gachihi

E-U sell sides swing concept. I'm precipitating an upsurge in the dollar index and a vice versa on both EURUSD & GBPUSD. Since last week Friday, we've been on a low resistance liquidity run to the downside 1 hr t.f. Though we got to a HTF sweet spot/ point of interest on selling pressure. We're kinda sluggish to melt to the downside. I might not know what move the...

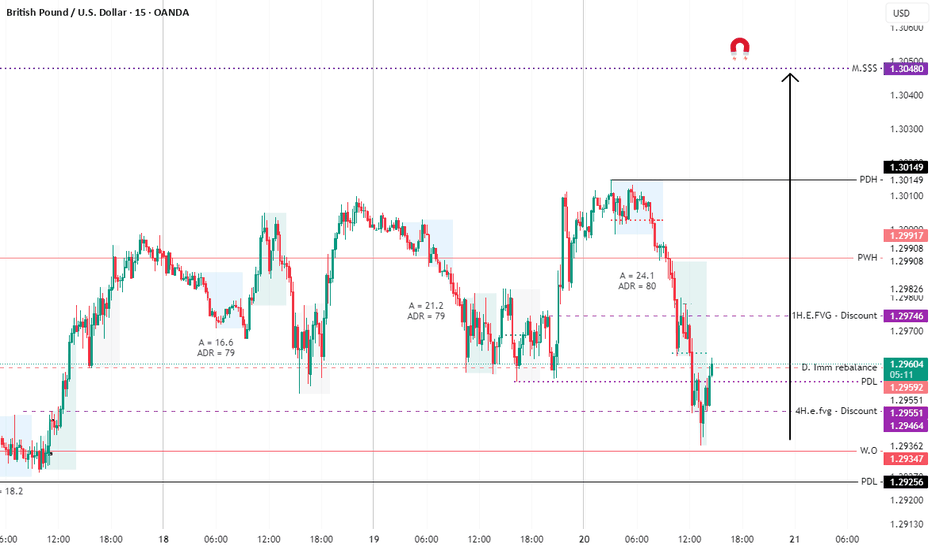

Markets are choppy and so is cable. I wanna see Tuesday's low being maintained as the low of the week and an expansion to prev weekly highs. I was awaiting a HTF Mss with confirmation of how the market will close above prev daily highs. Getting an entry on this one can be tricky unless the dollar index will be strongly drawn to the downside. Lets tape read this...

Is the bull run still alive? Does the Gold rocket still got juice to pump up to the 3100 level. Trend analysis with use of fibonacci retracement with extencion.

Morning ladies & gents. Ok... Gold has been playing games & hard to get for a while. I don't know bout you guys. As per today and the picture you're currently looking at, the market has cleared so many buy-side liquidities without proper retracements. Being a Thursday, we could possibly have a TGIF setup, or maybe have it on a good old fashioned Friday. So, even...

Good morning, depending where in the world you are @. I've been following Fiber for quite sometime now and its price action is quite interesting. So, we are currently in the London session and I still have no bias of the session. Let me tell you why, the dollar index is not clear/ strongly biased but HTF analysis shows me that we might push the dollar higher. That...

We had an inside bar on yesterday's price action on pound dollar. I want to see a smart money reversal and the the market delivers liq to the Asian level. But I would like to see a clear liq sweep @ the prev weekly lows and the see the reversal model form. I think on a 15 min/5 min t.f, we might have completed the ongoing AMD /power of 3 setup and that's why I'm...

Yesterday's sell idea was based on what I shared yesterday. If you did not see it, kindly check it out, it'll expand your knowledge based on the factors that I shared. Back into the uptrend concept,the current trend is an uptrend. I'ma update once I see the buy trade. Follow and boost the idea

We have a HTF Market structure shift and we still look like we can create newer lows. We've cleared PDH and some Intermediate highs. Unlike yesterday where I did not have a clear bias of what the market would go to; but still had a 'not so clear' direction, today I'm confident in the draw on liquidity, Doesn't mean that I'm right, I'm just confident in my...

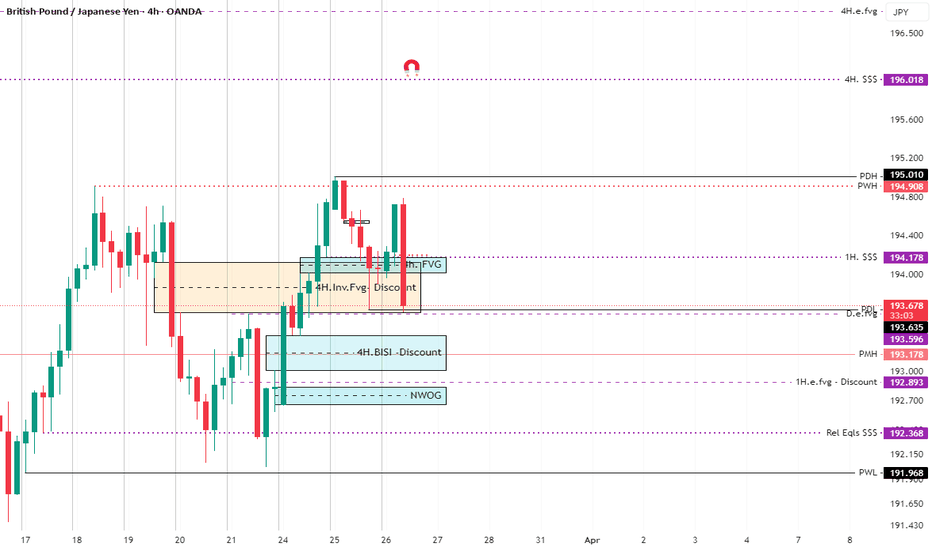

Yesterday we fulfilled targeting 195.000 and esp the prev weekly high level. So today, during any session or both London & New York session I wanna see the market melt to the downside. Reason being, the draw on buy-side liquidity was fulfilled and for those who did not take their t.p's @ that high could maybe get stopped out. Another theory is that whoever would...

Ok, this is a little tricky bcoz I'm not strongly biased in what direction Gold will take. This is what I'm precipitating though: Buy trend to continue upto 4h BSL Now, what makes me a little nervous is that the market has grabbed buy-side liquidity above the high of today and I don't know how low it would melt Any trade comments are appreciated

So, if you have followed my updates, I have a strong bias of where I expect the pound yen to deliver price. I'm not saying that it'll do just that today or maybe even next week, but its the draw on liquidity with IPDA that invites me in. Cutting to the chase, I'm looking for an area where might be a good institutional support level and then take the shot. It...

New week, new goals, new energy. So, We had a good liquidity sweep on a higher t.f. I wanna see the market pump to the PDH level for the longs idea. Possibly after the market does that, It'll ct to more BSL(Buy-side liquidity) and in-sufficiencies or reverse back down. We don't have the best economic calendar today so I'ma not expect much. Follow for more updates...

This longs idea is solely based on small factors that I would like to share with you today. That's from liquidity grab that happened yesterday during New York to today being a Friday; possibility for a TGIF setup. Ok, so I don't know if we'll start by melting to PDL levels, or run through the minor buyside liquidity first but, I believe both PDL and that minor BSL...

We've has a seek and destroy pattern almost for an entire week. Nice London reaction to the downside to sweep PDL and close out on some in-sufficiencies. I'm projecting if New York session will be an uptrend, we'll purge above PDH first.

G-J bull power idea. We've hit some good discount arrays, so I'm just trying to see if we can pump past PDH.

ICT silver bullet tutorial. I could not post a 1min t.f without it being subjected into posting in the private area. Here's the link though

Follow the annotations on my chart We have a SMR setup Watch ICT videos to understand what concepts I'm using

We have a rather strong draw on liquidity to prev weekly high. We had a great re-test during yesterday's New York opening into mid point of London & a 1H Inversion fvg. We're 5 min away from London open and I already have a bias that the market is going to push to the upside. If London session melts, I'ma take it as a Judas swing or Institutional sponsorship to...