i_saw_da_light_

Since we are bullish on XAUUSD, Price made a new high and now back on the discount of the 1hr range. I expect up down candle to send price to the buy side.

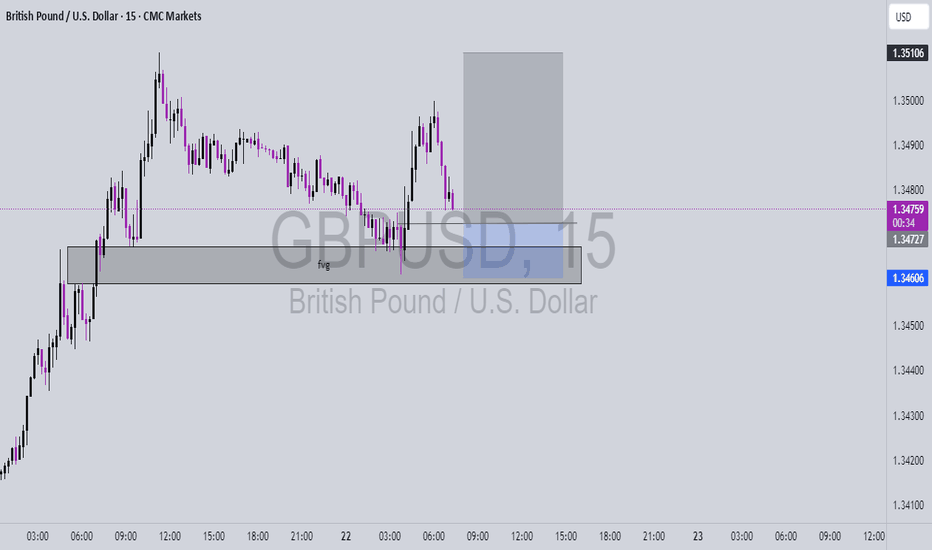

On the 1hr time frame price took sell side liquidity and ran into an FVG, I expect a little push up after the break of internal structure to the area of 1.35060

We could expect EURUSD to sell of from the Decisional poi which broke the structure or retrace deep into the extreme poi.

GBPUSD made a pull back either to sweep liquidity or for the banks to pair up there buy orders. Price is within the level of 1.27000. On the lower time frame i see a clear BOs after a pull back into my 4hrs Poi. I expect an internal pullback on the lower time frame into my bankers block and a clear bullish schematics then I could be a buyer of GBPUSD. Tp 1.28500,...

Gbpusd! This pair has been extremely bearish. On the 4 hrs time frame, a new LL was made which means that the bearish impulse will continue. I expect the market to retrace back to the supply zone and start redistributing. If I see a proper confirmation I could be a seller of GBPUSD.

For couple of weeks now Gold (XAUUSD) has been making a continues HH which signifies a strong uptrend. I anticipate the market movers or the banks to push price downward into my 4hrs poi which they did. I could be a buyer to take out the last high if I see a proper accumulation schematics and confirmations. Target @2440.000 Sl 5 pips below your entry point. N/B...

What do you think about BTCUSD ? This pair has made an ATH at @73000 and since then the market has been consolidating within the range of @73000 high and @60000 LL. At this point the market could break lower or higher. So on this 3rd leg of the retracement, I expect the accumulation inside my poi on the lower time frame to result to some buys to the level of...

(Gold) XAUUSD. we are trying to take advantage of the 4hrs pullback using Wyckoff schematics principle. An accumulation schematics was printed in the market as we can clearly see the SC (selling climax), spring which took liquidity, the Bos and sos (sign of strength). with proper confirmation i could go bullish to take out the 1hr high. target @2200.000 sl 5pips...

based on the higher time frame candle sticks structure, I still feel confident in buying price upward to the Area of @2034.000. Target 10pips from the entry point, Sl 3pips from the entry point.

GBPUSD. has created a new bullish trend, we don't know if the trend will hold for a longtime or just for a while. but we'll keep taking advantage of the pullback till the order flow fails. my 1hr poi could be a great area to look for some buy positions if there's a proper confirmation.

GBPUSD could continue the bullish trend and possibly make a new high.

AUDUSD has been aggressively bearish for some time now. A new low was made on the 13th of Feb, 2024. the price pulled back to the supply zone. I expect the continuation of the bearish impulse. So I am waiting to see good schematics inside my POI then I could be a seller to make a new LL.

got my eyes on GBPJPY. With the condition of the market, I could possibly sell price down to take out the last 1hr low. N/B use proper risk management and the market will not hurt you.

Trade alert 🚨GBPUSD - After a re accumulation schematics on the 4hrs time frame. On Dec 24th, 23 to 2nd Jan, 24. GBPUSD has been bullish. 1st 2nd, 3rd waves has been made on the bullish breakout. On the 1hr time frame I expect the pull back to re accumulate at the unmitigated demand zone or poi for a new high to be made. Target @ 1.28000

I anticipate the market to test the demand zone 2.0 and then make a new high except otherwise. N/B ensure proper risk management.

XAUUSD Analysis. Gold made a 4hrs expansion, the continuation of the downtrend. I expect a pull back or a retracement to the decisional poi or the 50% level then the market could possibly decline or make a dip pull back to the 70-80% percent then decline.

Gold violated the previous low-marked X, the efficiency of the pullback could be considerable because of the continuous internal LL and HH on the lower time frame. I expect a push into the 0.80 retracements of my Fibonacci which aligns with the supply level or POI. I could be a seller if, I see a clear distribution on the lower time frame. Ratio 1:4 risking...