gghsusa

PlusThis is a wave trend indicator on the S&P 500 index that is based on relative strength with straightforward oversold or overbought conditions. Relative strength is a measure of momentum where both speed (time) and magnitude (change) is measured and plotted with simple or weighted moving averages. What you are seeing above is a snapshot of a RSI/wave trend of the...

XRPUSD is looking good here. I was in xrp from .17 and sat on my hands when it hit 2.00 last year. I made the assumption that 'the big move' was months away. I did not anticipate the sideways and down consolidation for another year but my strategy on XRP is.. well. nothing. I accumulate and hold. If it goes to 4 8 15 16 23 42 then that will be great. If it...

Weekly Chart - BABA I am taking an interest in BABA here. It has been in a steep correction for well over a year and appears to have made a bullish wedge. What really has my attention is not only the price breakout above but also the momentum break. I may leave myself a little room and time here but I personally may take a heavier interest if it stays this...

First Majestic silver along with the rest of the mining stocks have been pummeled the last few weeks.. or months..er I mean years. It is my strong opinion that a rare opportunity has opened up in many of these stocks - historical. These monthly candles really help depict the birds eye view necessary to spot the larger patterns and trend. AG has been forming a...

Looking back at silver over the last decade reveals a very significant trend. Note the resistance peaks and where silver crawled around in the dirt for years and years. In 2020-21 silver broke out of that trend only to come all the way back down the touch the trend.. right now. Is the old ceiling the new floor? It very well could be. It is my opinion that...

This is a weekly chart of AG, First Majestic Silver Corp. I like to call this pattern a giant compression wedge - it's just a simple descending triangle. But considering this is on the weekly timeframe, it's a mammoth-sized wedge. I like the pattern but I really like the company. I'll try to focus on the technical analysis, but First Majestic looks incredibly...

May I keep this short and sweet? Okay, good. The price of CCL has reached 1990's levels and 'pandemic' lows. This is a bit overdone in my opinion. I shall begin nibbling from here.

Are you hunting for a bottom in stocks? Were you bullish 6 months ago but have now turned bearish? Are your trading decisions influenced by your feelings and 'current events'? There is a tremendous amount of information written right here on the charts if you know how to look for it. I will help you to see this. The best advice I can give is this: Do not make...

In this idea, I'm simply taking a look at the S&P 500 verses the actual stocks that make up the S&P 500 by using their 200d and 50d averages. This can be useful as an indicator to look for divergences, early warning signs, or confirmational trend changes. Top pane = SPX stocks above their 200 day moving average Middle pane = SPX stocks above their 50 day moving...

Borr Drilling Company has become very cheap once again. Considering the incredible rally in oil over the last year, BORR looks like an even better discount. The price action alone in BORR suggests to me that a bottom is being put in under 0.75. Regardless of my opinion, I have some tools and charts I can use to demonstrate why it is historically cheap and why I...

I know very little about this company. What I do like is the price action and pattern I am seeing. I have seen this giant broadening pattern many times over the last few years and they are extremely powerful. However, they are not easy to trade. The descending nature of the lower trendline make it difficult to catch a bottom. What I prefer to do is use...

..well at least to me it does. This is weekly chart on USAS but wow.. this looks like a deal. I believe we'll see this one over $11.00 in a few years. I believe this to be a very good value.

My early warning indicator can offer warning signals well in advance of market turbulence. It can also help on the long side by giving confirmational signals when in agreement with a trend. It recently had a negative cross and is enough for me to raise an eyebrow and err on the side of caution. There are times when a signal crosses negative only to return...

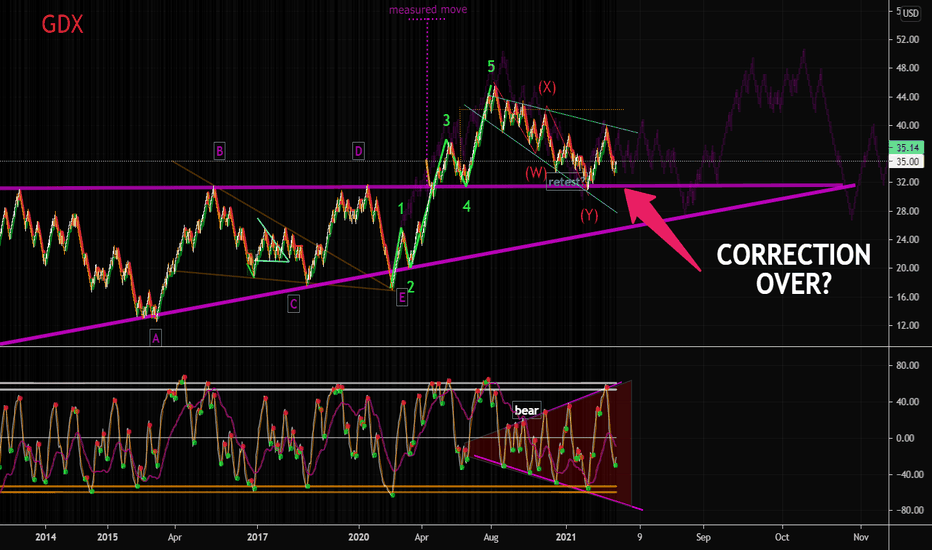

The metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden...

The perfect storm event known as the Covid pandemic has introduced many millions of new traders into the circus. The indices have performed amazingly well over the last year.. nearly parabolically so. While I do not believe the indices have formed a major top yet, a minor pivot is likely. I have been hoping for a decent correction to shake things up. I am not...

New all-time highs in the market combined with a creeping VIX are cause for some alarm. Inflation hedges/bets seems to be the talk of late with inflation on the rise.. and this is not unwise considering that money supply is off the chart and velocity is sure to pick up... although velocity is not a necessary component of inflation. Remember that the market is...

Market volume is drying up and we're seeing historic put:call ratio's on the indices. We have the necessary ingredients in the cake for a another wave of volatility to hit the market. Please see my previous post about the VIX and the compression patterns that often occur. Volatility tends to get bottled up and then erupt. We are likely in a bottling-up zone...

This could be an important moment in silver. I prefer that the metal stay cheap but I fear we are about to run out of time before this train leaves the station. What do you think will happen to SILVER over the next year or two?