Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 225/61.80% Chart time frame:D A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:C A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 100,622/61.80% Chart time frame:C A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall...

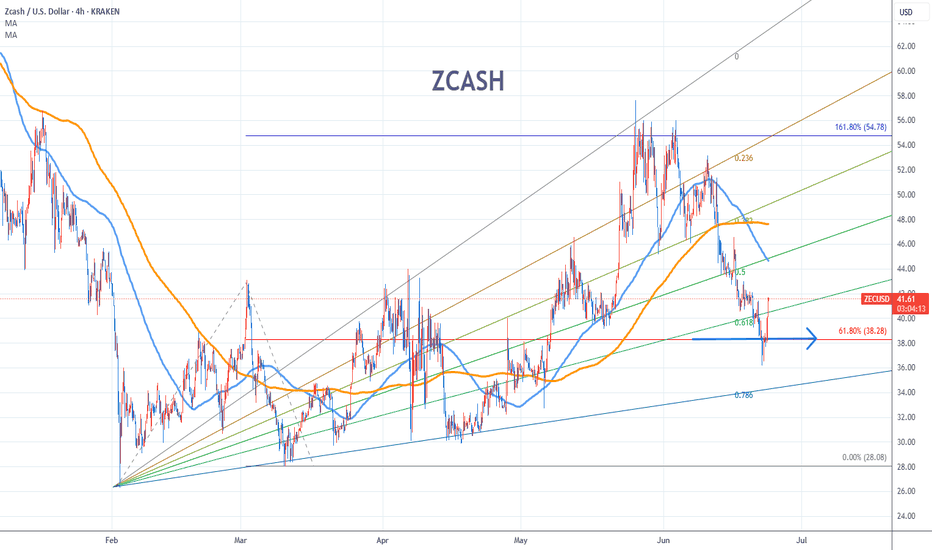

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 38.3/61.80% Chart time frame:C A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 81/61.80% Chart time frame:C A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 0.24/61.80% Chart time frame:C A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 0.15/61.80% Chart time frame:C A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 1.96/61.80% Chart time frame:B A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 99,063/61.80% Chart time frame:B A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:B A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 10.7/61.80% Chart time frame:C A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 10.6/61.80% Chart time frame:B A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 19.8/61.80% Chart time frame:D A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 3.5/61.80% Chart time frame:D A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 69.2/61.80% Chart time frame:D A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 1368/61.80% Chart time frame:D A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:A A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 187/61.80% Chart time frame:B A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:B A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 4.25/61.80% Chart time frame:B A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:B A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 11/61.80% Chart time frame:B A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:B A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 58/61.80% Chart time frame:C A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4 hr(6M-1year) D) 1 day(1-3years) Stock progress:B A) Keep rising over 61.80% resistance B) 61.80% resistance C) 61.80% support D) Hit the bottom E) Hit the top Stocks rise as they rise from support and fall from...