If your time horizon is more than one month, you might consider the recent post earnings pullback, as an opportunity to accumulate $SHOP Otherwise just wait for the $NDX to settle.

Purchased Jan 2022 $45 calls yesterday, to open new position. Already owned May $40 calls. Projecting downside risk as $48 to $50. My conviction is waning, but not broken yet. Will sell out my $XPEV before booking loss on NIO May contracts. Also bought $F shares yesterday. ____ Stick to your strategy when the market gets ugly.

Just my thoughts: Bitcoin is not just being bought be retail investors anymore. Wall Street is buying (and will continue to buy) as they develop and market new investment products such as Crypto exchange traded funds,Bitcoin Unit Investment Trusts, CD's indexed to Bitcoin movement. Look at $PYPL recent addition of Crypto purchases, still in the infancy stages....

Chart looks goods for entry here. Note: near-term earnings release. Expect volatility.

I like trading options on Amazon. My best experience has been buying in the money calls after a pullback. I'm looking for a buying opportunity over the next 2 - 3 weeks in the target area shown. Currently watching May 21 $3160 Calls Buying opportunity could result from $NDX pullback rather than AMZN specific news.

Steady selling pressure since mid January. Nice move today, but faded a little into the close.

Good entry point, for a near-term trade. Would expect it to follow any $NIO rally. Expecting $37 to $39 price target shortly. Don't know if I will hold it over Earnings Release.

Don't be disappointed in NIO. It appears to have stalled at the top of this range. I think it will bust through resistance with a spike rather than a slow melt-up. But remember this is already a $70 billion market cap company. There is a sizable volume by price shelf around 57.74 which should provide some support. Consider previous highs will now serve as...

Jan 11th close $62.70 Current (Feb) R1 Pivot $66.40 Top of 1%, 6 month linear regression channel (late Feb) $68.75 Looks Bullish; doesn't look that extended. Note $XPEV woke up and tried to follow suit this afternoon.

Looks like a good entry point to open a trade

Might have a opportunity to open a trade in $AMZN in the $3200 - $3220 range (before this time next month). The biggest unknown today, is how much and when will we get a pull back in the Nasdaq 100 (or the broader market). I believe the market will be exceedingly weak on any bad news regarding Covid relief bill. I don't think the market will care much about...

Sitting at lower limit of 1 std deviation channel. Currently at same price as Jan 15th and Nov 24th. Selling off from Jan 11th, post NIO-day rally (where it gapped opened almost $7). Note almost every day since Jan 11th has been on below average volume. I think $NIO closes February closer to $70 than $60 (upper half of the linear regression channel).

my current GUESS is $1205 - $1225 prior to earnings. Wouldn't be surprised by more.

Remember Shopify ran from $880 to $1280 mid November to Christmas. It will surprise you. I don't know why it sold off almost 4% yesterday, but I like the stock here and volatility works both ways.

Great earnings yesterday. Validating the recent 6 day run from $212 to $232, prior to release. And then hitting $244 immediately thereafter after the close, wow. But where to now? Let's assume increased volatility for this widely held, mega-cap, market leader. So we might want to slow the chart down to weekly look for example. Then one might see a price...

Bought a small position Friday, thinking it might have support around $185 (shares not calls). Down $30 since 12/31/2020 Couldn't resist trying to be contrarian. So I ignored many warning signs.

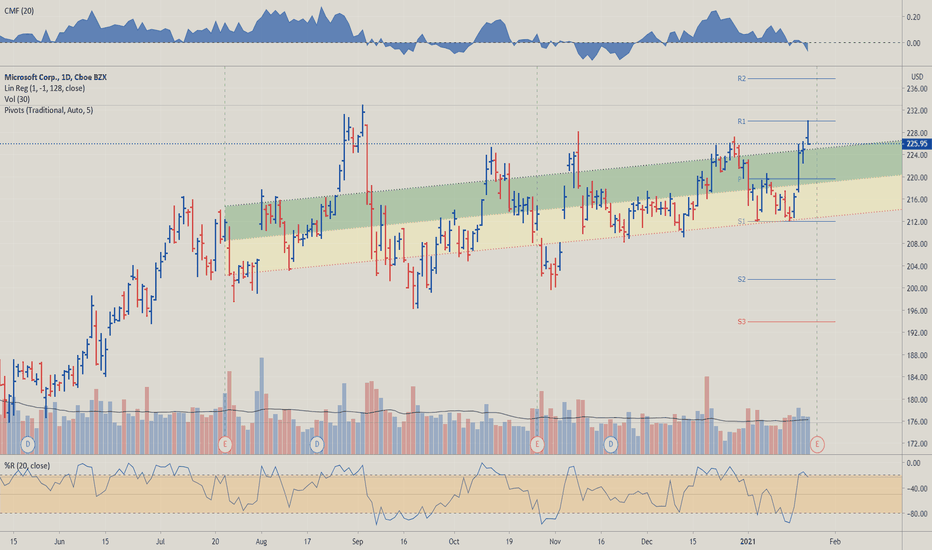

MSFT Looks fairly valued to me, maybe even a "little" extended. But could push to $232 as a result of bullish market and earnings speculation. MSFT just moved up $14 for the week ended 1/22/21 (almost 7% gain). Bigger question is valuation of the NDX 100 overall (which I feel is more extended). $NDXA50 currently showing 70 out of the NDX 100 are above their...