dc4uonly

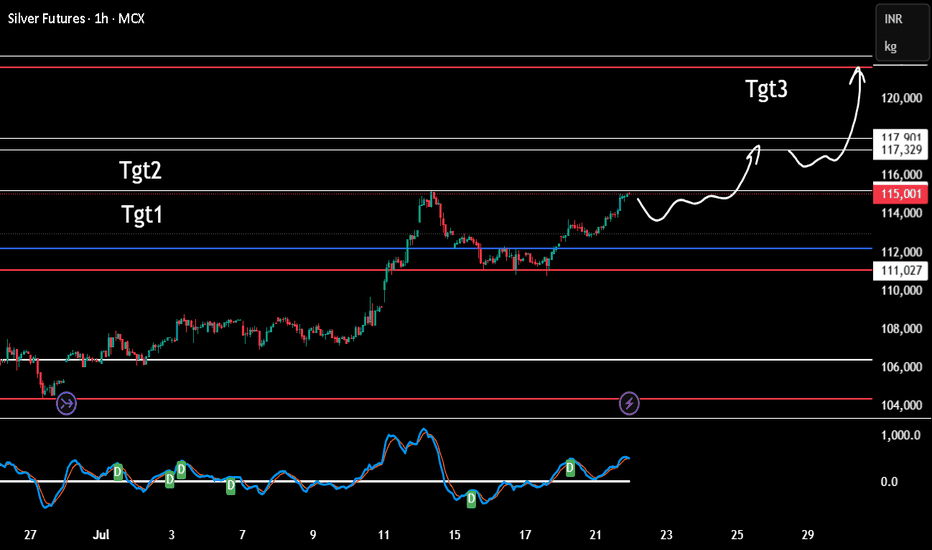

Premium1. A good price correction and time correction is notice. 2. The fifth wave for correction is to completed (it did not correct in abc form) 3. Higher high is made. 4. Expecting lower low not to be broken retracement max level should be atleast 0.1 rs above lower low. 5. creating lower low will initiate stop loss, probability is very less Before investment on long...

Expected path and view. This for educational purpose only. Not buying or selling recomendation

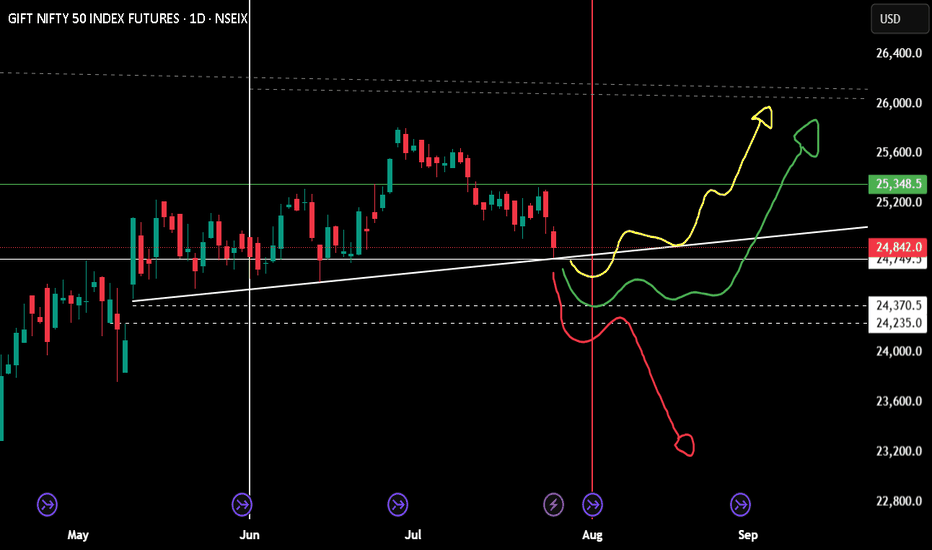

In August expecting bulls to enter in a huge way. This only for learning purpose.

This are no buy sell recommendation but sharing for learning purpose only.

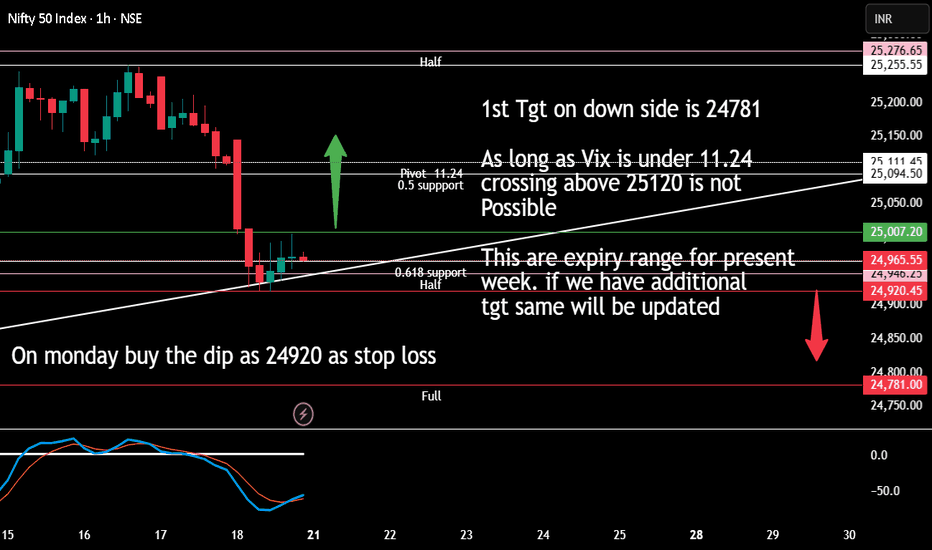

At present market is for scalper/intraday trader. Positional trade to be done only once, 1. 24438 is crossed on day closing basis. Bearish view 2. 25102 is crossed on day closing basis. Bullish view Pivot- Half-Full are weekly range and applicable only till 7th August. Vertical lines are important times for intraday as buyer

Expecting a reversal, yes geo political and 1st August announcement will play a major role. just wait for one day candle closing on your area. If you wish to be on buying side (buy nifty future) a positive candle on top of the trend line. Selling future for the month is only wise if 24k is crossed. Technically a bounce is expected and hopefully a green candle...

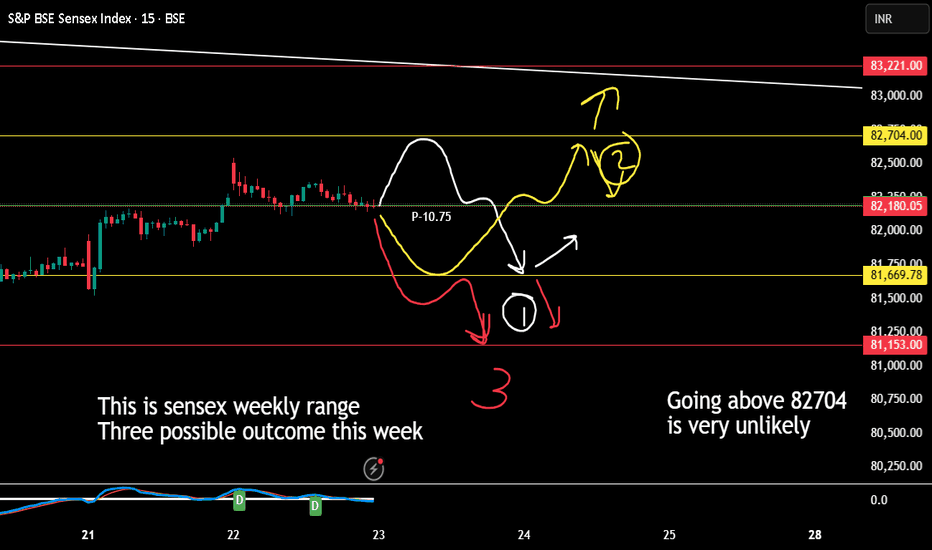

This are mathematical calculation not based on important level of fib or support level that are derived by most of the Technical trader. just trade the level with few point stop loss. for grabbing greater points. please do check out sensex where few greater points are explained.

1. If Market VIx is less than pivot point then any price coming near pivot line or above is an opportunity to short. 2. Coming to half line below the pivot is highly possible by 80% by 24th July 2025 if not today. 3. That half line point will decide the market direction and any closing below in day to day bassis will indicate weak market. I am expecting reversal...

Tgt 1 reached. A break out will take to tgt 2 and then tgt 3 Tgt1 is being tested second time, for good break out we need third re-test hence expecting some retracement before a a real break out. Anything above is a possible trap unless the momentum is fast and swift.

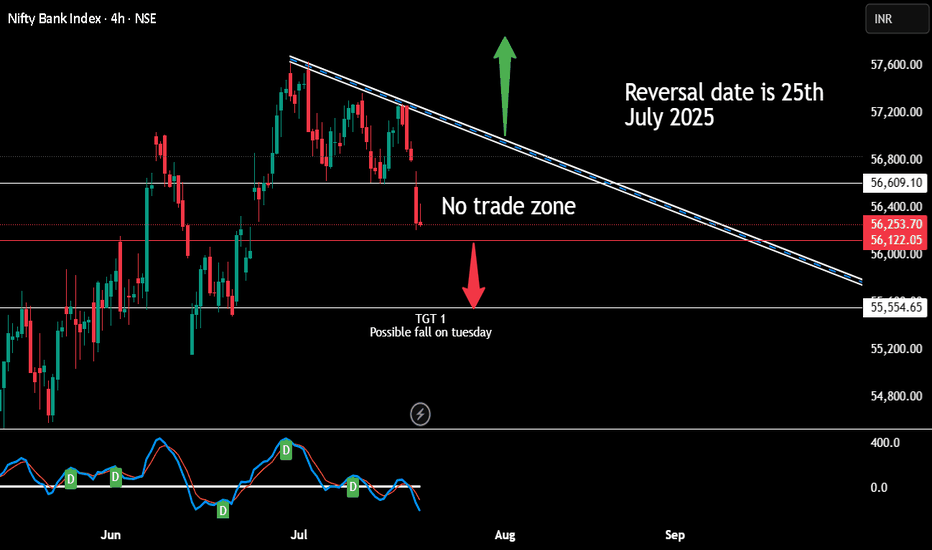

Once indicated level on red is broken and candle is closed even in 5 mins time frame then next candle execute the order. The only condition is the market has to halt before break out and consolidate for some time. Sell future with 20-50 point stop loss for tgt of 55555 This trade is applicable only till 25th july 2025 there after we need to be watchful for reversal

As long as vix value is under 11.24 crossing pivot and going on top is not possible as per my mathematical range calculation (accuracy is 80%). If it is near 25111 level on Thursday (and ind vix is less than 11.24) a very good time to make handsome money as market will touch 24946.27 level (probability s 80%) For Monday we should follow buy the dip as long 24920...

Based on a confluence of Technical Analysis, Gann theory, and Astro-cycle studies, the market continues to experience downside pressure. This phase is likely a volume accumulation zone, which could set the stage for a stronger uptrend in the coming weeks. The current bearish undertone is expected to gradually shift, with potential positive momentum emerging...