daytradederic

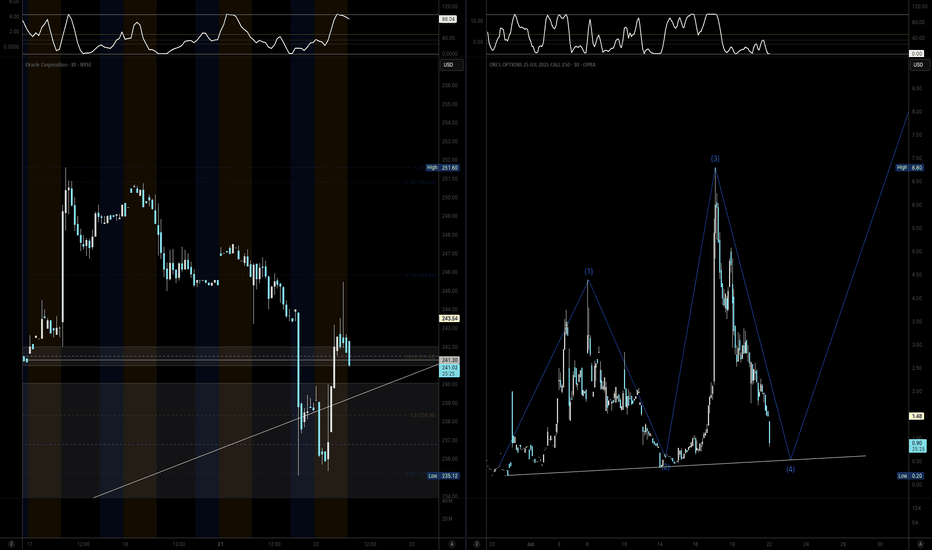

PremiumHello Traders! I'm providing an update to the ORCL trade idea from Monday July 21st. Here's what I'm watching: - Price to open lower from Monday's close - Rebalancing in the highest daily Bullish Order Block near $239 - A hammer or dojji candle on higher volume - Potential confluence with the daily 9 ema, trendline support and higher low on the options...

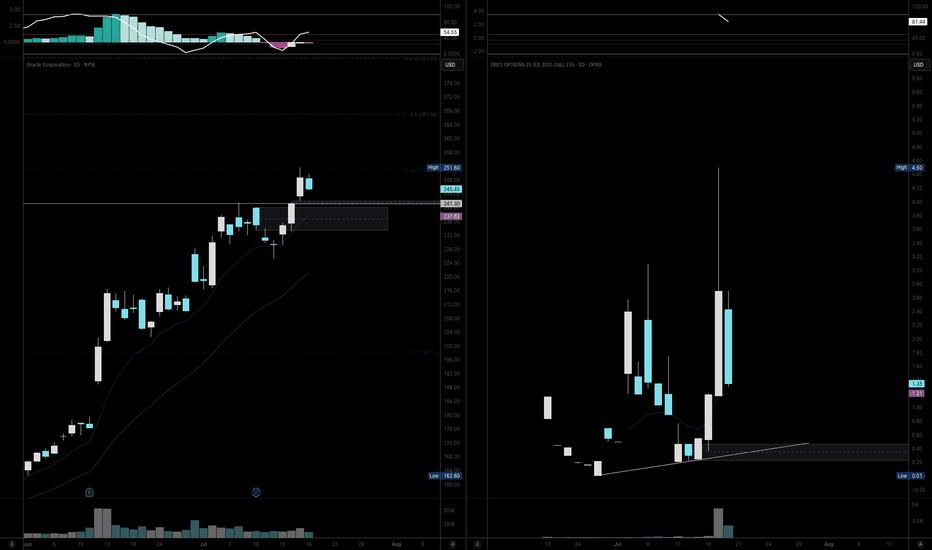

Hello Traders! As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows: - ORCL has been a headliner stock for the last couple months since its earnings, fueled by momentum in the Cloud AI and Services space - Right now price action...

Hello Traders! I'm providing an update to the CRCL trade idea from Monday July 14th. Here's what I'm watching: - Price to open within the range from Tuesday July 15th - Potential imbalance resolve from Monday July 14th at $204.70 - If price breaks Friday July 11th's high at $206.80 the trade is invalidated Cheers, DTD

Hello Traders! As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows: - CRCL is a high beta stock that seems to not be moving in tandem with its peers as of late - I am expecting volatility due to market data and monthly options...

NVDA was clearly a market leader today posting 4%+ gains. Looking at the overall structure I am anticipating a broader market sell-off / accumulation heading into the presidential election (topping next week on Tuesday or Wednesday 10/1 or 10/2). My best guess is that we bottom for the break out of this pennant pattern after October's monthly options expiration....

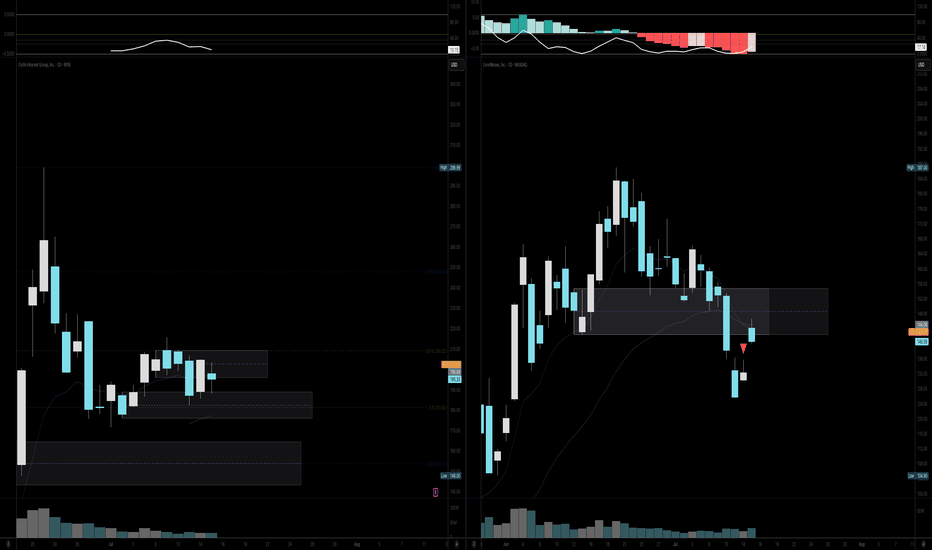

Looking at the charts side by side...GDDY is set to break a multi-year resistance similar to SQ. Not sure of trajectory, but SQ is at about 280% from March lows...so GDDY has about 200% upside on the break pricing it around $250 It sounds crazy I know...but what is up anymore.

The price action has been pretty choppy lately, but has provide some much needed context as to what to expect with earnings...I've learned to not fight the trend and hopefully will be able to confirm this pattern late morning tomorrow (7/22). I'm looking for a bounce off $1530 level to confirm the floor of the bull flag. Target for this week is 1.618 level of...

Not an expert at EWT, but it's relatively easy to see a wave 4 correction of larger wave 2. I'm targeting a pullback here before earnings to the horizontal white line (which was previous resistance before the recent breakout) and then continuation of wave 5 of 3 to about $210 (2.618 x total length of wave 1 (which is about 80 ($140-$60)).

Not an expert at EWT , but it's relatively easy to see a wave 4 correction of larger wave 3. I'm targeting a pullback here before earnings to the horizontal white line (which was previous resistance before the recent breakout) and then continuation of wave 5 of 3 to about $210 (2.618 x total length of wave 1 (which is about 80 ($140-$60)). Furthermore, I see the...

So I've been spending a lot more time preparing for the week ahead in equities by charting local support and resistance levels. I mainly swing vertical spreads once I confidently identify resistance levels and other strong TA reassurance for a strong move upward (hence call options on ROKU last week). But what about GBTC? Overall I'm bullish for fundamental...