iwaqasbaloch

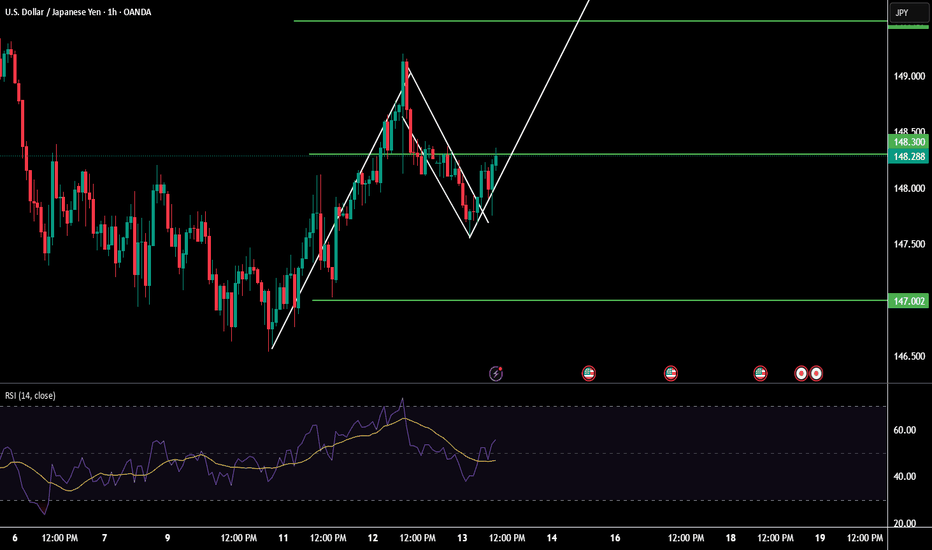

Trend is Bearish making LH and LL No divergence No reversal Pattern No continuation Pattern

It is now going to be bullish when it breaks the previous high. No divergence bullish Rectangle Symmetrical Triangle

The trend will be bullish if it breaks the HH Bullish Divergence Head and Shoulder No continuation pattern

Bullish Trend HH and HL No divergence No continuation pattern No reversal Pattern

Bullish Trend HH and HL No divergence Bullish Flag No Reversal pattern

Bullish Trend HH and HL No divergence Parallel Channel No Reversal Pattern

1: Trend was bearish 2: Bullish Divergence 3: Head and shoulder Pattern

1: Trend was bearish 2: Bullish divergence 3: Double bottom

AGLD was bearish and also had bullish divergence and now it is consolidating. If it breaks the resistance buyers control it

1: Trend is bullish 2: No divergence 3: Bullish Trend is the continuation

1: Trend is bullish print HH and Hl 2: No divergence 3: Bullish flag

1: Trend is Bullish 2: No divergence on It 3: Also follow the Ascending channel

1: Trend was bullish 2: Also made Double Top and Rising Wedge

The trend was bearish, but RSI made a bullish divergence, formed inverted Head and Shoulder, and broke the Resistance. Buyers get active.

1: Trend was bearish 2: Now It makes bullish divergence on RSI 3: It also makes falling wedge 4: Now the trend is going to be bullish

1: Bearish Trend 2: Making LH and LL 3: FIB is for the precise entry

1: Trend is a bearish 2: Making LH and LL 3: No divergence 4: Using FIB for precise the entry

1: This is a Bullish Pattern 2: This is printing HH and Hl 3: Instant buying because the price is tested FIB 0.382 4: Also, the price respect the bullish trend