Morning traders, Looking for the German DAX , this is the stock market index of the 30 largest companies in Germany to head lower today and tomorrow down towards 8000 area. This index is made up of individual stocks of German companies you will know like Addidas, Mercedes (Daimler is their parent company name), Siemens and Volkswagen among many others. Many of...

Morning traders Following the big moves in euro after yesterdays european central bank meeting and the Euro spiking higher on lower than expected levels of Quantative easing being announced. The move higher has taken Euro Cad to the upper levels of the descending channel as per our trading view chart work. This coincides with extreme overbought levels on...

Morning traders Looking at a great setup on British Pound versus US dollar with Bearish Engulfing candle pattern forming on the daily charts between Friday and Monday and drill down to the 4 hourly charts and we see a head and shoulders pattern forming. Both suggesting British pound is about to head lower versus US dollar. Additionally we have bearish...

Morning traders We are taking a look at Aussie dollar versus US dollar on our trading view channel today. We have taken the daily chart to show the support level the market has found dating back to January flash crash as well as the descending channel we have been trading in for many months now. We are looking for a bounce from this support area at 0.675 area up...

Morning traders, Easy to read pattern on our Euro British Pound trading view chart with an ascending channel showing both support and resistance on multiple occasions since the start of August. We are looking to enter a long here for the Euro to strengthen up towards 0.933 area and potentially break out above depending on Brexit headlines at the time of meeting...

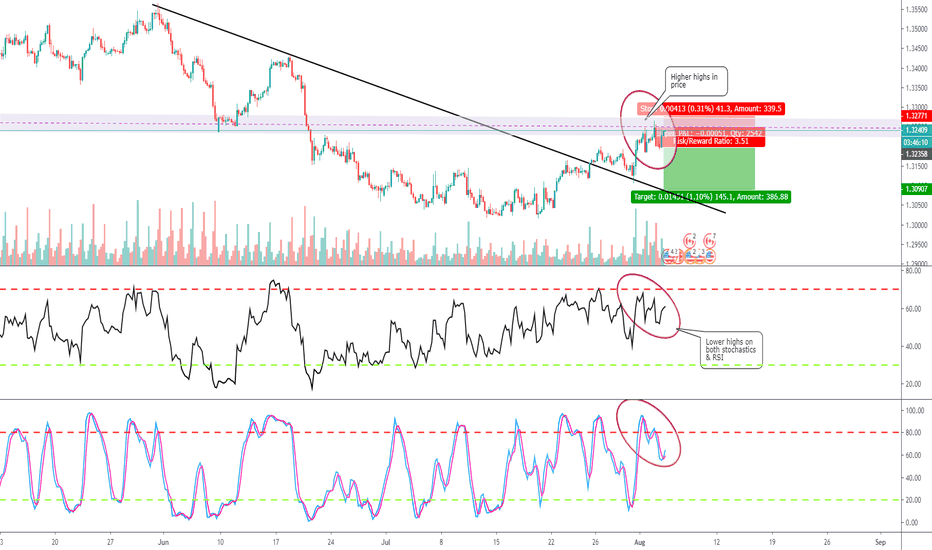

Morning traders New week and we are looking at a new bearish divergence setup showing up on US dollar versus Canadian dollar on the 4 hourly charts with new highs on prices being met with a combination of lower highs on both RSI and stochastics pointing to a bearish divergence and a likely fall in prices over the coming trading session. Looking to trade this...

Morning, Quick trade on US dollar Canadian dollar looking for a breakout lower back towards low 1.31 area into tomorrows Fed meeting where market is expecting a rate cut. Pair are looking overbought on hourly whilst we have had a serious of three lower highs and the psychological level 1.32 was tested as a spike/wick but failed to break higher or hold...

Morning traders, Re entering our Canadian dollar Japanese Yen long trade as the bullish price pattern continues to play out. Last week we traded it up to our take profit 1 before cashing out and now we are looking to re enter at todays pull back level. As per our trading view chart we have an ascending channel which has been tested multiple times and should the...

Afternoon traders With the ECB press conference now complete the market is now cleaner to enter other trades. In this case we are looking to get long Aussie Dollar versus US dollar after the pair have settled in oversold levels at support price of 0.6970 area. As per our chart work on trading view we have an ascending channel which is allowing us to set up for a...

Morning traders, Waking up to Thursday morning ECB day with a great short setup in British Pound versus Australian dollar. What we have is a descending channel being touched at the same time as the pair meets a resistance level to the upside around the psychological price point of 1.79. Compounding the trade is that as this is occuring the pair is reaching...

Afternoon traders, Enjoying this setup in Canadian dollar versus Japanese yen and the ascending channel which the pair have been in since mid May. We have had higher lows in RSI whilst price has been setting new lows pointing to a bullish divergence signal for the pair to move higher within the ascending channel as per our trading view chart. The setup allows...

Morning traders Looking to go short US dollar versus Swiss Franc as the pair tap the descending trendline that has held since April and is highlighted in our trading view chart . The re tap again yesterday coincides with reaching overbought levels on stochastics. Given the market has been challenging recently we have have waited for confirmation of a cross over...

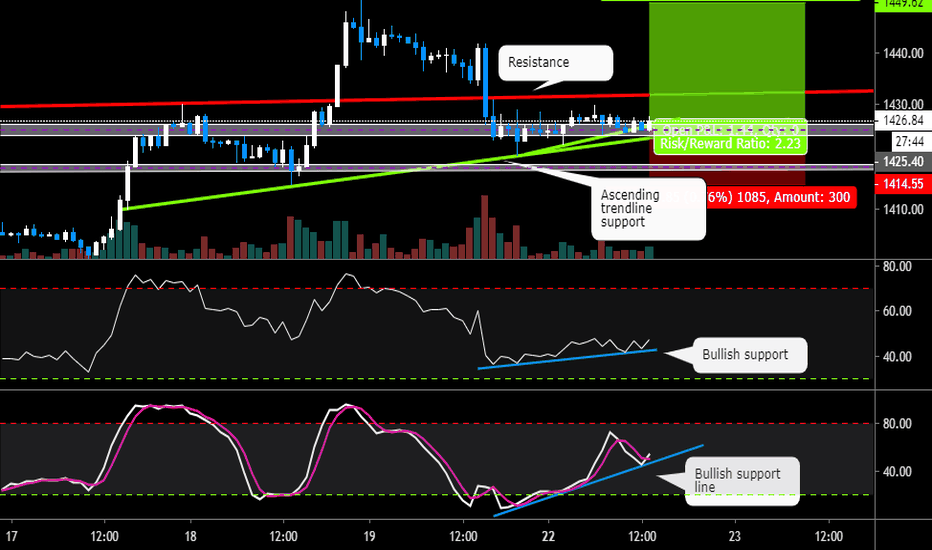

Afternoon traders, We are looking at Gold this afternoon which is looking setup for a move back towards 1440 area with multiple support levels coming into play. As we have highlighted with our trading view chart we have two strands of an ascending support line from the 17th which has been tested on 3 occasions leading to higher lows pattern being formed. Off...

Morning traders We have multiple indicators lining up to suggest US dollar versus Japanese Yen price action is about to head lower towards low 107 area. Firsly we have a descending trendline that we have highlighted on our trading view chart coming from 109 area on 10th of July and being tapped twice overnight at low 108s before pulling back to 107.85 area. ...

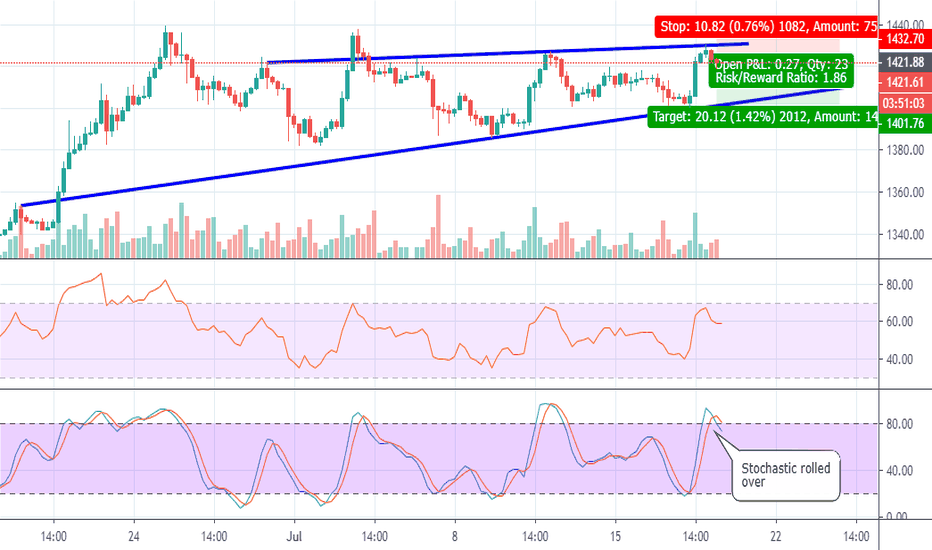

Morning traders, Quick look at the setup on Gold which trades under ticker XAUUSD, the pair are trading at the top end of its upward sloping channel with a range of 1430 at the top and 1400 to towards the bottom. The pair yesterday spiked to the top of the channel on Ray Dalios latest macro outlook suggesting the market should be buying gold long term. Since...

Afternoon traders, Another strong beat for US retail data further suggesting that the economy does not need a full 50bp rate cut from the US central bank and that 1 cut is more than enough. The retail beat along with strong employment data at start of the month making the market rethink multiple rate cuts and a lower US dollar. For this specific trade we have...

Morning traders We have a clean simple trade setup on long British Pound versus Australian dollar with an ascending trendline holding after multiple taps since the start of July following a Bullish Engulfing line on the daily at end of month. Additionally we have an ascending support on RSI and a crossover on Stochastics pointing to the support line once again...

Good morning traders, After last nights confirmatory words from US central bank chair Powell that they will be looking to cut interest rates (as the market expected) we had a bout of USD weakness which we were able to take advantage of for our team in longs on GBPUSD, EURUSD and short USDJPY clocking up over 200 pips on those three trades alone. We are now...