Vale has reached an area of very strong weekly (not shown) and daily resistance. Furthermore it has just broken and retested the upward trendline. So consolidation and retrace can be expected. Possible scenarios for rebuying: ORANGE: Simply consolidation at the current levels before we continue up. RED: Wee do a retrace to the 0.5 fib, which lines up nicely with...

So FCX has been on an incredible run, so the question becomes when is a good time to sell and wait for a possible retrace. We are currently getting close to a confluence of resistances, so I wanted to highlight this as a possible good selling point. First of all there is the long term downward trendline that is currently around 17.5-18 (depending on how you draw...

Odfjell Drilling still has this big gap looming overhead from the Corona crash. And made a strong recovery impulse after. At the moment it seems to be in a retrace. The reason I highlight ODL right now is because a couple of things line up nicely. We'll have to be patient to get to the ideal buying moment, but we will get there! The fibs line up beautifully with...

So Bioartic is still looking very good from a fundamental point of view. If you are looking to buy (again), I've looked at several scenarios. First of all BIOA_B is consolidating between 2 support/resistance areas and has just broken it's upward trendline, so a correction is definitively a possibility. If looking for a target for that correction, around the 78-80...

GOGL is consolidating inside the daily cloud, after breaking into it upwards. The key now is the downward long term trendline (blue), it's eyeing this one at the moment. If this breaks and retests, it's a buy from me for GOGL!

SNI is nearing the end of it's triangle, so now let's see which way it will break. Recently it seems to be forming support on the purple support area, but we simply need to wait for a break out above (or below) the triangle.

HUNT is getting squeezed between the strong support and the 50MA that's sloping down. Again, we are talking about a stock that has a big thumbs up from a fundamental perspective, which gives me a bullish bias. Very short and simple, I think once it breaks the 50MA it will start a run up into the cloud and further upwards. So this break will present a good buying...

Patience is the word with EURN, despite it looking bullish and fundamentals being good. - It's inside the D cloud, first needs to break out of it, or find support at the bottom. - Strong resistance at 8.7-8.9, let's see how it reacts there. - Possibly might just fill the gap at 8.885 and then do a retrace. Stay tuned!

FRO found some strong support on it's long term upward trendline (brown) and fundamentals are strong for this company. Furthermore started forming an uptrend already (blue lines). However seems to have broken the steepest trendline and retesting it now. So expecting a retrace at the moment. This will present a good buying opportunity. There is good support at...

ONCO has been consolidating for quite a while. The reason I'm looking at it now is because it has just found support on the daily cloud (not on the chart displayed) and just arrived at the bottom of the weekly cloud. So now let's see if it will enter the weekly cloud. Once it does, I see a bullish scenario unfolding. I've drawn 2 potential scenarios; Scenario...

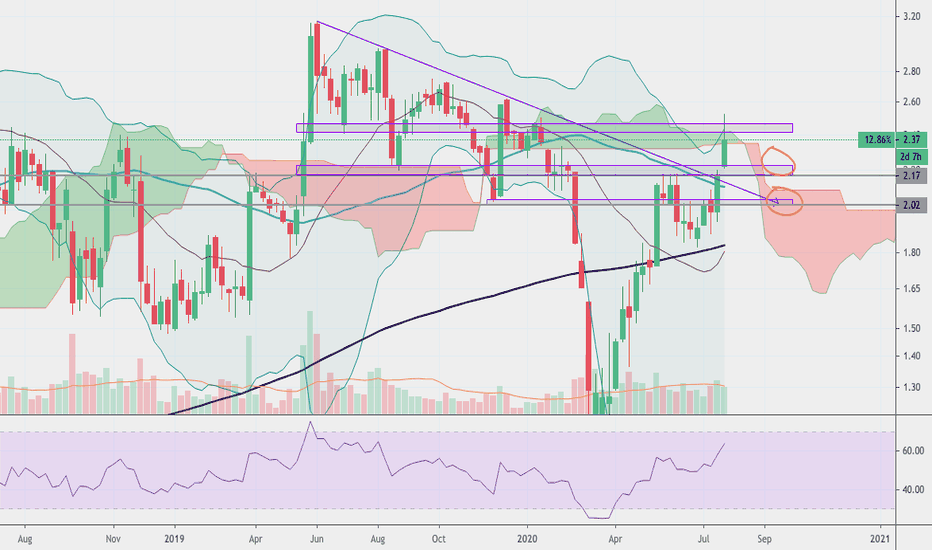

LYC has broken a long term downward trend, great news! However, it seems to have trouble with the above horizontal resistance. So now it's important to wait for a retest and LYC finding support. This could be around AUD 2.17 where a gap was left recently and we have horizontal support. Or it could be around AUD 2.00-2.04, which will be a retest of the trendline...

The fundamental outlook for Vicore is extremely bullish with a target of SEK 41,-. So I've been looking at a good entry for quite a while now. After the most recent rejection at around SEK 20,-, VICO seems to be finding support on the weekly chart. Both the 200 MA (thick black line) and a horizontal support area are credit to that. The black arrow, creating a...

FLNG has done several bullish things recently: - Broke it's blue downward trendline(s). - Broke overhead resistance and retested it. - Broke through the daily cloud and retested it. - Made 2 higher lows, thus creating an upward trendline with 3x touch. - Moved above the 50MA on the daily chart and found support above (light blue line). So very simple, this is a...

So looking on the monthly chart we see that despite covid, Ericsson nicely held it's long term upward trendline. Furthermore, it broke through some pretty tough resistance with a big green candle this month. All great signals for a continued long term upward trend. So what do I want to see for a good buying opportunity? - A retest of the horizontal resistance...

SO FRO is another one that arrived at strong support and that has several hopeful signs. - Fundamentals give a value of NOK 98,- as a target. - Recent downward trendline has been broken. - Bounce on a long term upward trendline. - Gap at 100.50 that needs to be filled. However, for now FRO got rejected at a pretty strong resistance. So basically I want FRO to...

EURN has been respecting an upward trendline for quite a long time, with a recent bounce of it once again (red circles). Furthermore the downward trend has been broken recently, which is another good sign. And don't forget we still have a gap to fill at 8.885, plus fundamentals are good with a target of EUR 13.50. So overall looking bullish for now. So what...

A little while ago I expected NOD to make a correction already, but it kept steaming on upwards! Target for this one according to fundamentals is around NOK 130,- However, the big problem with these runs is to find a good buying opportunity, especially if the price is at an all time high, so you don't have previous supports/resistances to work with. So all I can...

Positives: - After the impulse, did a perfect retrace to the 0.5 fib and found support. - Gave a buy signal earlier in March when the 200MA held. - Seems to be finding support above the 50MA at the moment. What to wait for/when buy: - Breaking above the daily cloud. - Retesting the blue upward trendline and reacting positively. When invalidated (for now): - If...