Tesla Inc. (TSLA) has been gaining strong momentum lately, and on the 4-hour chart, my BBofVWAP strategy has shown a notable signal. In this post, I’ll walk through how this custom strategy works and what the latest price action could mean for traders. 🔍 What is the BBofVWAP Strategy? The BBofVWAP (Bollinger Bands of VWAP) strategy I use combines two powerful...

SPY Technical Breakdown: Bullish Momentum Building into Key Resistance Zones Analyzing the SPDR S&P 500 ETF Trust (SPY) on the 4-hour timeframe. As of the latest candle, SPY trades at $547.37, up 0.15%, and is showing signs of sustained bullish momentum after a recent pullback. For swing and short-term traders, this setup could present a strategic...

Bias: Neutral-to-Bullish (for breakout) Setup: SPY is consolidating between $520–534. A clean break above this zone could signal continuation toward the pivot level at 562.75. Entry Options: Aggressive Long: Buy near current levels (~526), stop-loss below $520, target $534 short-term and $550–562 swing target. Conservative Long (Breakout): Buy above $534, on...

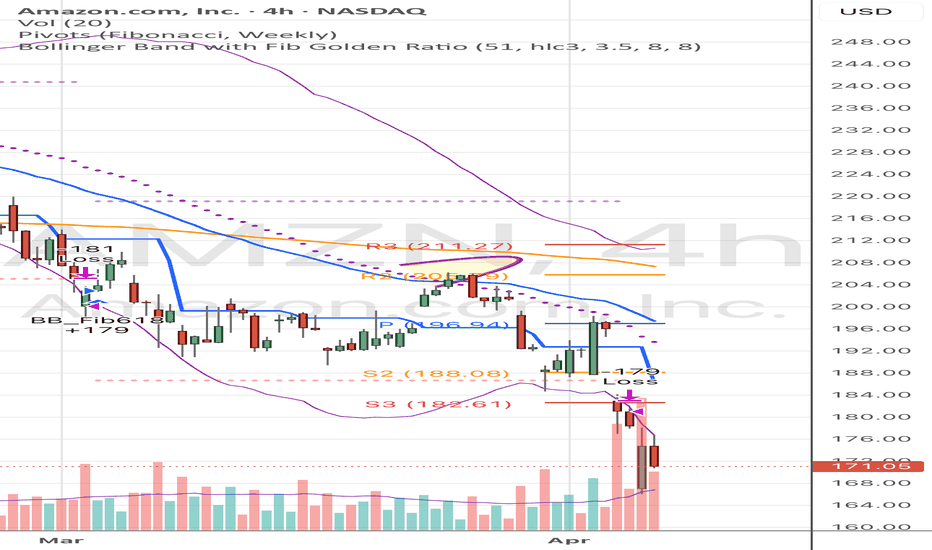

Analysis on 4H Chart (April 2025) Amazon (AMZN) experienced a sharp sell-off, currently trading at $171.05, down -7.41% on the session. This 4H chart shows a significant bearish movement, and there are clear signs of trend continuation if key support zones don’t hold. • Current Price: $171.05 • Weekly Pivot S3: $182.61 (Broken convincingly) • Next Major...

I have been watching SNOW on hourly chart for a week. This week it is just trading weekly S3 pivot (camarilla) My rsi strategy triggered buy earlier and now it triggered add position There is divergence in momentum ( bottom indicator on the chart) , price is coming down near S3 , but momentum indicator is going up Momentum indicator also has squeeze feature(by...

QQQ / TQQQ is in uptrend on 1 hour chart. I am watching this to pull back to BB Lower Band. Then it should close up with green candle. I am planning to BUY it here. Target price should be upper Band.

QQQ is showing Long signal on RSI of MACD and RSI of VWAP strategies. when it shows on more than one strategy , it is strong signal. Yellow color on the chart is from RSIofVWAP , blue color on the bottom chart is RSIofMACD.

Cup and Handle pattern found on SBUX hourly chart ... Please see the notes on above chart

Cup and Handle Pattern found on hourly chart of TQQQ. Height of the cup is 16 points Top of the is 92 ish Expected target = 92 + 16 = 108

8 Mar 2021 I see W pattern on hourly chart volume registered high (see below) if price closes above 51.60 (green line on the chart ) , it will go up further 5.50 dollar up .. That is the height of the W pattern

I see Double top on hourly chart for QQQ , breakthrough below 311 will push further down 13 points. Good idea to short it when it break down to red line above chart Let me know what your thoughts

I saw Head and Shoulders pattern on SPY hourly chart ... I have made these notes on the chart on 19th Feb . However I didnt get chance to publish the idea nor I took the SHORT trade. Please note , this pattern already completed , dont enter any short trade now ... I Just wanted to share , to show how the pattern works

QQQ bullish divergence found on hourly chart Please see the notes on chart

for TSLA stock , I have noticed ronded base on Hoourly chart , this might end up as CUP and Handle pattern. If that happens , Long entry can be taken when price comes out of handle ... (this is not formed yet )

Cup and Handle pattern found on XPEL hourly chart closing above 55 with good volume will push it higher ... my guess target is 60

CUP and Handle Pattern found on hourly chart of QQQ

Hidden bullish divergence on SPY hourly chart

![SPY ... Head and Shoulders pattern on Hourly [short setup] SPY: SPY ... Head and Shoulders pattern on Hourly [short setup]](https://s3.tradingview.com/5/56tvQLmf_mid.png)