jake66

Weekly support being tested, look for a daily reversal to the upside.

Price stalling around 4HR ascending resistance, look for long opportunities.

Wait for the pull back then re enter short. Price has had days on continued down movement, needing a pullback then re enter.

See weekly support for possible levels at which this stock will fall to. (TP=$100) Very weak guidance + bad earnings report + slew of analysist downgrades (KeyBanc, BMO, Deutsche, Stifel) + dropping amazon as client and now competing. FedEx is a deteriorating company caught in global trade tensions as well as a slowing global economy. I am short.

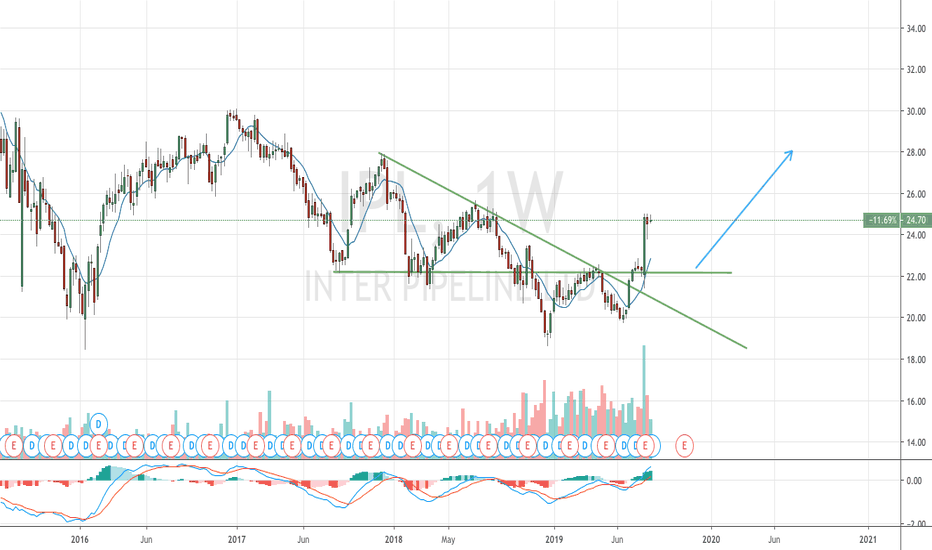

Picture perfect double button singling a reversal. quickly breaking out of descending resistance. Long

Strong technical bullishness for USDCAD. A slew of USD/CAD ECO releases this week. A break above resistance could mean continued upside for USD against CAD. Both country release GDP #'s, buckle up for a volatile week.

4HR Support break indicating more movement to the downside. Wait for a retest and enter short. USD consumer is still strong however industrials/ GDP/ Exports is deteriorating.

Weekly candle blew by support indicating more down movement to come. Monitoring support zone outlined. Great company anchored by Walmart and a great group of holdings. Upside potential includes massive apartment tower currently under construction in northern GTA. Superb management/ leadership/ company. waiting patiently to buy.

trade for the week: EURUSD short on a resistance touch. Look for a reversal candle/ consolidation on lower time frames. USD also has a few key ECO data releases this week, expecting relatively positive 3's.

Weekly chart of $EURGBP, as you can see price was rejected at weekly resistance. I expect downside movement with price with regard to technical levels. I expect downside movement in price with regards to fundamentals ie: EUR zone consumer slowing, manufacturing slowing, debt crisis. Good Risk to Reward trade. $EURGBP SHORT

Fundimentals -Walmart is currently the biggest Tennant. - Continued growth throughout GTA/ Ottawa -Growth geared from industrial through residential Technicals -Currently trying to reverse at key weekly support level. Wait for confirmation ie: reversal candles. Good Risk to reward + added benefit of monthly dividend.

looking like this is the last support channel we have. Hoping it holds and regains some footing. If not then this will be going below a penny. Technically it looks perfect for a major reversal. We need a massive Pr and some Caverstem buy out rumors. (Why they created own LLC for Caverstem) Holding on tight. GLTA

Update from my last analysis. Price looks to be holding in a wedge formation however I believe the break out is near. Look for a large extension (around .20 cents) given massive technology adoption, Russia contract plus updated 8-K and Q2 coming soon. Will update as price continues. GLTA

(Picture perfect breakout + retest above) Couple things to point out; 1B authorized, 189M shares Outstanding. - Already selling in Indonesia, Turkey, Nigeria, Kenya, Bulgaria -Plans to begin distribution into China, India, Russia, Poland, Hungry -USA FDA approval is an 18 month+ project -Product is superior cancer detection; painless, non-invasive with...