from0_to_1

PremiumI wrote this note on TVC:VIX a few days ago: www.tradingview.com And am now expanding it a bit more. As someone who was working middle office during the original 2016 Trump Election, Brexit, during the Taper Tantrum and a few other major events - I want to lay out my principles on trading the VIX because spikes like this bring a lot of "first time" VIX...

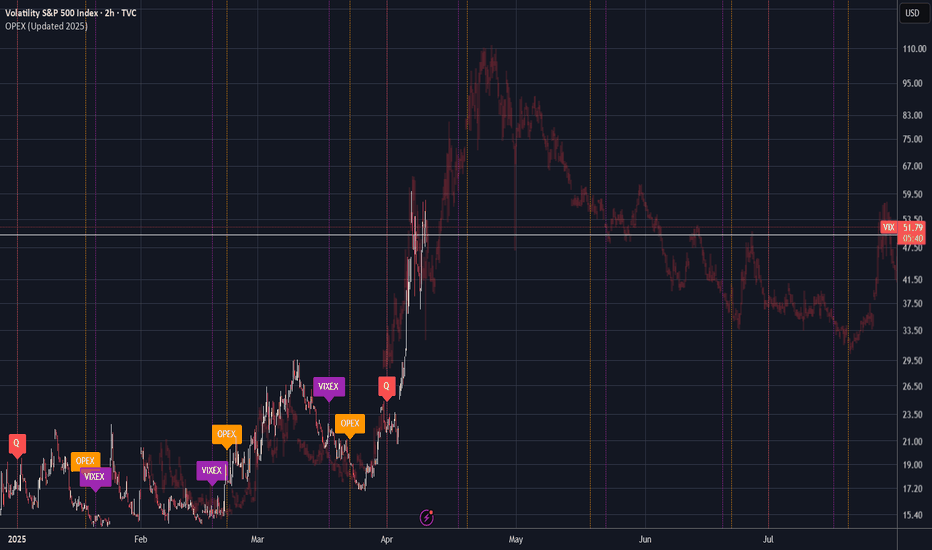

As far more eloquent and technical writers have covered (spotgamma, etc) - it's very clear that the markets in general are driven by single name options on the largest market cap companies. And to help visualize just how much volatility can happen around earnings on these single names, I wanted to be able to visualize those earnings dates and impacts against...

Hi all, Given the recent attention to short interest, short volume, short everything - I'm publishing this analysis about what my indicator does and does NOT do since I've already been getting a few questions about it. Terminology: Short Volume = the number of shares opened *or* closed short in a given day. (Unfortunately, this data does not exist...

For some time, I've been developing a working theory around how to spot and take advantage of the "buy to close" activity of short side market players. Shorting is inherently a difficult endeavor. Unlike long only players, shorts have additional variables to contend with: borrow fees, short squeeze risk, and the return max of +100% (if something goes to 0). For...

"Sometimes the light at the end of the tunnel is just the light of an oncoming train"

Publishing to be utilized in upcoming tutorial

Watching developments along EMA crossover as a short swing indicator.