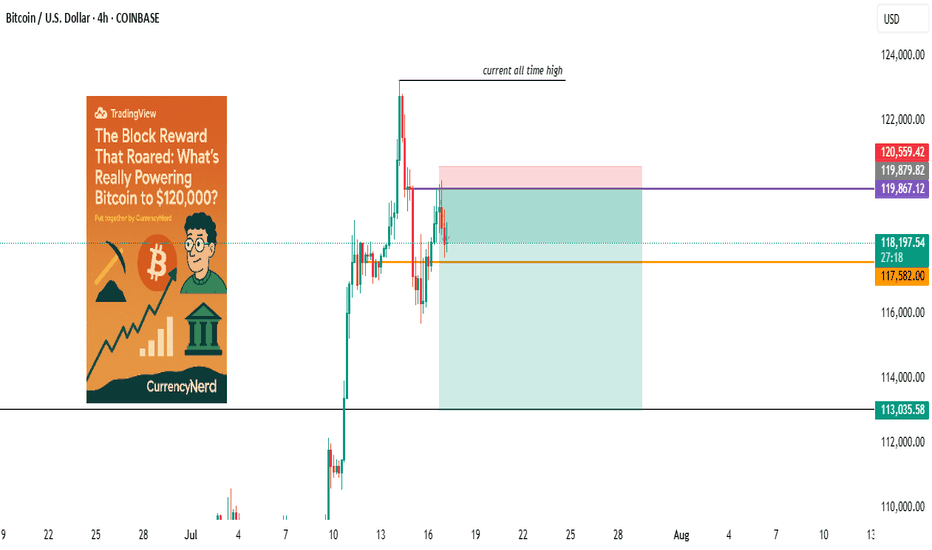

Bitcoin didn’t just wake up and choose violence. It chose velocity. As BTC blasts through the six-figure ceiling and fiddles $120k with laser precision, everyone’s pointing to “the halving” like it’s some magical switch. But let's be real, Bitcoin bull runs don’t run on fairy dust and hope. They run on liquidity, macro dislocations, structural demand shifts, and...

stablecoins were once the rebels of finance—anchored to fiat yet untethered from traditional banking laws, but the tides are turning. Across major economies, lawmakers are drawing up legal frameworks that place stablecoins inside the banking sector rather than outside of it. This shift could be the most pivotal regulatory development since Bitcoin was born. But...

In the world of trading, technical analysis often gets the spotlight—candlesticks, moving averages, and indicators. But beneath every price movement lies a deeper current: macroeconomic forces. These forces shape the environment in which all trades happen. Great traders don’t just react to price—they understand the context behind it. That context is found in...

"Watch what they do, but also how they say it." In the high-stakes world of central banking, few things move markets like the subtle wording of a Fed statement, But beyond the headlines and soundbites, one market absorbs this information faster—and with greater clarity—than almost any other: the bond market. 💬 What Is "Fed Speak"? "Fed speak" refers to the...

“In football, some say Messi was born with it, and Ronaldo built it. In trading, the same debate lives on—are the best naturally gifted, or relentlessly crafted?” The Messi vs Ronaldo debate is more than just about football. It’s a lens into how we perceive greatness: Messi, the effortless genius, gliding past defenders like he was born with a ball at his...

Crypto is more than coins and charts. That’s the surface most traders never look beyond. It's a stack of revolutionary technologies working together to build the future of finance, data, and trust. But if you’re serious about understanding crypto’s long-term value—or timing its major shifts—you need to grasp what lies beneath. Here’s your deep-dive into the...

If you've ever asked, “Why is the market going up on bad news?” or “Why did it dump after great earnings?”, you're not alone. Markets may seem logical—economic data in, price action out—but in reality, they’re driven by human emotion, crowd psychology, and reflexive feedback loops. The charts don’t lie, but the reasons behind the moves? Often irrational. Let’s...

📊 What Are Tariffs & Why Should Traders Care? 💱 Tariffs are taxes imposed by a country on imported goods. Think of them as the "price of entry" foreign products must pay to access domestic markets. 🔍 Why Governments Use Them: Protect domestic industries from cheaper foreign goods Retaliate in trade disputes Raise revenue (less common today) 🧠 Why Traders...

Whether you're a forex newbie or a seasoned trader, having the right tools can make or break your trading success. One platform that consistently stands out is @TradingView charting powerhouse packed with features designed to give you an edge. I @currencynerd I'm all about helping traders stay smart and stay sharp, so here’s a look at @TradingView features that...

Money never sleeps — and in certain cities, it practically runs the show. These financial capitals aren't just centers of wealth; they're the beating hearts of global finance, moving trillions every single day. Today, let's take a quick tour through the cities that move markets, set trends, and shape economies. 🌍 1. New York City: The Global Titan Nickname: The...

When it comes to forex and macro trading, it's easy to get lost in charts, indicators, and economic calendars. But one of the most overlooked—and incredibly powerful—macro indicators is the M2 Money Supply. In this post, we’ll break down what M2 really is, why it matters, and how traders like you can use it to get an edge. 💰 What Is M2 Money Supply? M2 represents...

Artificial Intelligence isn't just changing tech — it’s rewriting the rules of trading and investing. What used to be the domain of seasoned floor traders and intuition-driven bets is now increasingly dominated by algorithms, machine learning models, and predictive analytics. Here is how AI changing the markets — and what it means for traders like you. 📈 AI in...

Everyone talks about strategies, indicators, and secret setups. But if you strip trading down to its core, three pillars separate the winners from the quitters. me @currencynerd , i call them The Big 3: ✅ Mindset/ Psychology ✅ Risk Management ✅ Strategy/ System with edge You master these — you grow. You neglect even one — you stay stuck, or worse, blow...

🎯 Introduction: financial/economic bubbles are a recurring theme in economic history, this is often when a particular financial asset goes to unrealistic price levels often making money for early investors but usually these high price levels do not match their fundamental value this is then followed by a large public participation who also want a piece of the pie...

these incredible women have paved a way for female investors and traders around the world showing great resilience and fearless mentality despite facing gender discrimination going on to achieve great things in the financial field, motivating the future generation of young women that they too can achieve the unthinkable. 1. HETTY GREEN the witch of wall...

THE HISTORY AND ORIGIN OF TECHNICAL ANALYSIS I am a firm believer that as investors/traders we need to know the historic and major events that have occurred in this magnificent field of ours that have shaped how it is today. Today i want to shed light of knowledge on the history/origin of technical analysis as this is a widely used concept that is used by...

bitcoin whales are individuals or entities that hold/own the most amount of the digital XAU, to achieve this financial status one has to own at least 1000 BTC, with the coin's supply being infinite to 21 million (also known as HARD CAP), meaning that only 21 million bitcoins can ever be created. it's important to know who the big players are in the market also to...

there are various significant classes of stocks that help investors/traders to make more insightful and informed decisions when choosing the right stocks of choice here are my most important and favorite. 1.MARKET CAPITILIZATION this is the size/ total value of a company's outstanding shares of stock, which can be calculated with a simple formula of : ...