focusprofit

Plus⬆️ Buy XAIUSDT, 12.06.25 💰 Entry: 0.06687 🎯 Target: 0.14819 ⛔️ Stop: 0.05947 Reasons for entry: — 1D Price in consolidation for more than 1 day Correction into the discount zone — 1H Divergence in long, exit from correction Decrease in volumes during correction Predominance of volumes for purchase — 5m Breakdown of the structure with correction into the...

⬆️ Buy TRBUSDT, 10.06.25 💰 Entry: 47.52 🎯 Target: 140.12 ⛔️ Stop: 39.12 Reasons for entry: — 1D Price in consolidation for more than 1 day Correction to the discount zone — 1H Divergence in long, exit from correction Decrease in volumes during correction Predominance of volumes for purchase — 15m Breakdown of structure with correction to the discount...

⬆️ Buy LPTUSDT 💰 Entry: 7.725 🎯 Target: 14.501 ⛔️ Stop: 7.199 Reasons for entry: — 1D Price in consolidation for more than 1 day Correction to the discount zone — 1H Divergence in long, exit from correction Decrease in volumes during correction Predominance of volumes for purchase — 15m Breakdown of structure with correction to the discount zone Strategy:...

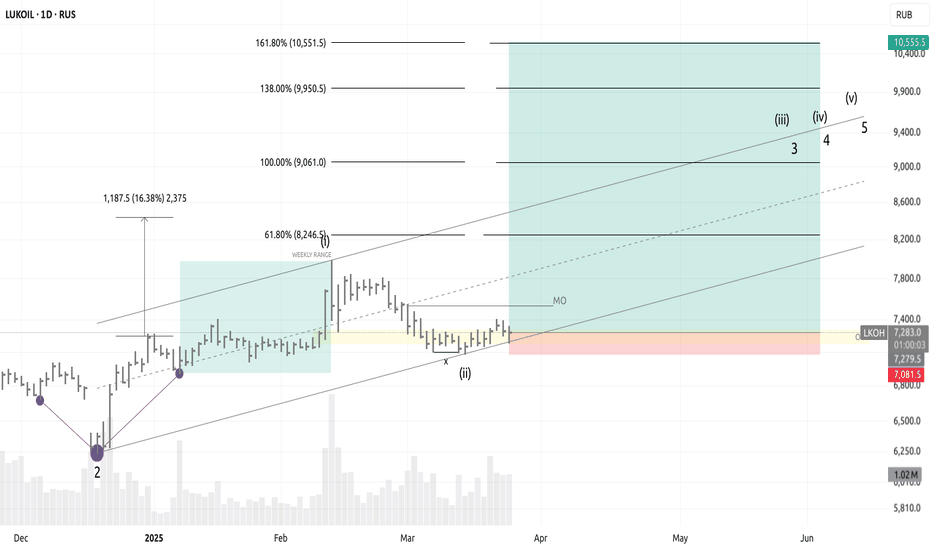

⬆️ BUY LKOH 25.03.25 💰 Entry: 7279.5 🎯 Goal: 10555.5 ⛔️ Stop: 7081.5 Entry reasons: 1) OSOK: — Month minimum was set at the 2nd weekly 2) Eliott waves: — 1D: 2th wave is formed, 3th is forming 3) Larry Williams: — Long term point is formed 4) Range: — Weekly bullish range, correction into OTE 5) Additional arguments: — Divergence delta cluster — Divergence...

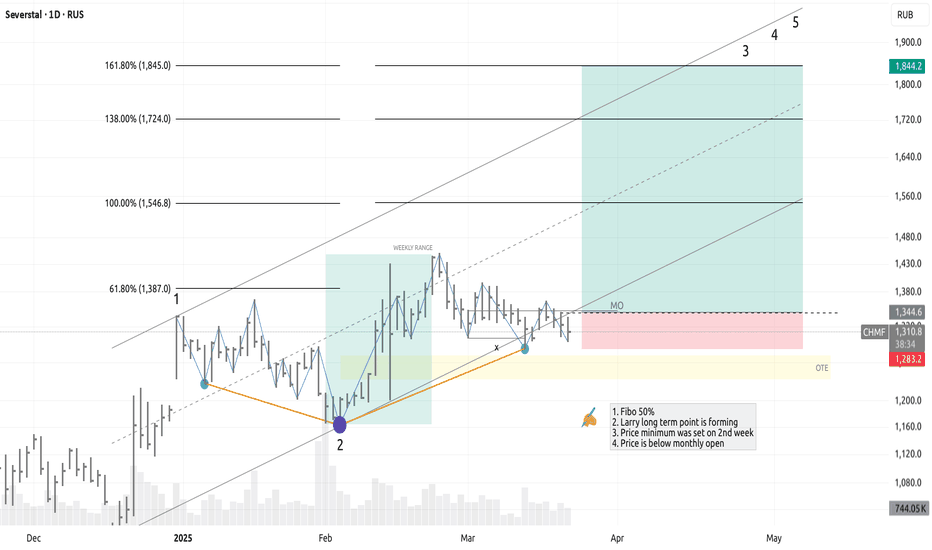

⬆️ BUY CHMF 21.03.25 💰 Entry: 1344.6 🎯 Goal: 1844.2 ⛔️ Stop: 1283.2 Entry reasons: 1) OSOK: — Month minimum was set at the 2nd weekly 2) Eliott waves: — 1D: 2th wave is formed, 3th is forming 3) Larry Williams: — Long term point is forming 3) Range: — Weekly bullish range, correction into discount zone 4) Additional arguments: — Divergence delta cluster —...

⬆️ BUY MAGNIT 21.03.25 💰 Entry: 4930.5 🎯 Goal: 6931.0 ⛔️ Stop: 4526.0 Entry reasons: 1) OSOK: — Month minimum was set at the 2nd weekly 2) Eliott waves: — 1D: 2th wave is formed, 3th is forming 3) Larry Williams: — Long term point is forming 3) Range: — Monthly bullish range, correction into zone OTE 4) Additional arguments: — Divergence delta cluster —...

⬇️ SELL EUR/USD 20.03.25 💰 Entry: $1.08926 🎯 Goal: $1.04254 ⛔️ Stop: $1.09548 Entry reasons: 1) OSOK: — Month maximum was set at the 3th weekly of month 2) Eliott waves: — 1D: 2th wave is formed, 3th is forming. 3) Range: — Monthly bearish range, correction into zone OTE 4) Additional arguments: — Divergence delta cluster — Divergence 1d — Weekly...

⬆️ BUY ETH/USDT 19.03.25 💰 Entry: $2152.40 🎯 Goal: $15059.05 ⛔️ Stop: $1755.78 Entry reasons: 1) OSOK: — Month minimum was set at the first weekly of month and price 2) Eliott waves: — 1D: 2th wave is formed, correction abc 61% 3) Range: — Monthly range, correction into zone OTE 4) Additional arguments: — Testing of big cluster — Divergence (1d) — Weekly...

⬆️ BUY BTC/USDT 19.03.25 💰 Entry: $84302.9 🎯 Goal: $158227.2 ⛔️ Stop: $76560.0 Entry reasons: 1) OSOK: — Month minimum was set at the first weekly of month and price is above monthly open level. 2) Eliott waves: — 1D: ABC, 4th wave is formed 3) Range: — Price is inside bullish monthly range (correction, 38-50%) 4) Additional arguments: — Testing of big...

⬆️ BUY EUR/USD 11.02.25 💰 Entry: $1.03266 🎯 Goal: $1.05333 ⛔️ Stop: $1.02838 Entry reasons: — Wave ABC (zigzag 5-3-5) on daily time frame. — Week minimum was set on monday and price is consolidated above weekly open. — We has got 2 wave on 4H time frame and see h4 bullish imbalance. — Price moves to monthly bearish imbalance (FVG 1M). Goal is previous weekly...

⬆️ BUY BTC/USDT 25.02.25 💰 Entry: $87119.4 🎯 Goal: $99431.5 ⛔️ Stop: $86020.4 Entry reasons: 1) OSOK: — Week minimum was set at the tuesday — Month maximum was set at the 4th weekly 2) Eliott waves: — 1D: ABC — 4H: 1-2-3-4-5 3) Range: — Price is inside bullish weekly range 4) Additional arguments: — Forming of big cluster + HFT — Divergence (15m x 2 =...

⬆️ BUY EUR/USD 25.02.25 💰 Entry: $1.04732 🎯 Goal: $1.05333 ⛔️ Stop: $1.04528 Entry reasons: 1) OSOK: — Week minimum was set on tuesday and price is above weekly open level. — Month minimum was set at the first weekly of month and price is above monthly open level. 2) Eliott waves: — 1D: ABC — 4H: 1-2, wave 3 is forming. 3) Range: — Price is inside bullish...

⬆️ BUY EUR/USD 19.02.25 💰 Entry: $1.04324 🎯 Goal: $1.05333 ⛔️ Stop: $1.04190 Entry reasons: 1) OSOK: — Week minimum was set on tuesday and price is moving to weekly open level with 15m bullish structure. — Month minimum was set at the first weekly of month and price is above monthly open level. 2) Eliott waves: — 1D: ABCDE — 4H: 1-2, wave 3 is forming. 3)...

⬆️ BUY BTC/USDT 12.02.25 💰 Entry: $96136.2 🎯 Goal: $102456.0 ⛔️ Stop: $94814.3 Entry reasons: 1) OSOK: — Week minimum was set on tuesday and price is moving to weekly open level with hourly bullish structure. — Month minimum was set at the first weekly of month and price is moving to monthly open level with bullish structure. 2) Eliott waves: — 1D: ABCDE — 4H:...

⬇️ SELL EUR/USD 30.01.25 💰 Entry: $1.04294 🎯 Goal: $1.02664 ⛔️ Stop: $1.04678 Entry reasons: — Week maximum. Monday. PMI. Capture liquidity PDH. — Price is consolidated below weekly open. — Full inverted bearish daily imbalance and made daily bearish imbalance. — Daily bearish imbalance has tested. Goal is previous weekly low: $1.02664 Strategy: #osok...

⬆️ BUY EUR/USD 30.01.25 💰 Entry: $1.04174 🎯 Goal: $1.04473 ⛔️ Stop: $1.04096 Entry reasons: 1. Context: h4 candle rebalance 2. Momentum: strength of buyers 3. Discount zone 4. Capture liquidity Goal is bearish daily imbalance.

Entry reasons: 1. Context bearish h4 imbalance. 2. Set up max weekly high and price below weekly open 3. Extension with bearish 1h imbalance from bearish h4 imbalance 4. Go to last weekly low

SELL BTC/USDT 28.01.25 💰 Entry: $102544.0 🎯 Goal: $95425.9 ⛔️ Stop: $103325.3 Entry reasons: 1. Premium zone 2. Capture liquidity 3. Break of structure 4. FVG