SOL/USDT: Key Levels to Watch SOL/USDT trades at 146.66 (+2.94%), showing bullish momentum but facing key tests ahead. Critical Levels - Support: 142.12 (immediate), 138.21 (strong), 130.00 (major) - Resistance: 151.10 (breakout zone), 155.00 (next target), 160.00 (major hurdle) Outlook - Bullish: Holding 142.12 and breaking 151.10 could push SOL...

The cryptocurrency market continues to navigate a complex macroeconomic landscape marked by trade tensions, inflationary pressures, and shifting monetary policies. Against this backdrop, SOL/USDT is trading at 105.83, posting a modest 0.41% gain in recent sessions. However, the road ahead remains uncertain as external factors—including the U.S. dollar index (DXY)...

Analysis: The price has shown significant volatility, with a notable peak at 258.62 USDT. The projected high of 392.77 USDT by mid-2025 suggests a bullish long-term outlook. The immediate resistance at 157.93 USDT is a key level to watch for potential breakouts. Support at 128.98 USDT is crucial; a break below this level could see the price testing lower...

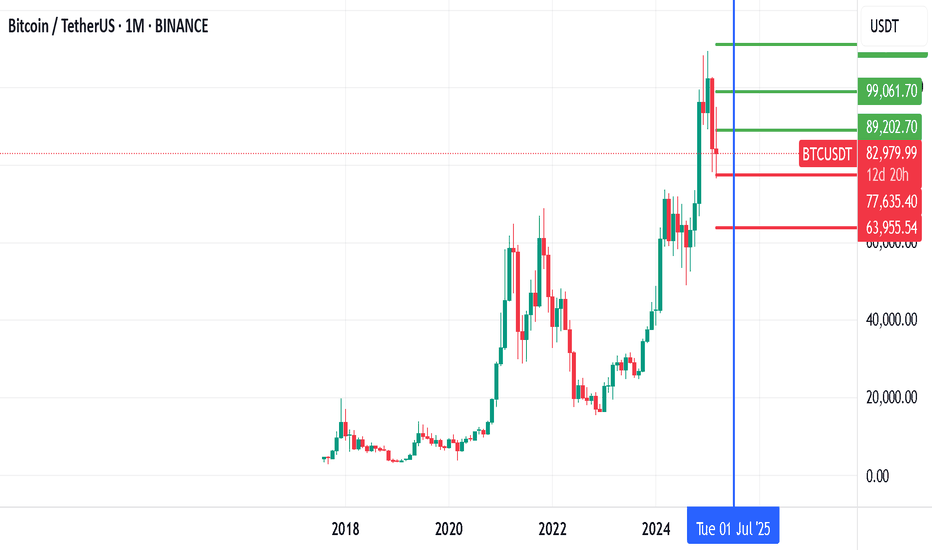

The Bitcoin's price movement and its long-term valuation, with key factors such as Trump's tariff policies, Fed interest rate decisions, recession fears, and global geopolitical instability influencing its trajectory. Here's an analysis and long-term valuation of Bitcoin based on the information: Current Price and Trends: Current Price: Bitcoin is trading at...

Traders: Might look to buy near red support levels and sell near green resistance levels, anticipating reversals at these key points. Breakouts: If the index breaks through a green resistance level with high volume, it could indicate a potential upward trend continuation. Conversely, breaking below a red support level might signal further declines.

Price Movement: Bitcoin's price has recently decreased by 1.43%, indicating a short-term bearish trend. The price is currently closer to the lower Bollinger Band, suggesting that Bitcoin might be in an oversold condition, which could indicate a potential reversal or support level. Bollinger Bands: The price is near the lower band, which often acts as a support...

Price Movement: Bitcoin's price has recently decreased by 1.43%, indicating a short-term bearish trend. The price is currently closer to the lower Bollinger Band, suggesting that Bitcoin might be in an oversold condition, which could indicate a potential reversal or support level. Bollinger Bands: The price is near the lower band, which often acts as a support...

"The 3-month trajectory of Bitcoin’s price (support/resistance) depends on Trump’s tariff policies, the Fed’s interest rate moves, recession fears, and global geopolitical instability."

Breakout with RSI Momentum Scenario: Price breaks 138.06 with RSI > 50 (bullish momentum). Action: Entry: Buy on retest of 138.06 as support. Target: 150.02 → 160.00 → 200.00. Stop-Loss: Below 126.23 (previous resistance turned support).

Bullish Breakout: If Nasdaq breaks 17,800, the call option gains value. Bearish Reversal: If it drops below 17,436, the put option profits.

Pattern: The price action is forming a "W" pattern (double-bottom reversal), signaling potential bullish momentum in the near term. Near-Term Target: The formation is expected to test 180 (Est. 180) as an initial upside objective. Resistance Level: A key hurdle lies at 228.62; a breakout above this level could confirm stronger bullish continuation. Support Level:...

"Tesla declined by 43% (205) over 55 trading sessions, but its RSI(Relative Strength index)indicates bullish divergence,signaling potential upward momentum. Key levels to watch include esistance at315 and critical support at $201."

Solana is consolidating near 143.58 USD, with 144.08 USD and 142.65 USD acting as immediate directional triggers. A sustained move above 145.49 USD would signal bullish intent, while failure to hold 142.65 USD risks a drop to 140.46 USD.

expect Solana to surge to 152.00–154.50 USD, assuming sustained buying pressure. Monitor volume and resistance at 150.00 USD for confirmation.

A break above 150.00 could signal bullish momentum toward 160.00. A drop below 140.00 may trigger a retest of 134.75 (strong historical support).

Resistance Levels (Potential Selling Zones): 18,480 – 18,590: Immediate resistance at the 0.382 Fibonacci retracement (18,480) and the session high of 18,589.49. 19,140: Stronger resistance (horizontal level and 0.236 Fib), though likely out of range for next week unless a sharp rally occurs. Support Levels (Potential Buying Zones): 17,930 – 17,945: Critical...

Support & Resistance Levels: Immediate Support: 140.00 (psychological level) and 136.28 (lower support). Resistance: Levels cluster between 150.00–175.00, with 158.42 and 152.09 as intermediate hurdles.

SOL/USDT faces intense bearish pressure, with no immediate signs of reversal. Traders should monitor: Bearish Scenario: Sustained trading below 166.82 could accelerate declines toward 120.00. Bullish Rebound: A reclaim above 180.00 (resistance) might signal short-term relief, but skepticism remains.