Many investors seem to be overlooking that Vermilion Energy's production is nearly 50% weighted to natural gas. From Q2 2020, 45% of corporate production was natural gas. Vermilion was suffering from an extensive Eurogas bear market thanks to unprofitable shale production flooding Europe's shores in addition to a warm winter in Europe and Asia. TTF and JKM gas...

Over the past month especially, crude has fallen into a bear market. Most of this bearish reasoning is coming from the U.S. EIA reports which is showing a large amount of undocumented crude which has resulted in a very swollen crude storage inventory, mostly all in PADD 3 (Gulf Coast.) There is strong reasoning to believe that this undocumented crude is actually...

One might think that having a founder of the shale revolution in Mark Papa could be a good thing, but despite the hype and once hurrah, Centennial Resources has become a prime example of all things wrong with the shale industry despite being a Delaware-basin focused producer in the heart of the glorified Permian. Last year, Centennial had to issue even higher...

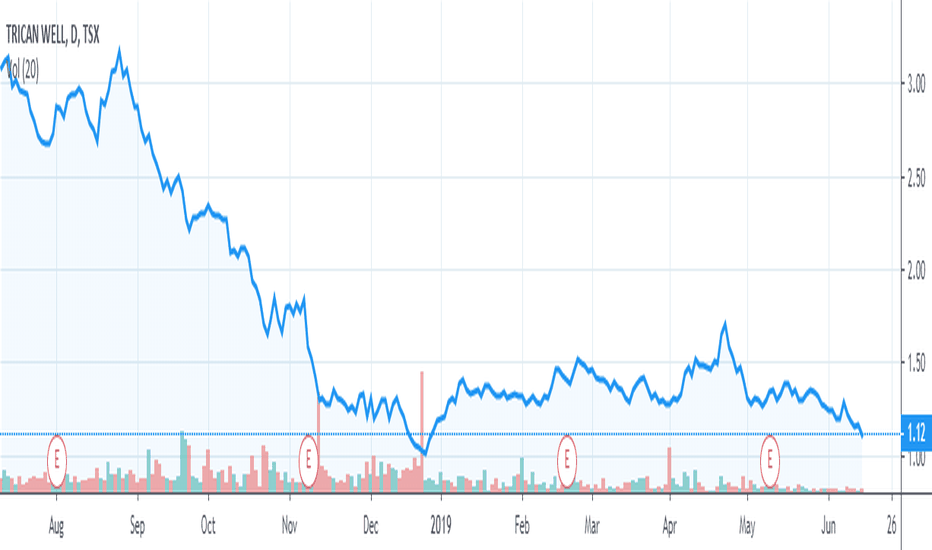

Trican Well Service has come along way since they were last trading at lowly levels in 2016. The company has sold some overseas divisions and paid off mostly all their debt, acquired their largest Canadian competitor in 2017, Canyon Tech. For the past few years they have been re-purchasing their own shares thru an annual NCIB. Even during the most bearish...

Took a quick glance at Whiting Petroleum Q1' 2019 to see if there was a special reason they have been extra decimated in the past year, including losing half their stock value in just about 2-months. Whiting in a Williston basin focused producer who primarily does business in North Dakota. Q1 results showed that Whiting, a Bakken shale producer, saw a 3% drop...

1) Midwest (PADD 2) refineries are still operating in the low 80% utilization. 2) Differential increased to ship more crude by rail, which had dropped to a recent low after initial AB cuts. 3) Jason Kenney's new UPC government is looking to extend the Albertan oil production cuts into 2020 as Line 3 looks delayed. 4) With the rise of U.S. ultralight crude,...