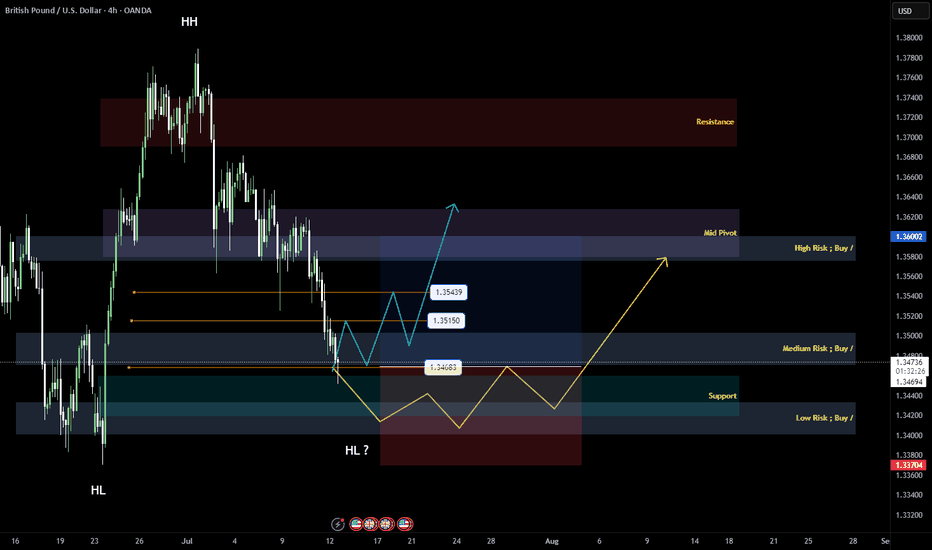

Price has already reached my third reversal line and this is where I can expect to price to close above the reversal line to hint a possible change in the direction of the trend. Currently right now I am waiting for the price to show me a bullish reversal candle for the price to give me confluence to possible change of trend. I am still bias with the trend...

Currently in the 4H timeframe I can see that the price itself has given me a shift of momentum and this indicates that there could a chance for a possible bullish movement. Now I have marked my zones base on fibonacci levels and gotten my zones to participate in the market. Base on the market structure we can see that the price has now shifted its direction...

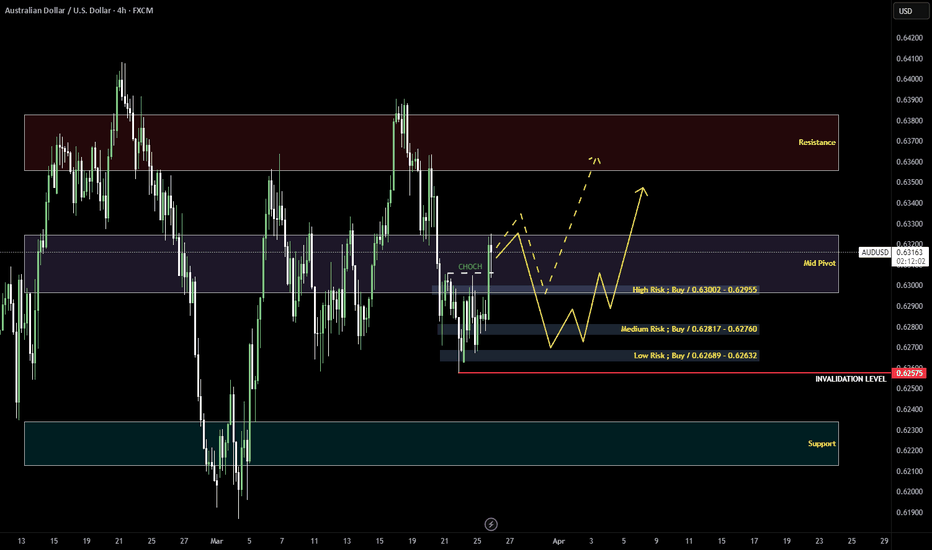

Price has broken previous structure. This is the first indication I would take in my trading to before placing a trade. We can see in the charts that the price has broken through medium risk zone and is now heading to low risk zone. I would be looking for a short position there as it is closer to my invalidation level. This allows me to leverage a higher position...

Base on the market structure in the smaller timeframe. We can see a potential CHOCH in the 30 minute timeframe. This allows me to understand that there is a potential chance for the price to change its direction. I will be looking for a position to leverage my short position.

Base on the market structure given in the 4 Hour timeframe. A CHOCH has been formed and this would make this pair and interesting one to look at as the price now has reached all 3 fibonacci retracement levels. I believe that this set up is valid and worth to look at. I will only be participating in the market if there are any reversal confirmations within given...

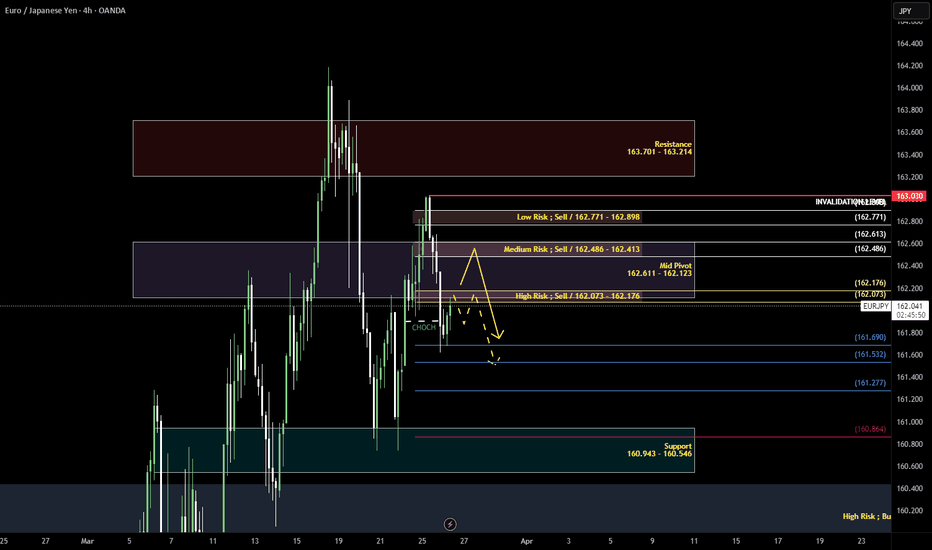

Given the structure that has been formed in the 4 hour timeframe. We can see that there is CHOCH within the structure. This could indicate us that there is potential for the price to move downwards. Currently the price has just touched the first reversal point of the fibonacci retracement it has yet to touch the 2nd reversal point. I would not rush my entry as...

There is a potential CHOCH that was formed in the 4 hour timeframe market structure. This clearly indicates that the price is ready to change direction especially when there is a strong bullish reversal candle in the 4 hour timeframe. I will be looking for a long position within the set zone and wait for confirmations. If the price does not retrace to set given...

Currently price has entered the medium risk zone. Price has shown signs of rejections in the smaller timeframe. This should be additional confluence for me to participate in the market as there is a potential CHOCH in the smaller timeframe. In this trade I am only participating base on market structure and fibonacci retracement

Base on the market structure in the lower timeframe in H1. There is a clear indication of potential CHOCH. Price action has respected the support and formed a new structure with potential signs we can go for a Long Position. I will be participating in the market with my positions at Entry - 1.29220 Stop Loss - 1.28879 Take Profit - 1.30236 I am interested in...

EUR/JPY has finally shown a Break of Structure within the higher timeframes. This gives me clear indication that the CHOCH yesterday was correct. Thus I should be looking for buyging positions.

Currently EUR/JPY has managed to pushed itself all the way back into last week Medium Risk Zone (ORANGE) . Personally I believe that the zone from last week won't be as strong as it used to be so there are also possibilities where EUR/JPY will use the zones from last week and bounce off. This means that there is a chance that EUR/JPY will touch Medium Risk Zone...

I believe EUR/JPY has the potential to go down some more. The reason being so is because of the market structure that was set in the 4 Hours Timeframe and this allows me to pivot my bias into shorting EUR/JPY base on the given risks levels. If the price breaks those levels then I will consider this set up fail but if it doesn't break and actually follows how the...