graham.edwards84

It wouldn't surprise me to see a reversal here to the upside. Especially with the first wave target retracement met exactly and the strong divergence on the STOCH RSI.

Both the one hour chart and the three day chart have moving average targets (indicated) that have been met. This gives further credence to the reversal idea I touted just a few minutes ago. As long as these supporting averages can hold here I'm fairly optimistic. Also, you can see the MacD on the three day chart does look interesting with a potential crossover. ...

It will break out here. Clearly hitting a strong level of resistance but it's evident on this 30 minute chart that it will break through in short order. However there are multiple key averages overhead between 12000 and 12400. There will need to be a move sideways around this level for the rally to continue. In other words it will need to find support here and...

It was only about 6 months ago I guess and my news feed was buzzing with "the big crash is imminent" stories... not so much anymore... whatever happened to those guys? FOMO I guess... I think we could hit some resistance here though, I mean it has had quite a good run. Not the top yet though in my opinion but this area is usually good for a decent pullback and...

Nice looking fractal formation on the 15 minute and 8 hour charts. I think we're getting close to putting this consolidation down in the history books.

I'm going to try this idea again and set the target at 14000, which happens to coincide with the 50 MA on the daily chart and the down-sloping trend-line established from the top. Once the final wave of consolidation is complete (yes there is still a potential to .786) then my longer term outlook is still 31000 for a larger wave top (2). There's a possibility to...

On the left ETHUSD big run up from a little over a dollar to almost 400 is eerily similar to BTCUSD big run up to 20 K. How long could this consolidation potentially take? It took ETH 4.5 months for the 20 MA to catch up with the 50 MA and start the next wave higher but when it did, it moved from 300 to 1400... that would be like BTC moving up to the 60 K area...

20 MA touching down on the 50 MA signals the end to the move lower and now we can go higher. Next intermediate target is the 14400 fib level.

So a couple of things now to discuss with you guys. If you have been following this idea you know that the pullback last night was expected and it did exactly land and reversed off of the 200 MA on the 30 minute chart. So today I have switched over to the one hour chart because I want to point out the bullish crossover scenario we have just ahead of us today....

So a couple of new items here to share if you have been following this idea. First I have switched from the 15 minute to the 30 minute chart as we had discussed earlier. The reason is that the 200 MA here on the 30 minute chart has clearly turned to the upside and I have place a small extension on it to indicate where it is headed. Second, I have moved up my fib...

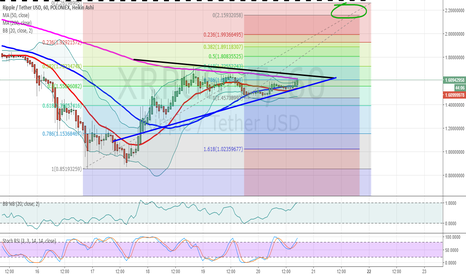

I am using the 8 hour chart to watch XRPUSDT as the 200 MA here is providing the base support. It is an interesting chart and as you can see it looks as though XRPUSDT is breaking out (red circle). I have extended the 20 MA and 50 MA to show what would need to happen to move it to a new all time high. I would want to see the 20 MA move up through the 50 and this...

Here on the one hour chart I have placed my trend lines on the 200 MA (black) and 50 MA (blue) and we can see that it has not quite achieved a break out condition but is very close. We would want to see the 50 MA move up through the 200 to get a decent rally. One concern though is the steepness of the 200 still moving to the downside and this average will have...

We had a nice breakout (finally) that I was expecting from this pennant formation and I was beginning to wonder which way the big move was going to go but the bulls succeeded in pushing it higher. The interesting this is that the Asian traders were responsible for the higher move, quite opposite to the previous few days when the European and North American traders...

I have adjusted my trend lines and the price action seems to forming a more classic "Pennant" style formation. I still think we are in good shape although there is always risk to the downside but the action has moved along sideways for three waves and so we would no longer be looking at a double bottom formation. This is different. Not a rising bearish wedge, not...

We can see now that the 200 MA on this 15 minute chart is turning nicely to the upside and I have extended it out for the purpose of this idea. It appears that the price action is now going to follow this average and this could be the verification that traders are seeking to break the resistance (black line) and propel it above 12000. I have placed the blue trend...

On this 12 hour chart I have extended the 50 MA and the 20 MA into a projection (red and blue arrows). It is key that the 20 MA finds itself in a position to rise up through the 50 in order to end this consolidation phase and fuel the next rally to next all time high. The 200 MA here (pink) is displaying the support area. Should a breakdown occur and a move below...

Target potential if this plays out would be in the 14000 range before the next pullback. Just an idea...

How many times will BTCUSDT hit this key resistance level before breaking through? I think I can see maybe 6 or 7 attempts? Ultimately this is a very bullish indicator and some call this "hanging around the high". Eventually it will push through and there will be much pent up energy expressed in subsequent move higher once this gate is unlocked.