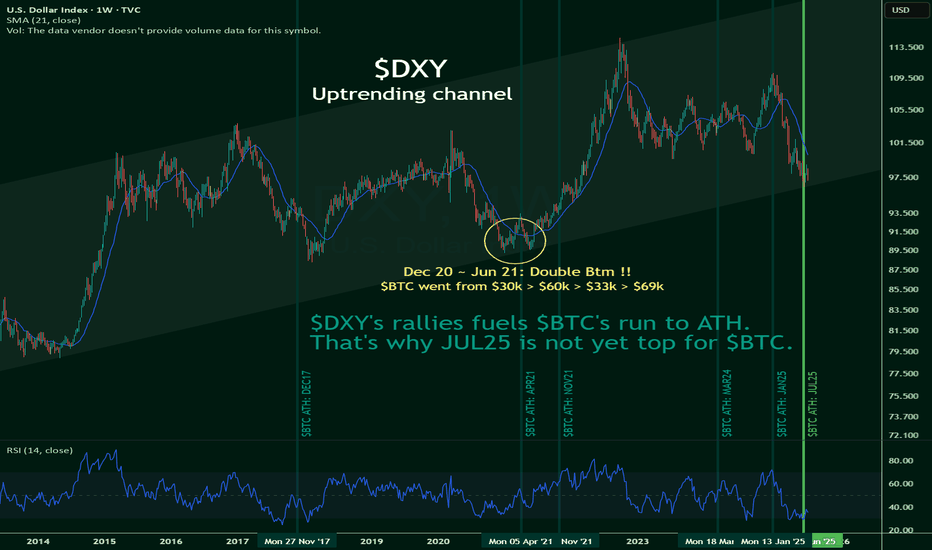

NOT FINANCIAL ADVICE I've yet to see this being mentioned anywhere on the internet, but TVC:DXY 's rally may just be CRYPTOCAP:BTC 's best friend. This, despite the popular notion that when TSX:DXT goes up, CRYPTOCAP:BTC goes down, and vice-versa. However, this novel idea puts a break to it. TVC:DXY is hitting the bottoms of its uptrending channel, and...

NOT FINANCIAL ADVICE This is a very generous idea that considers the bullish scenario for $VET. The risk/reward ratio is 7.5 (317% upside vs42.5% downside). However, this is only due to the really high beta that NYSE:VET posits. It's a risky trade, sure, but the rewards are sweet -- if this plays out.

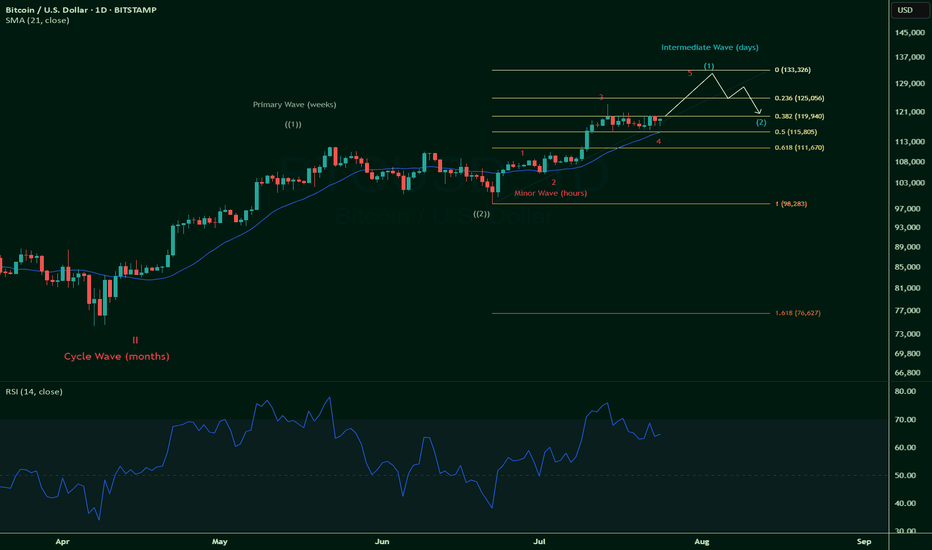

NOT FINANCIAL ADVICE Let's start with this bullish outlook on Bitcoin and its various phases: Here, I estimate the likelihood of CRYPTOCAP:BTC 's journey through its Cycle Wave III.

Not Financial Advice Born in 2009, bitcoin was a proof of concept out of an esoteric online forum. It was intended as a secure, swift, P2P solution to transact on a global stage without global scrutiny nor supervision. Sure it worked, but would it last? Then Proof of Work, PoW , showed it's efficacy and prowess as years quickly approach a decade's...

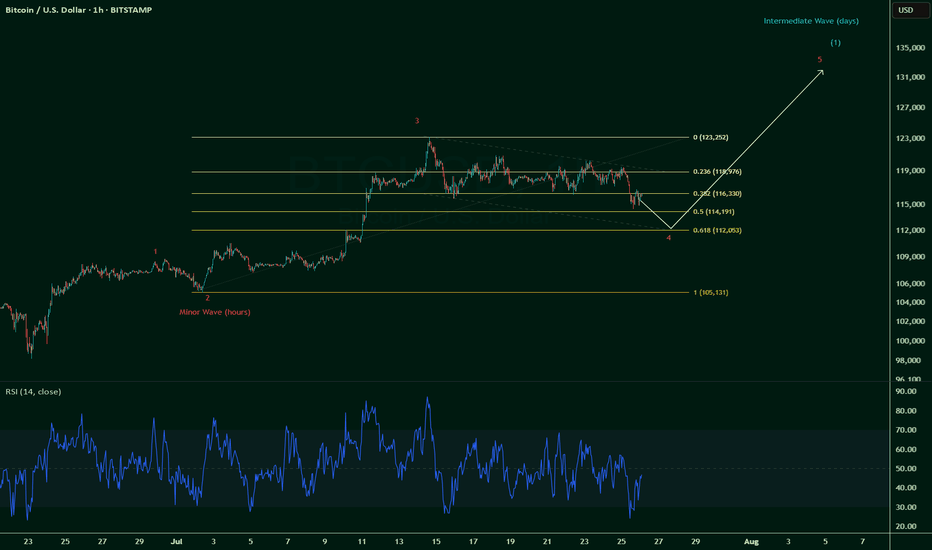

This is not financial advice. In my previous post, I suggested that Minor Wave 4 could go all the way down to 0.618 fib: However, after doing a deeper dive into the long squeeze in the last day and looking at its recovery, I think CRYPTOCAP:BTC has completed its corrective Minor Wave 4. This means that we're looking up towards an impulsive Minor Wave 5. If...

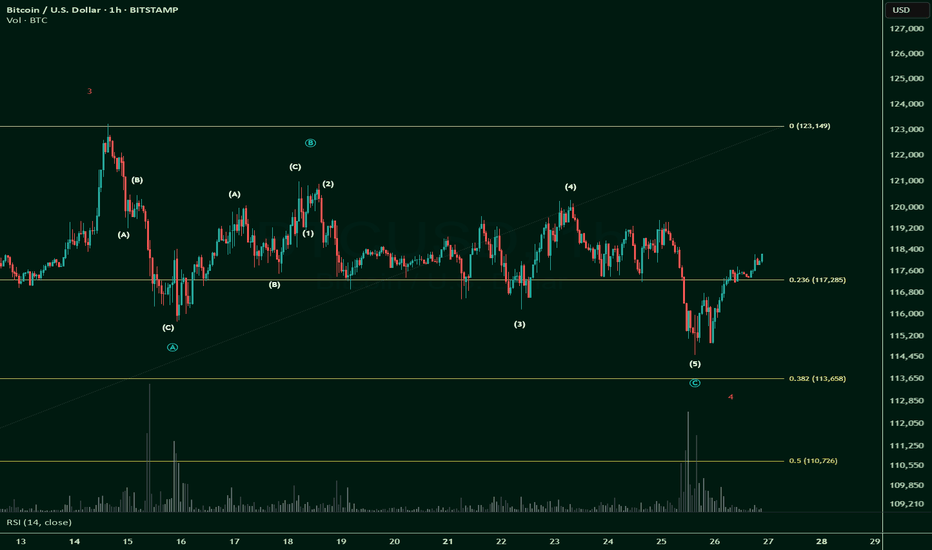

So it was a long squeeze after all, and one that was coming. The initial thoughts were that we're on a Wave 5 up and counting: But we're brought back down to earth as CRYPTOCAP:BTC breaks below $115k, invalidating a Wave 5 count. So, it's official: we're still on a Wave 4 correction, which can go as low as 0.618 fib towards $112k. Now painting a likely...

Supercycle (years): Wave (III) Cycle (months): Wave III Primary (weeks): Wave ((3)) Intermediate (days): Wave (1) Minor (4H): Wave 5 Looks bullish in the short term. Let's Go!

* Not financial advice. For educational purposes only.* Let's go for the next bull run! Blow off top, here we go~

NOT FINANCIAL ADVICE + DYOR + DD These last 4 weeks have not been like the torrid last 4 years for team Zilliqa, whose co-founders left, CEOs kept changing, price action were depressed, projects (Metapolis, console gaming) waned, and TVL lost steam. But Zilliqa 2.0 is coming with plenty of promises. And promises create hype. And hype creates demand. And...

NOT FINANCIAL ADVICE One word: Mark up. Okay, so they were two words. Support at $0.022 tested successfully but we could still test this if no breakout takes place in the next few days. A markup towards primary resistance zone 1 is underway. Ideally, we see a breakout and a test of this zone as support, shortterm. With Zilliqa 2.0 approaching, and new...

Let me preface everything with "NOT FINANCIAL ADVICE." Right. So, it’s been a crazy Uptober, hasn’t it? When we thought CRYPTOCAP:BTC was going to continue its bear market trend from February 2024, the Trump trade happened. Everyone was caught off guard—or maybe, like me, you were too. So, I set out to find the next alphas. Presenting... The Three Amigos:...

CRYPTOCAP:BTC broke descending wedge structure towards new price discovery territory after exhausting $60-$70k Bears. Path of least resistance? Expecting a small correction (Nov/Dec24) before continuing towards $95~$115k n beyond (Jan/Feb/Mar25). Stochastic RSI plateauing but RSI is bullish. But I'm not one of those calling for $250k this Bull Run. There are...

Disclaimer: It's been really hard to count the waves since the start of 2023, not helped by erratic political and geopolitical movements. These counts are based on super-basic Elliot Wave rules: - 5 wave movements (3 impulses, 2 correctives) - Wave 2 is never a triangle, often retraces 61.8% - Wave 3 is never the shortest, often the longest - Wave 4 is opp in...

The halving is a process in cryptocurrencies like Bitcoin where the reward for mining new blocks is cut in half approximately every four years. This reduction in mining rewards helps control the supply of the cryptocurrency, leading to a decrease in the rate at which new coins are created. As a result, halving events typically lead to increased scarcity and can...

NOT FINANCIAL ADVICE Structure is forming a very nice counter trending zigzag (5-3-5) formation; wave (4) aka waves ABC. Currently wave C underway, and we're expecting further impulsive waves to the downside, coupled with some strong divergence signal. If signal is found AND price touches the region between $25.8k to $26.2k, then we can safely say waves ABC,...

It's a bear market rally. But first, where are we in CRYPTOCAP:BTC 's wave cycles? Cycle wave V underway, cycle wave IV completed. With these wave counts, we can validate that we have already seen the bottom. Rejoice! Looking deeper into its primary wave counts and its fractals.. Ongoing: Primary wave ① > Intermediate wave (4) > Minor wave ⓑ I slant...

The macro trend for BITSTAMP:BTCUSD is.. And this publish looks at the Intermediary Wave 4 in further detail by studying the characteristics of Minor Wave 5. Here are the 2 possible scenarios to play out in the days and weeks to come: Scenario 1 Intermediary Wave 4 is not yet completed, despite touching 0.328 retracements, and will play out in a triangle,...

After seeing a capitulation, rarely do we see an immediate reversal back up. Even if the current trendline sends a strong signal to the bulls, it is unclear if a reversal is imminent or is this just a temporary relief bounce. We noted that 2 weeks ago there was plenty of air (lack of market participants) in the region of immediate price action and expected a...