The other day I posted the confluence of resistance patterns in alts. They are now down 10 - 25% depending how much of a gamble the bet was (My idea is if the price starts 0.00000 then there are numbers, this is probably a gamble). Let's now map the typical downside break path. We're going to use the norms of breaks of 1.27 - 1.61 zone. 2.20 - 2.61 zone and a...

Concurrent with the indices being at major inflection points crypto has broadly also filled major inflection points. Let's look at the different setups. First we have SOL in the main chart. Inset is the BTC high before the 2022 bear market. Different in a few ways but both the same general idea of a nominal spike above the previous high that fits inside of a...

This is feeling suspiciously like honey trapping of the bears and I think there's fair odds we're going to see a strong squeeze starting now and lasting over at least the next couple weeks. This could easily take us to 5800 or so inside of the head and shoulders setup

This capitulation period could be the end of a bearish butterfly / failed break of the range low. If it is, then it'll be uppy from here. Very tight tolerance for stops here. If this fails it could be absolutely horrific. But markets have what I suspect to be wash out low properties. I'll try one more batch of longs and if they don't work write that off as...

SPY has bounced off the 1.61 and is inside a possible 1.26 rejection. Clean breaks of a 1.61 like this tend towards big fast drops to the next fibs. Often this zone will then hold a retest. Big area for SPY. If this isn't support, bad things are likely.

I've explained for a while my idea if 5500 isn't support for SPX then we see a capitulation period to the 5100 sort of area. I think the case for this is picking up increasing merit. For a while I've not really been sure what to expect if that happened. My natural tendency to fade moves would make me naturally bullish but some different outcomes I considered...

I suspect we might be at a low in indices, which would likely also mean a low in crypto. Banked on all my shorts. Longs on now. Long 1800 Stop 1542 Target 3328

This looks like it might be a big corrective ABC leg inside of a downtrend. While markets have had a very bullish tone to them recently we've not really bounced that much and the daily trend is still down on big swings. Perhaps the corrective period is over and new bear waves are forming. If so, this should be about the high of them here.

We now have a lot of match up in how the BTC and SPX moves have formed with both of them showing properties of what could be a choppy wave 4. This would predict we see a period of panic selling (likely driven by news) and then we enter into the ABC correction. Now ... by the book, if a bigger bear move is happening the high should now be in. If there's to be a...

BTC now trades at a really interesting level where one would fairly make a case for a few different technical outcomes likely if we dumped again to 70K. There are three things that would make sense inside the knowns of trend development; 1 - We are making a pullback of the last leg (bullish overall). 2 - We are in a bearish wave 4, about to spike out (bull...

We currently have a pending bullish butterfly in the current general area. This can be a really good continuation pattern, when we have the basic trend conditions of there being a couple corrective legs, typically being around the same size and the final drop being the fastest (Scary false breakout). In the successful version of this as a continuation pattern...

MSTR is filling my alerts for the optimal short zone mentioned previously. I've explained the various macro bear trend setups in MSTR previously. For some additional stuff; Generally a correction will be two legs. When it's not, there's usually at least 4. 3 corrective legs is rarer. Breaking under might have been a bear break. If it was, a retracement is...

My previous forecast into the high of the rally was for a capitulation from the high, no major retracement in the drop and then once we broke the low - slam to 5500. This trade went well in the first stages. Top where it was expected. Sell off in the style expected. New low as expected - but there has yet to be a big follow through. This failed follow through...

The Cycle of Crisis: How Fed Interventions and Post-Crisis Policies Set the Stage for Future Turbulence Research suggests that solutions to financial crises—ranging from the Federal Reserve’s early market interventions in 1922 to post-2008 policies—often create conditions that later lead to new crises. Historical evidence indicates that measures such as...

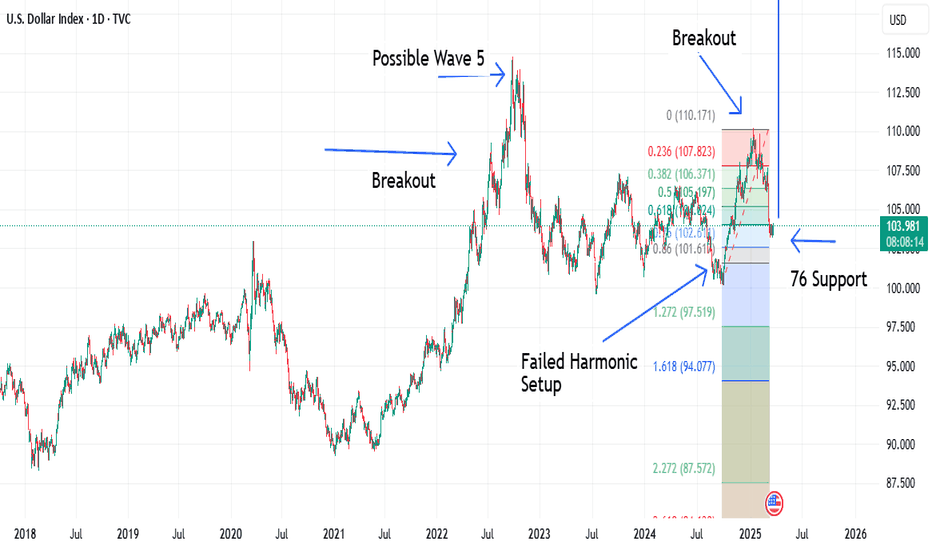

I'll start this by going over the case for the DXY rally broadly and then dial into the reasons why this seems like the optimal level to look for it starting. Working left to right. The 2021 Breakout A very sharp rally happened in 2021 in the USD. It was one of the most impressive things seen in the USD for decades. DXY had downtrended for a long time....

A common retracement level for a pullback is the 76 retracement fib. On the first rip off this ETH looked good for trend cont but this failed a long time ago with the failed new high. Now we have further development of the failure of the uptrend with the 76 breaking again. Here's a similar point where the doge trend failed. Most alts failed to make new...

BTC has traded off the 1.27 of the current topping swing and held a retest of the previous structure. I find these are things commonly seen in a prelude to a 1.61 break. Clean breaks of 1.61s are rare but many of the times they do happen the pullback comes from the 1.27 - this sort of "Loads up" the momentum for the break. Not all 1.27 bounces produce clean...

Saylor The Bubble Man MicroStrategy (MSTR) – A stock that only shines in bubbles, then burns its holders. 1999 Dot-Com Hype: MSTR skyrocketed in the late 90s, purely on dot-com speculation. But after aggressive accounting was exposed, it crashed over 90%. Saylor paid fines, survived – investors didn't. 2021 Bitcoin Mania: Saylor rebrands as Bitcoin...