dudebruhwhoa

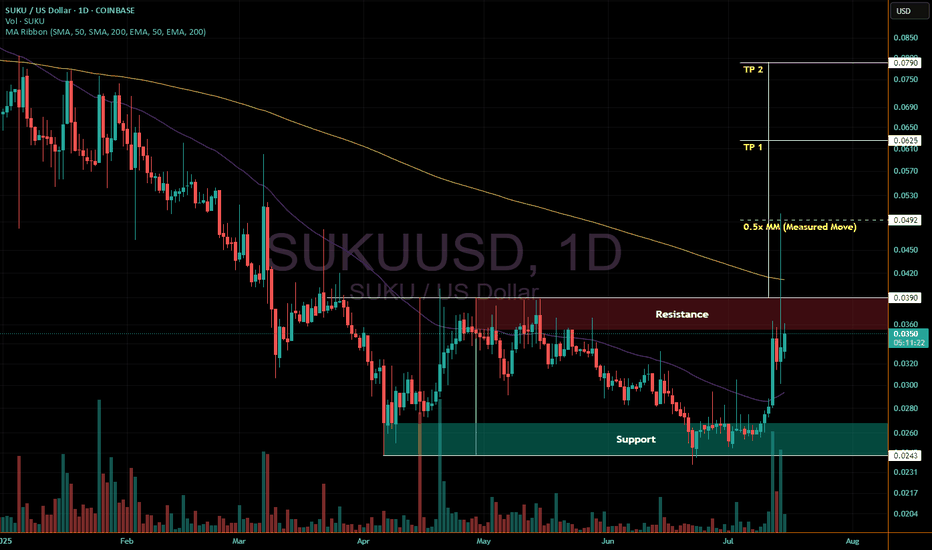

PremiumQuick double bottom pattern chart for suku/usd. It has finally seen an impulsive move up after bottoming around 2.4 cents. That move did breach 3.9 cents and tap the 0.5x measured move towards TP 1, but hasn't yet held above 3.9 or the 200 daily EMA just above it. It is presently pushing on resistance. As long as bitcoin holds up, a move above 3.9 and the...

Bias - bearish unless it closes and holds above 4.536. May make a move up to that level before moving below 4.387. A move and hold below 4.387 targets 4.17 and then 4.067 A move and hold above 4.536 targets 4.769 and 4.896. Possible to see brief pullbacks above or below either key level vs strong moves above or below that are held.

The CME Gap around 5710-5730 is beginning to align with the 4h 200 EMA. 4h RSI has been diverging bearish 3 times with each leg up within the channel above. Also, a breakdown of that channel has measured moves down that align with both the 4h 50 and 200 EMA: - 50 EMA an 0.5x measured move down - 200 EMA a 2.5x measured move down Pre-req on targeting the...

Targets = 1.289 then 1.338 Wick already reached and breached halfway point to TP 1, re-test of support and neckline in progress now. Hold and/or a pullback and reclaim of 1.889 to head up towards targets. Good luck!

Short until the gap, then long. Daily S&P E-mini futures chart, a failure to remain above the 200 EMA and failure to reach the 200 MA, now pushing on the 50 EMA and MA and a confirmed death cross. We have a CME gap between 5332-5355 (so approx 5345ish as a target). Scenario here is a move down to the gap to act as a springboard to get back above the 50/200 EMAs...

Oil futures recently broke down from a long-term wedge, following a failed breakout at the start of the year, and a recent death cross of its 50/200 weekly EMAs and MAs. It looks to flip long-term bearish here unless we see a rapid recovery of the wedge, the EMAS/MAs and a subsequent breakout. It could lose half its value or even 2/3rds if it hits TP 1 and then...

Looks like a confirmed double-top, might turn into a Head/Shoulders even. Head Shoulders: A common scenario with these is, it looks like a double top, then has a strong reclaim of the neckline, which is around 41.9k, and then a 2nd loss of it shortly after w/ yet another re-test with failure to reclaim. Double Top: Another common scenario is just a re-test...

Lose $2.08 - Ripple will move down to 1.26 and then 98 cents approx Hold 2.08 and reclaim ~3 dollars - Ripple can move up to 4.91 and then 6.3 Dashed lines are additional possible targets if it continues in either direction, the first dashed lines also mark halfway points to bull or bear TP 1

Nvidia needs to reclaim the bottom of a rising wedge it just lost and failed to reclaim on the last two daily candles. It did wick back above it with the most recent daily candle but failed to reach the 200 day EMA, and closed below. There could be further tests, but the most likely scenario here is down towards the two take profit targets shown on the...

The "Flippening" goes back to 2017, a term coined back then referring to a possible future where Ethereum overtakes the marketcap of Bitcoin. Should that ever occur, it would also take a larger portion of market dominance than Bitcoin Here's a silly chart, just for fun, imagining that scenario during the current bull market.

The daily chart should be headed to ~5 and then ~6 dollars give or take. It already has a confirmed double bottom that is currently re-testing its neck after reaching the top of the larger wedge here and getting stopped there. If LTFs moves down to re-test 4.27 or even a pullback below it around the EMAs occurs, and these levels are held or reclaimed as...

Just a quick post noting the similarity of these two, they are moving in near lockstep. Presently HBAR is moving slightly after XRP. This will flip flop over and over though, as you can see on the chart - at times HBAR will move before XRP. Good to watch both if you are wanting to know what one or the other may do next.

Bitcoin weekly basic patterns and measured targets shown to work well over time. Present pattern with unreached targets in red (bear) and green (bull). Good luck!

Bull and bear targets on the chart. Conditions for Bear - lose 91.4k and fail to reclaim Bear Targets TP 1 and 2: - approx 77k - approx 71k Conditions for Bull - reclaim 102.750 and hold above. Bull Targets TP 1 and 2: - approx 122k - approx 133k

The daily has been forming a rising wedge, which had a failed breakout back in early-to-mid November. A failed breakout makes an actual breakdown even more likely than it already is for this pattern. I'm expecting a move below 40 and then a stronger move down: TP 1 = 24.27 TP 2 = 19.06 Invalidation of this short would be a 2nd and successful breakout (so, look...

Short-term: Bitcoin is in a parallel channel on the 4h chart. Break above the channel to head towards 120k and continue making new ATHs Break below the channel to re-test 85-90k. Long-term: Bitcoin is likely going to approx 132.5k, as shared here:

Remain in the channel to break 4k: , break down from the channel to test 3k or lower. break out of the channel to move to and above 5k break down from the channel to test 3k or lower

If Others (non-top 10 altcoins) marketcap can remain above 350 billion, it may head up to 1.72 trillion and an initial target and then 3.8T from there, a nearly 10x move from where it presently sits. Prerequisites is Others.D holding above ~10.5% or if moving below that, not moving below 9.15%. And, BTC.D remaining below 60-61%