djh860

It seems to be failing at the resistance level at $130 Good chance for URI to fall back to the bottom of the range at $105.

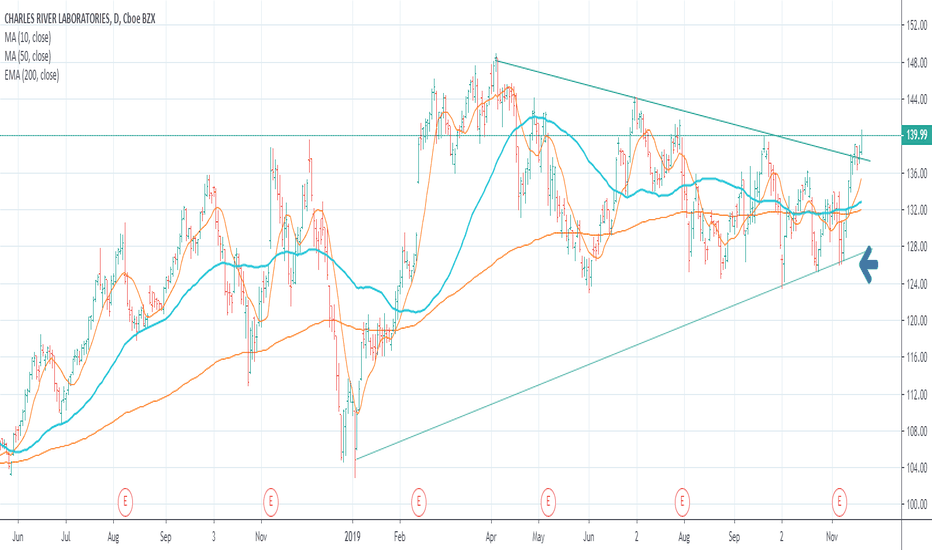

Has been listless and weak since march while putting a substantial floor in, now breaking above the trend line on solid earnings.

The entire group is taking a break now SAAS stocks are all down OKTA TWLO ZEN NOW and TTD But as a group they are meeting and beating their earnings estimates. TTD beat and guided higher while posting a 41% increase in sales as they usually do. I think the weakness is a short term move from growth to Value by the big $$ factor players. Its a little...

ACB is running out of steam and possibly is grossly overvalued. Still it has not violated support and is slowly declining in a clear trading range. Consider a long here with an exit envisioned in the $8.5 $9 area.

All of these cloud based software stocks with no earnings are taking a breather. See OKTA TWLO ZEN NOW COUP . The big money seems worried about valuation and cash flow and eventually earnings . SPLK beat and raised last quarter. Sales are growing 33%. SPLK bounced strongly off support at $108 and will make its way back to the top of the range at $140

The first breakout attempt failed. This one looks safer to succeed. The fundamentals are solid and improving.

I expect YETI to move back up to the top of its range.

URI is showing solid growth and a recent earnings beat. Still it looks like the market wants it to retest the low. This story is fundamentally beautiful and technically ugly. Buy at $96.6 or so

Twice now CVS which has been bottoming has shown signs of breaking out. The latest is on better earnings.

After a blowout beat last Q HZNP is set to release earning on Aug 8th

Out of favor and below the 200 day line yet is just above support and in a clear trend.

The fundamentals are solid and dependable. Will the breakout fail again?

This business is characterized by customers who never leave, a high dividend yield ( 7.8% ) and low single digit sales growth. It's now at the bottom of the trading range indicating strong support.

If it does we have room for a nice pop and a breakout from the downtrend.

Solid fundamentals, and big div increase should lead to sustained momentum on this beat down unloved name.

First product is selling very well +47% yoy sales growth, NDA for second product expected in Q3 for NASH ! The chance to first to market with a NASH drug is a huge opportunity.

Over the longer term the Chinese pork herd is decimated by swine flu. It will take years to recover. So it is strongly expected that substitution to chicken will lead to stronger chicken volume and pricing. However over the near term the US corn crop looks very poor right now due to poor planting conditions. The fear is that feed prices will rise. The reports...

Rock bottom P/E, high 3.8% yield and bouncing off support with and excellent plan to drive same store sales growth.