develuse

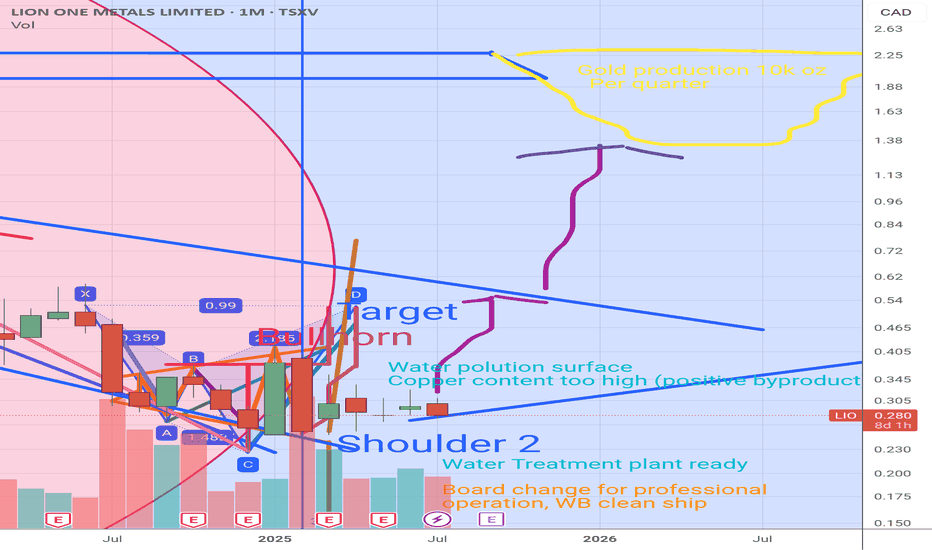

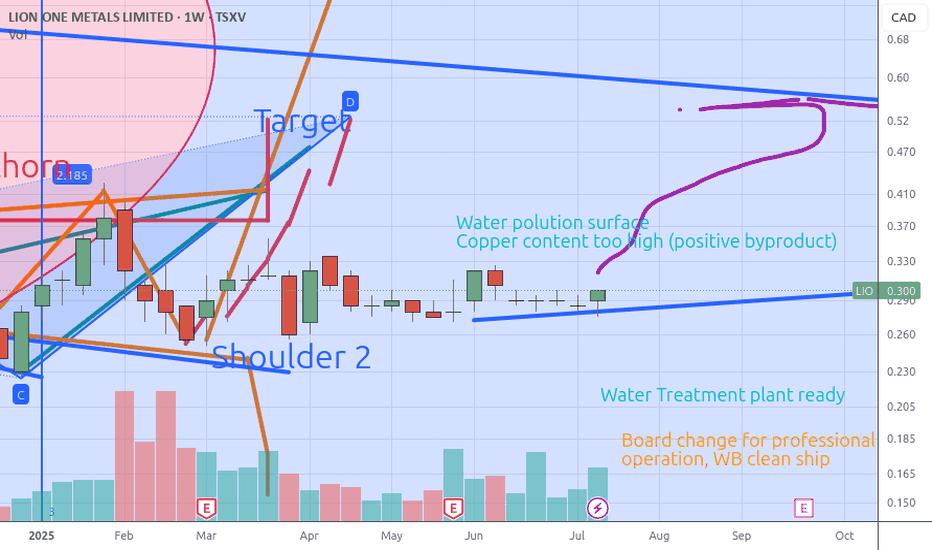

So at 10k oz per quarter production 2026, this stock is worth 0.60ct and 120 million usd

Water polution 30th of May gave a storm to the share. Like an oil spil, their copper spil was seen negative. There is considerable potential for Copper as by product with 200 eu a kg. Further we see WB is making a clean ship, firing the people who were not sustainable. Finding an Operation veteran who brough another mine to 2 billion marketcap. size. All positive...

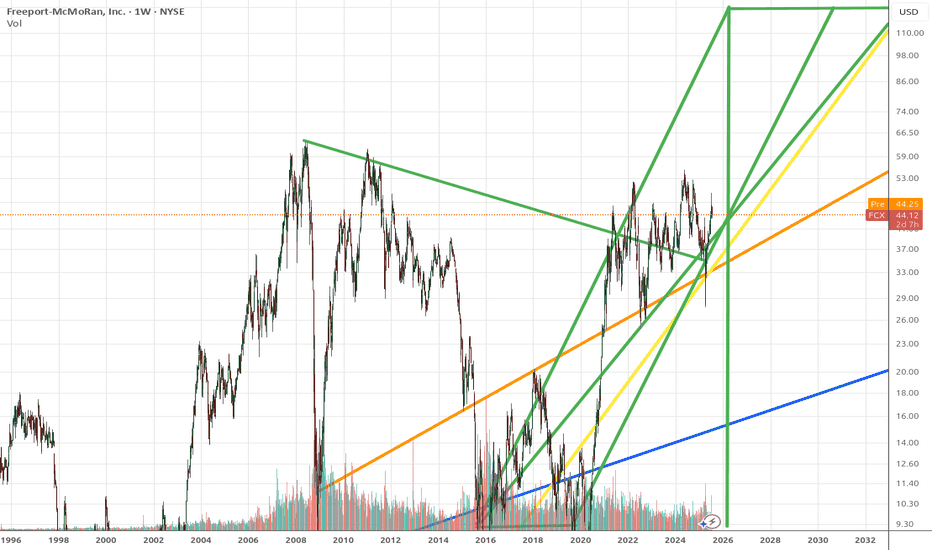

When gold and silver are high and copper is in high demand as well as other metal, FCX goes balistic

A sector wide issue, resources to double at least. It seems to be a world wide issue that resources do not get valued well. Their Price to Earnings is often below 5, while tech often gets above 100. The growth does not warant that anymore.

Ride the wave down on your surf board. Fresnille will kneel a 20 % where tech firms might go down 40-50% (e.g. Apple)

Lion One Metals, Just in production 4000 oz/quarter SOLID 2.00 Solid target from 0.3 to 2 !

Gap closing, AEX might go a further 4% down this week

Peak in Asian markets today, together with Germany yesterday and US, the whole world will be selling equities upcoming months with such bad trade and job perspectives.

40$ Silver comes next month At that price current production free cash flows enables to Finance their own development of the site 10% equity from our pockets does the same Let them have balance, let them realize The dream of 100$ per ounce The reality of a 100 million a year Silver mine in Peru by 2030

Break out in the silver market. Fresnillo is a tier 1 player. It breaks through the earlier highs and we are aming at the 2017 and 2020 highs

Chinese stocks are plunging, Hang Seng -13%. Alibaba will be hit by the trade tarrifs.

Sierra Madre has is in production and will ramp up quickly Has 40% gold in their production Silver equivalent value.

De vraag naar olie droogt op zoals de vraag naar Haver terug liep toen paarden vervangen werden met brandstof autos. We vervangen nu de olie met electriciteit en dan is Koninklijke Olie klaar. The demand for oil dries up like the demand for Horsefood fell back when horses were being replaced with fuel cars. Now we replace fuel with electricity and then RDSA Shell...

A lot of gold with the drill results Also their production is ramping up this year from 300tpd to 600tpd

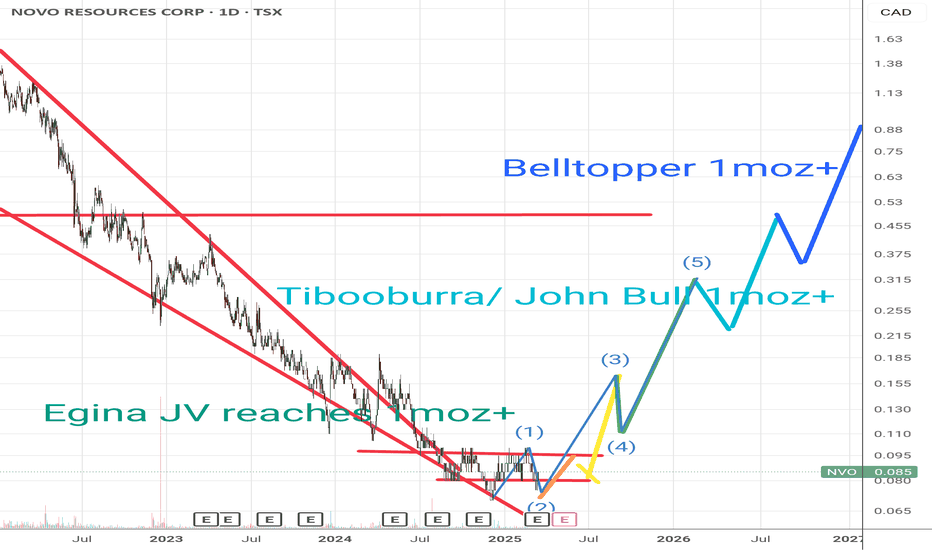

Strategic joint ventures aiming at 1moz+ development potential by farming/ exploring properties by drilling rock. Very exciting as it fully depends on management risk taking and knowledge of potential gold trends

With western markets breaking their lows China will accelerate down

TED spread to spike when liquidity need is high among banks Today markets fall. Margin calls will happen and banks liquidity will be drained quick.

Lion One Metals doing the zigzag 0.41 target GOLD PRODUCER This producers will aim at 500 tonnes per day crushing in 2025 When each tonne deliver 3gr + gold => 1500 gram => 50 ounce worth a day. With each ounce at a 2800+ this money machine is in the top league of gold producers. 50% is their margin and dilution has taken place, hence the low entry From 0.3 -> 0.4...