The breakout of this Bull Flag is going to bring BTC once again to heights we have yet to see. When we use a Trend Base Fib Ext, we can see the next Golden Pocket sitting up at $85.600. This is a continuation of the monster Cup & Handle we broke out from earlier this year.

Yet again, we can see GME has formed another massive bullish falling wedge/flag on the 15. A breakout out of this flag should bring a $25 to $50 gap up within the next 10 to 14 days. Stay tuned.

What an absolute monster Cup & Handle on the 4hr. GME has been on quite the run lately. If this continues we could see another $3 to $7 gap up over the next week or so according to the Fib Ext. And being DFV is now active again, this may be the catalyst needed to spark the fuse on this weekly Bull Flag that has begun to finally breakout.

Taking a look at SPX on the 15, has 2 up gaps to fill and is nearing the top of this Ascending Channel. If it decides to break down, we could see a $100-120 gap down.

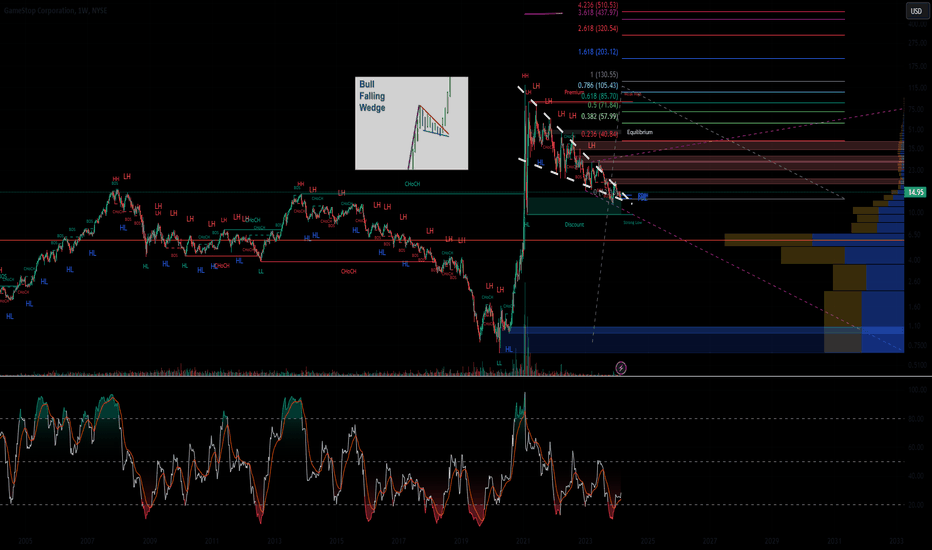

Still tracking this absolutely massive Bull Falling Wedge/Flag on the weekly chart. A breakout could bring the biggest move we have ever seen to GME. When we use a Fibonacci Extension on the last gap up in 2021, we can see the 1st Golden Pocket sitting up at $85, which would be $340 pre split. And the second, third, and fourth pockets sitting up at $203, $320,...

Looking at the 4Hr GME chart, we can see the GME has broken out of the wedge and has formed a Cup & Handle as well and an Inverse Head & Shoulders. Also, the 15 min is showing a Bull Flag breakout. Bulls are out in full force. Quad witching is in 3 weeks also...

Tracking a pretty substantial Rising wedge on SPY 1 Hr. Could see a 10 point pullback if this does decide to breakdown. Looking closer at the 15 min, looks like we have just broke the bottom trend line of this wedge. Stay tuned.

4Hr head and shoulders on APPL. Could see a pretty substantial breakdown Once this right shoulder completes formation. Possible $10 point gap down.

Looking at NVDA on the hourly. It seems to be flirting with the lower trend line of the ascending channel. Could see a 15 to 30 point pullback here in a few, if it decides to break down out of this channel.

Keeping an eye on this Ascending Triangle on the 4Hr. A breakout could bring a 30 Point gap up.

Looking at this Bear flag on SPY. If this breaks down, we could see a 5 point dip.

I was just looking at both TSLA and GME on the hourly and low and behold, these charts are almost identical. Both inside falling wedges, and both with double bottoms. I'm unsure of the exact fundamentals on this one, but the charts do show that they are moving in unison. Keeping close eye on this.

Looking at a small breakout of a pretty large falling wedge on GMEs hourly chart. If it can break these two supply zones at $16 and $17, It may re-test those $18.50 levels again. I would keep an eye on this one. Also if you zoom out a bit more you will notice a massive double bottom... On the flipside, we are also still inside the weekly wedge with a bit more...

Tracking this text book falling wedge on the VIX, which is about to enter demand. We could see this breakout if SPY decides to breakdown out of the Rising wedge its currently about to break.

Looking at this Rising wedge on SPY 1hr that has formed after breaking down out of the massive ascending channel it had been in. If NVDA breaks it's ascending channel, it may assist with this wedge breakdown on SPY. Looking for an 8 to 10 point gap down on the hourly. Stay tuned!

Just wanted to update you on the adjustments we have made to the wedge, since the last minor breakout. I have widened it to include the most recent uptrend. Looks like we are coming to the end now, and this should finally breakout sooner than later.

Looking at the massive falling wedge breakout on TSLA hourly chart. Also notice the oscillator on the Ultimate RSI, just crossed north of 50 and looks like it wants to retest those +70 levels once again. The next supply zone sitting at $240-$242, if we break through that the next zone after that will be $248-$250, and if we break that we should see $255-$265. If...

If we break this current demand zone, and enter the break down of the Head & Shoulders, I wouldn't be surprised to see this break back into the 30s before entering the next demand zone. Also, with EV coming in strong and less demand for oil, and more and more nuclear plants on the rise, prices should start to slide drastically. This may be the last hurrah for...