isnarain

Indicators are showing gold are hitting its bottom at 1200 oz/ Resurgence to 1340 oz likely in the near term.

The charts couldn't be better for ASR gold. Price Target for next run could go as high as 3.40. All indicators are showing signs of a fantastic bull run ahead (52 points used).

Guy Chamberland will be announcing upcoming appointments board and big pharma distributor for Canada and Europe in the coming days/// Insider Has learned. 10:15 2018-08-07

All indicators are extremely oversold, MACD showing bearish sentiment, however, we believe this to be a fakeout. Expect a strong Bullish reaction week ending. We expect bullish break up to 8.30 - 8.55 per share. The need for reassessment will be performed once certain price points reached.

Strong Fundamentals will keep this stock from dipping below 10$ per share. 11$ price levels should be retested by tomorrow. Short term Higher highs and higher lows are present. To note: Collapse of Coors deal was exasperated by Trumps warning on tariffs to Chinese market as evidence of TSX fall. The further decline today was a result of such effects on TSX....

Fundamentals are showing a breakout in the next hour. Enjoy the profits.

Gtec Holdings is in serious need of volume as price supports higher share value. Good news, Higher Highs and Higher lows should continue with a new bullish wedge from my last report. Subsequently, without the necessary volume the share price will remain range bound for the time being. My recommendation is to hire a publicity company to get your name out there....

Volume has dropped off substantially, while maintaining SP. RSI remains in oversold territory with a bump up in target to 48 points on the Daily chart anticipated in the short term. AO showing bearish reversal, strong bull in the coming days. Indexes (TSX/MJ) look to be providing near term support. Break out from the exp. ribbons would show a bullish recovery in...

Average Mean Price for today: .95$ per share (Yellow); 1.05$ per share by July 20th. Range bound high/Lows for today: .84$ per share to 1.04$ per share; .91$ to 1.11$ per share by July 20th. Major Supports: .90$ per share Major Resistance: .95$ per share Trend analysis is bullish from current SP.

43 minutes ago Stock pulled back from short term highs and is beginning to consolidate, range bound - .72 - 75$ per share. 52 point indicators show stock has pulled back into oversold territory. Wave analysis shows sp -1.26% below moving averages giving credence of a likely bullish increase, short term prospective. Forward looking statement. expect consolidation...

Stock pulled back from short term highs and is beginning to consolidate, range bound - .72 - 75$ per share. 52 point indicators show stock has pulled back into oversold territory. Wave analysis shows sp below moving averages giving credence of a likely bullish increase, short term prospective. Forward looking statement. expect consolidation and gap up before...

Stock is continuing its bullish pattern with higher highs and higher lows. Bullish wedge forming with a gap up/breakout likely in the near term. Company has outlined plans and is delivering on such plans. Fundamentals (52 points) show low chance of bearish reversal. Writer recommends buying on the dips as GTEC is poised for further gains.

Stock is breaking out of a prolonged consolidation period with considerable short term gains ahead. Price momentum is bullish with a short term spike capable of reaching 1.43 - 2.41$ per Share. Technical data is showing am median target of 1.96$ per share in the near future. Coverage on GTEC Hldgs Ltd.

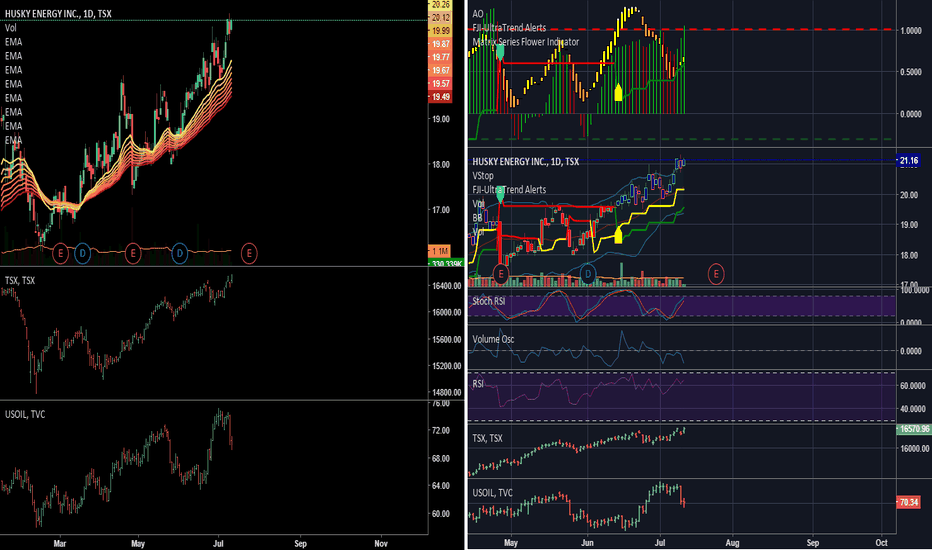

Stock is breaking out of consolidation with considerable short term gains ahead. Price momentum is bullish with a short term spike likely to 21.50 in the short term.

Stock is breaking out of consolidation with considerable short term gains ahead. Price momentum is bullish with a short term spike likely to subside for another round of consolidation range bound 5.08 - 5.20.

Two Words: STRONG BUY! PLI is in a bidding war with as many as 5 companies for the buy out the company. Estimated buyout would bring the SP up to 2 - 3$ per share. Expect more short and longer term gains ahead.

Resistance is low, Price momentum is bullish - out performing the MJ sector. Something appears to be up! Next major resistance is 12.36 - 12.45. A break above these levels would propel the stock to 12.64 - 12.84 per share. I do not see a pull back based on technical data. Further short term gains to come.