Mega high RR after the spike. Completed a butterfly pattern in the parabolic move. Adding to my short. Will do a full analysis update if it goes higher but I think this is a great sell level.

I think the SPX is topping on the spike. Good news into the high, quite common. Adding to my SPX short. I think there's a good chance this is a major high.

Been waiting and waiting for this one. I think the USD bullish breakout will be explosive. 500 pips up in USDCAD. Really one of the best opportunities in the USD for many yrs if this sets up. Positioning big in this one now.

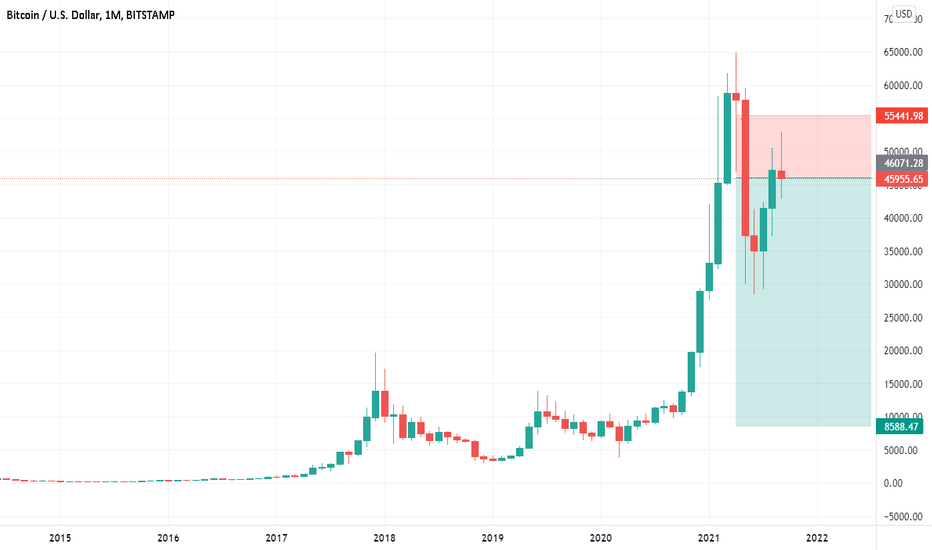

Taking some positions for my full target on BTC now. I expect to see at least one (And probably a few) rallies before this (And have intermediate targets around 30K) but here's the big swing trade I am looking at. See attached ideas.

Looks like BTC might have broken the bull trap today. Selling into the rally. Shorting 45,050 Stop 46, 999 Target 31,240

Exited quite a lot of my short term SPX puts a while before the close expecting to see a rally. Looks like we're into the end of the correction.

Looking to see AAPL rejection off the harmonic pattern. Adding to my AAPL short.

Entering a short on AMZN after the butterfly high rejection and now the completed pullback. See linked ideas for more analysis.

I think TSLA is in a bull trap and we're going to see a break in it soon. Adding to my TSLA short.

Continuing to build up my swing short. I think we're soon entering into a capitulation leg to 30K

After a mega boom and re-boom Sol has finally reached the final 4.23 extension level of the last range and made a spike out of it. This is one of my favourite places to fade a move. I think this can mean revert all most of the rise and then overshoot into the low. Stop loss 215 target 20.78

This is my approximation of what the SPX price move would look like if there were to be a crash and that crash was to be consistent with models from previous market crashes. See linked for an options trading plan to go along with this analysis.

You can't short companies just because you think they are abhorrent (You just give your money to people you'd not like), but just for the record - I don't like GS. Been waiting a while for the shorting opportunity to set up in GS. GS has been hy6per parabolic through the last swing. A common trait of a blown-off top. These moves often terminate in the 161...

I think if there was a crash to be coming in the SPX the warning signs will come this month. They'd be in the form of price downtrending over the next few weeks, breaking under the previous supports and then entering into a shallow rally. If this price action happens, I think there's a lot of value shorting into that rally. I plan to finance deep OTM puts by...

My first major sell target is 31K and I'm also setting pending buy orders there. Looking for a rally of about 25% off that level and then I'll be entering short again somewhere into the 40K zone if this move happens. See linked ideas for trade plan.

This is a fill or kill to my short pending order - meaning if the short fills the buy order is invalid and should be cancelled. We're looking for this to fill and price to head into shorting area. See linked idea for the short entry and an example of a previous trade I think is similar - betting on a harmonic forming.

I don't think the buy trade will hit target. Adjusting target to 45,300 on that. Adjusting my sell limit to be lower too. See linked ideas. Sell limit cancelled and buy target adjusted.

In 1989 Japan was known as the "Miracle" economy. Then it crashed, and it was thereafter known as the "Bubble economy" (Funny how things change). While I am becoming more and more a huge US bear, I am becoming heavily bias towards the Japan bull, along with some other Asia markets. Seeing the Japan market down over 75%, stagnate for decades and now starting to...