There is strong bullish div on the weekly wave, I expect a longer term uptrend to begin soon. It currently is floating at the $1 area, but there has been support at $.085 four times since 1999... I expect DNR to push below $.085 before making an uptrend, maybe even into the $0.070s... I have come to believe that price supports points are used to scare people out...

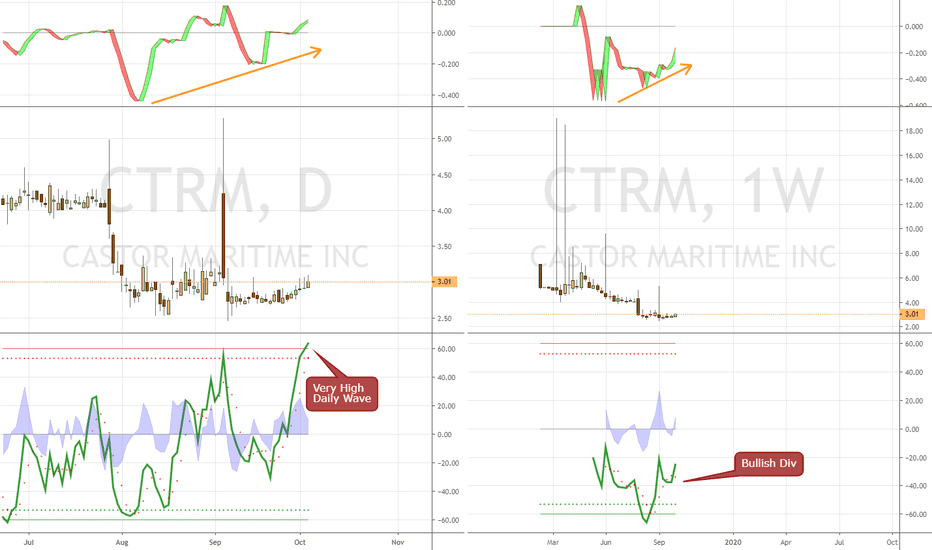

The daily wave is very high and there is also bull div on the weekly. I use a very short time frame for my waves to get early signals. The hourly waves are also strong, I expect this to begin a decent trend upward.

It's been a while, but here's an idea. I really like GEVO. I have been analyzing stocks using wavetrend with a very short length (mainly for daily/weekly/monthly), and it has been giving an early indication of big moves. Let's see if that is the case here.

First idea in a while and my first crypto one, which is basically where I have been tinkering for months on Poloniex. The notes are on the chart, but I really like how MAID is set up. Trading these alt coins is not to be taken lightly, you can quickly get wiped out... which is why it is important to choose ones that are strong on the weekly and daily charts,...

See notes on chart. All time frames in front of the daily have broken trend or are about to. There needs to be a correction on the daily time frame, which will make it a significant one. I believe that we will drop down to 2070ish, which is the the top of the bull flag that we recently broke out of and also the .618 fib retracement from the Brexit drop. The...

It appears that NGAS is in the perfect upward reversal pattern, except it hasn't broken the neckline and there is bearish div on the upper hourlies and daily. also, the waves and momentums have not broken into any new uptrends lately and it doesn't look like they will. That tells me that there is a pullback before NGAS goes well into the $3s (and likely...

Trend support at 2146, also happens to be the .236 fib, which then makes this a bull flag. We're going to new highs.

After a mega run, Natural Gas needs to take a break and will be pulling back before beginning a new run upwards, likely toward the $6 range... it might not go that far, but it's going to have a lot of power behind it once it reverses. The daily time frame has broken the uptrend in COG and CMF, so the uptrend should end. I believe that Natural Gas will be one of...

As I noted in this idea from a week ago, we were going to new highs, which we did, but now we're ready for a pullback before continuing on. I think the chart has one more bounce up in it, but then we'll come back to the 2070s before going to 2185. The Day/Weekly/Monthly COGs/CMF/Waves all look strong, but haven't broken into any higher levels of momentum, so...

The Daily COG has turned over and has bearish div. All Waves from the 1hr to Daily have bearish div and are on the brink of breaking their uptrends. We might be a little more a move up from here, but I think it is ready to turn over. Also, Gold seems to have been acting as the inverse to GBPUSD the last few weeks and I believe the GBPUSD is on the brink of a...

Notes on the chart. For a long time I thought a big correction was imminent, but I now think this market is ready to move up to the next level.

So my timing was significantly too aggressive on the 15% correction / inverted H&S continuation idea from two weeks ago, but the idea is still the same... except now we finally have confirmation of a break of the uptrend on the weekly chart in the Ehler's Center of Gravity indicator, one of my favorites for determining if a trend is increasing, reversing, or...

One of my favorite parts of analyzing and trading stocks is sleuthing through charts to find hidden and not so obvious candlestick patterns, and I believe that I may have found a massive one on the S&P. There is the potential for an Inverted Head & Shoulders Continuation Pattern that stretches back to 2000. When using the lower line of the uptrend channel from...

the Dollar has been beaten up lately, but it is poised to come back strong in the next day. The notes are on the chart. If any of my trend lines get broken, this idea is invalidated. I believe that this increase will coincide w/ a strong decrease in Gold, Oil, Nat Gas, and S&P. I will try to release those near term forecasts tonight.

Gold Miners (GDX) is at the very bottom of a major channel and could rise up before reversing the trend by completing a H&S pattern. If TP # 1 is passes, $25.50 would be TP# 2.

notes on chart. the chart looks fairly strong and not very confident that this will happen, but if a drop does happen, this is what I will be looking for. I hope that it does pullback because I think Gold wants to go on a nice run the next two days, the Day wave is just about to turn up and the hourlies are looking strong.

the Dollar looks to be in a diamond reversal pattern (120min) and will climb the 120/240min cloud before pulling back, possibly to the lower 94s and then continuing up. the three day and weekly waves are strong, making this only a short term pullback... this could form a H&S reversal pattern on the daily and the dollar will begin an uptrend that was stronger...