9 from $18 , and then within 3 years seen a high of over $48... doing a 5X in 3 years. I see that it is also currently falling along with stocks again, and see the current monthly chart similar to that in 2008. I'm going long. TVC:SILVER

Monthly Chart shows a very nice Bull Flag for SLV A long stock play can be done if I want to hang onto the stocks for a few months. The length of the flag pole shows about a $3.5 move, so an option about half way up that move with the expiration of March would also work. In fact. I'm looking at the decently16 s priced strike that expires on March 31 2020 ...

just now We have a Bull Flag on the monthly for GLD, Price movement is expected to be around $12-$15 I'm going to play the options on this; buying the 45 Strike on Exp 20 March 20, if I want to lower my risk, I can turn it into a debit spread by also selling the 150 strike onEx [ 20 March 20 .. as of the writing of this the debit spread would cost $59 with a...

The week containing the last Friday of the month has seen the price of bitcoin fall for the last 5 months. I think it's due to longs expiring on that day and price manipulation to liquidate them, but the reason it is happening doesn't matter to me.. I just see that it's happening. If you buy bitcoin on the last day of the month and then sell it sometimes...

This penny OTC pot stock iAnthis is going to break to the upside tomorrow, I'm going to scalp it and buy 1000 shares at 2.01 and sell them at 2.14 for $120 or so profit. I'm not that wealthy though, it's all I can afford.. I'm sure some of you would be up for buying 10,000 shares for a $1200 trade tomorrow. If so.. I hope it goes well for you .

I plan on buying a call on spy when it hits 180.5, It has support levels that go back over a year many times it has bounced off this level. I do not think we will end up dropping below this level but not at first. I plan on buying a call at 180.5 with a .20 trailing stop loss