fxtrends28

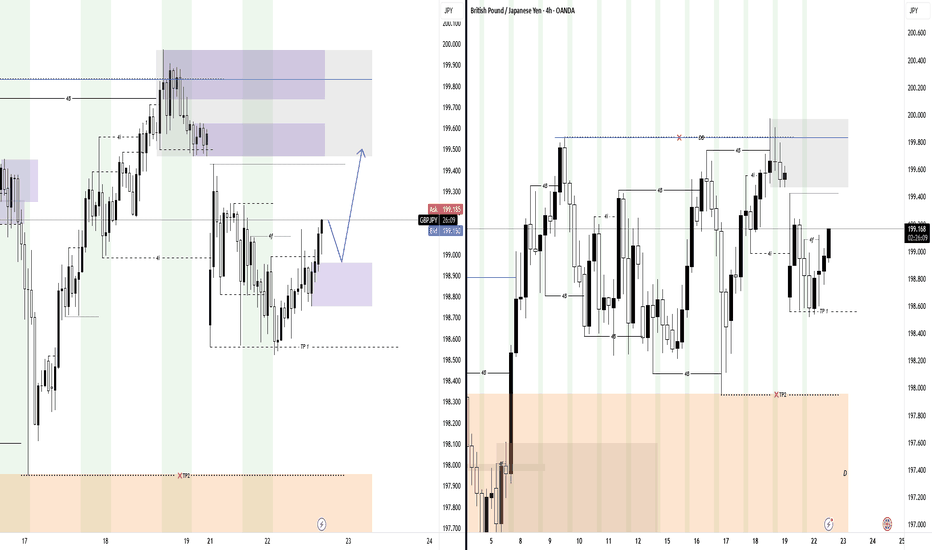

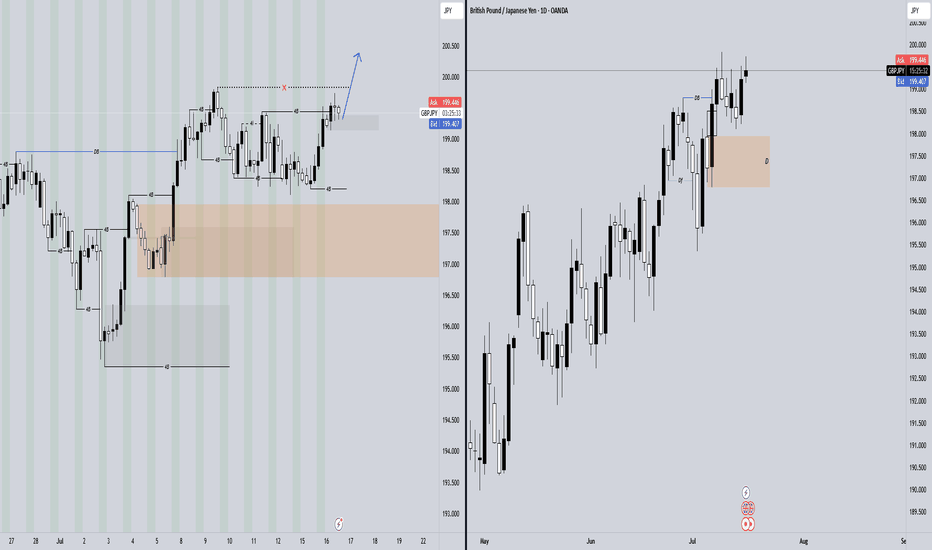

EssentialHey Traders, hope you’re having a great day! 👋 GBPJPY is making a sharp bullish reaction after sweeping the Sell-Side Liquidity (SSL). Although price is currently at an external structure supply zone, this move originates from the daily structure, so the dominant daily bullish continuation bias remains intact. I’m watching key Points of Interest (POIs) for...

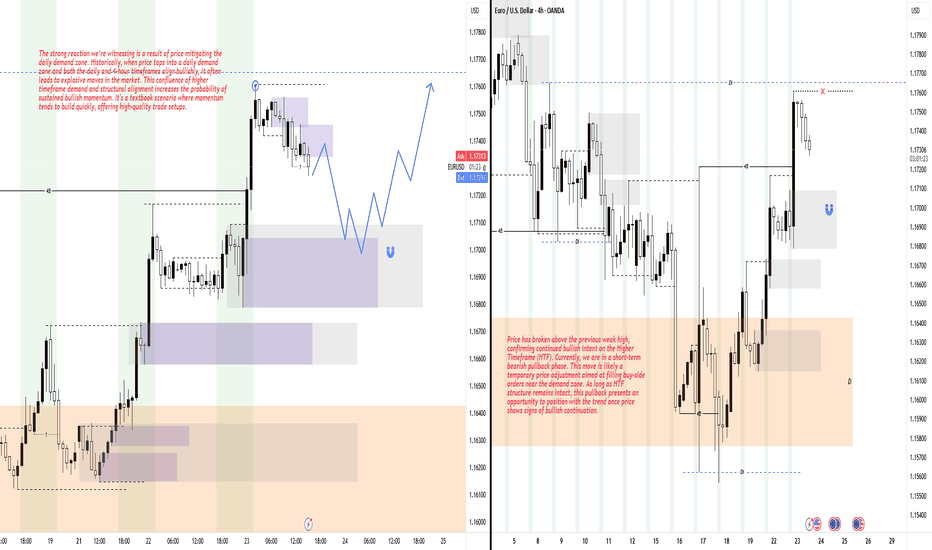

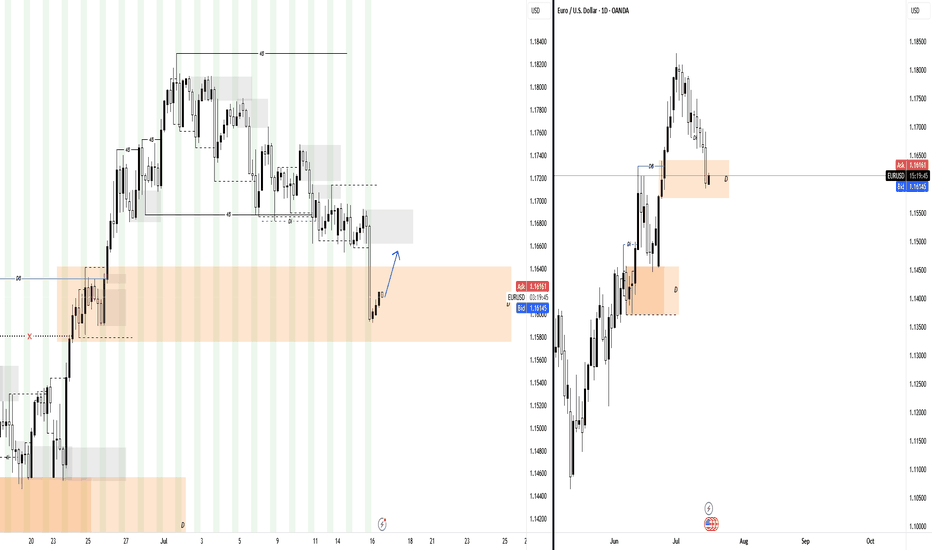

Hey Traders, hope you're all doing well! 👋 Price has recently broken above the previous weak high, showing strong bullish momentum. At the moment, we're seeing a short-term bearish pullback — a common market behavior aimed at filling buy orders near the demand zone. Despite this minor retracement, the Higher Timeframe (HTF) remains firmly bullish. As long as...

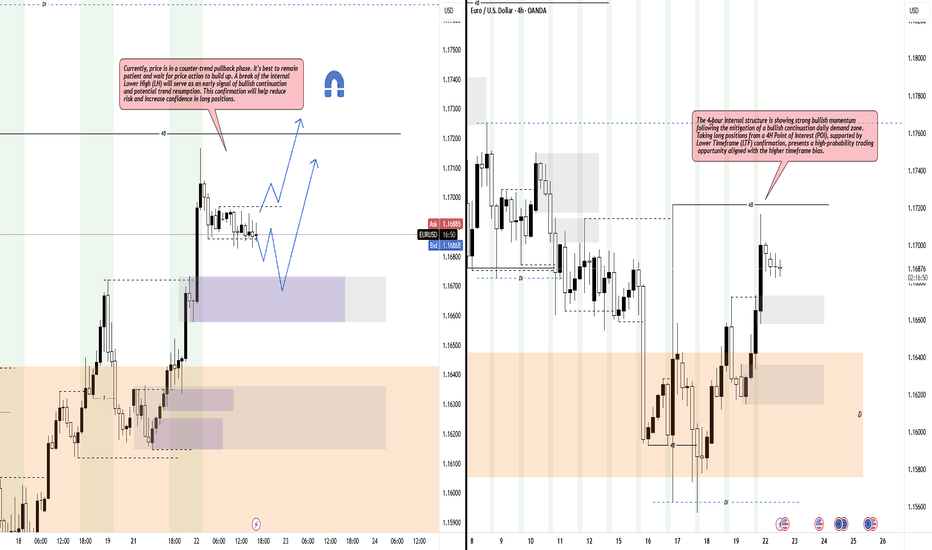

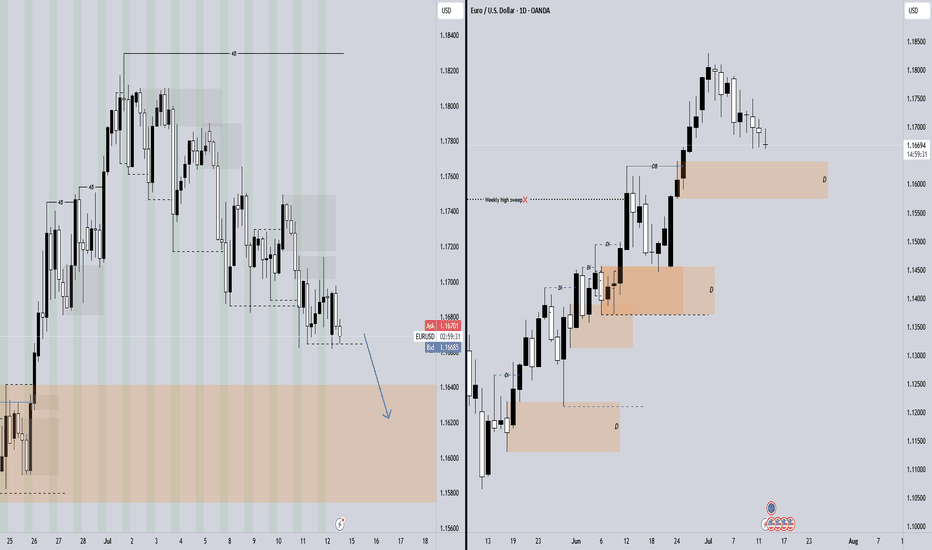

Hello Traders, Price is currently in a counter-trend pullback phase, showing signs of temporary weakness within a larger bullish context. Patience is key as we wait for price to build structure and break the internal Lower High (LH), which would act as an early signal of bullish continuation. The 4-hour internal structure remains strongly bullish, following a...

Hello Traders, As per yesterday’s analysis, price successfully swept the weak internal lower low (LL), but failed to close below structure. Instead, price has shifted bullish, indicating that sellers were overpowered by buyers at that level. Before considering any trading decisions, I would like to see price take out the Buy-Side Liquidity (BSL) to confirm the...

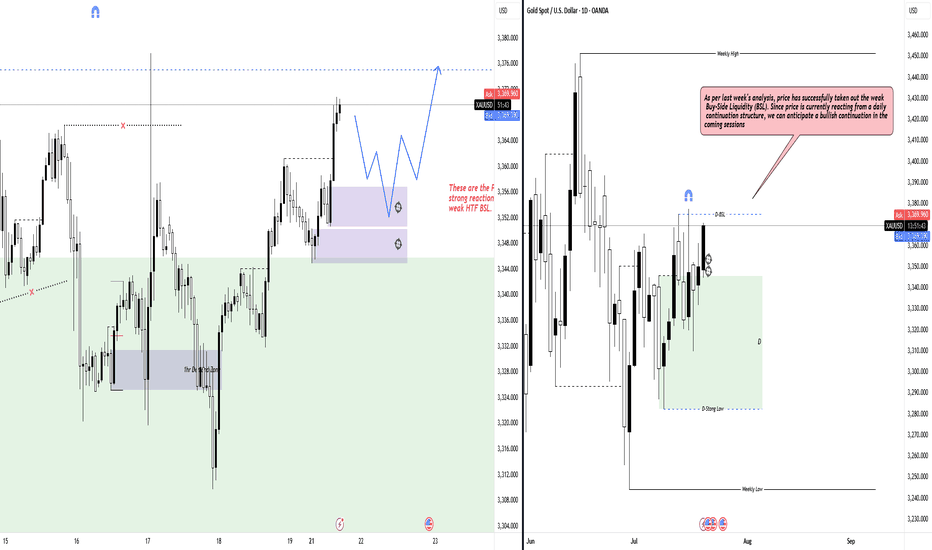

Hello fellow traders, Welcome to the new trading week. Following last week’s analysis, price has successfully swept the weak Buy-Side Liquidity (BSL) and is now reacting from a daily continuation structure, signaling potential for bullish continuation. However, before reaching the weak Higher Timeframe BSL, there are several key Points of Interest (POIs) where we...

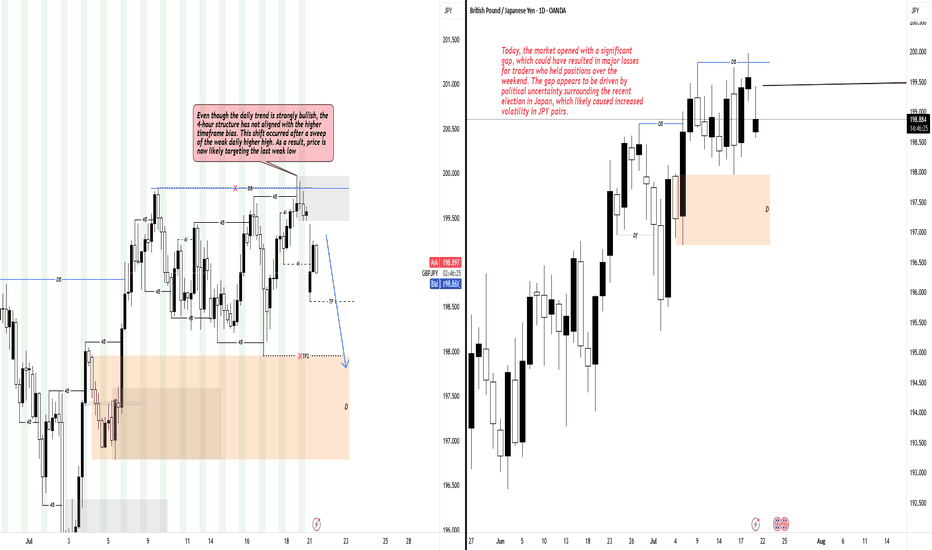

Hello Traders, Welcome to the new trading week. The daily timeframe remains in a strong bullish trend; however, recent price action shows a break in alignment on the 4-hour chart. After sweeping a weak daily higher high, the 4-hour structure has shifted bearish, indicating a potential retracement or deeper correction. This internal shift suggests that price may...

Hello Traders, On EURUSD, we opened the new week with a significant downside gap, which has already been filled during the Asian session. Price has reacted from that gap area, and heading into the London session, I’m expecting a deeper pullback into the daily demand zone before the bullish continuation.

Hello Traders 👋 Today in XAUUSD, we've identified a newly formed fresh demand zone on the lower timeframes, which was created after a liquidity sweep of the sell-side lows (SSL) within the daily demand zone. This move suggests that smart money may have engineered a stop hunt to accumulate long positions at a discount price, setting the stage for a potential...

Hello Traders, I hope everyone is having a fantastic week! Today on EURUSD, price is trading within the daily flip demand zone following yesterday’s USD CPI news release. While I usually avoid trading during CPI events due to the high volatility and unpredictable price spikes—often driven by algorithms and emotional retail reactions—yesterday did present a valid...

Hello Traders, Hope everyone is having a fantastic week! Today on GBPJPY, price has shifted the 4-hour swing structure to bullish following the mitigation of the daily Fair Value Gap (FVG)—a strong sign of a change in character (CHoCH). From this point, price may aim for the daily weak buy-side liquidity (BSL). Use your lower time frames (LTF) to identify bullish...

Hello Traders, On GJ, price remains in a daily counter-trend pullback phase. This has just been confirmed by a 4-hour break and close below the weak swing low (LL). To stay aligned with the overall bullish trend, I’m expecting a deeper pullback into the daily demand zone before price resumes its upward movement.

Hello Traders, Today we’ve seen a Change of Character (CHoCH) form on the 4-hour chart after price broke above the higher time frame’s weak high (HH) from yesterday. This suggests we’re now in a bearish counter-trend pullback phase. Trading short from the 4H supply zone with lower time frame (LTF) confirmation presents a high-probability setup. However, keep in...

Hello Traders, Today on EUR/USD, we observed a sweep of the sell-side liquidity (SSL), where price failed to close below and instead left a strong wick—indicating a potential institutional move. A fresh demand zone has now formed, suggesting that price is likely to target the nearest high before initiating a deeper move to the downside. With lower time frame (LTF)...

Hello Traders, Today on EUR/USD, we could see a deeper pullback into the supply zone. From there, we may look for potential short setups targeting the daily bullish continuation demand zone. Based on multi-time-frame analysis, both the 4-hour and daily charts are aligned with a bearish expectation in the short term. Let me know your thoughts on this trade idea!

I am expecting price to continue higher after mitigation of this fractal 4hr demand zone. In 4hr Price has shifted the swing structure to bullish with strong momentum and now price has formed a another bullish continuation structure within the bullish leg imbalance zone. This is the very clean winning trade setup and has the higher probability. The closest target...

I am expecting price to pullback deeper into the bearish range but when that is happening I need to see any violation of structure or institution sell pressure. Entry has already formed during the Asia session so for the new bullish counter pullback I need to find a fresh demand zone.

I am expecting price to continue lower from the newly formed area of supply zone. For now price has already mitigated the EQ of the bullish swing range so this is a medium probability trade setup. When price breaks the structure in HTF trading from the fresh demand zone in support of HTF bullish continuation would be much higher probability than this. But since I...

I am expecting price to continue lower from here for the short term. Since we have already mitigated the HTF bullish continuation demand zone this is a medium probability setup. Often this types of setup works best when applied with the LTF confirmation. Also there is a strong spike after the mitigation of daily demand zone so that is a good indication of big...