jalapablo

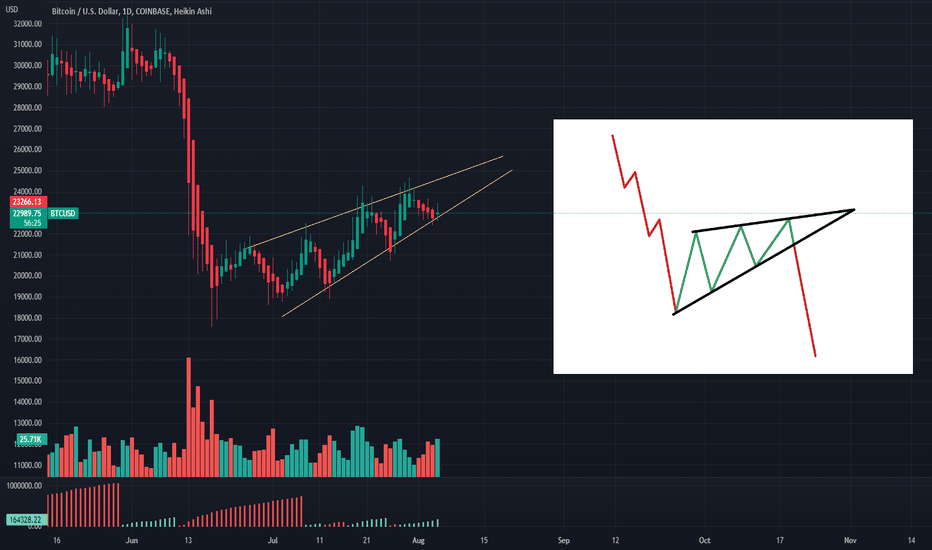

EssentialA potential BTC distribution is playing out, according to Wyckoff Schematic #1. Nothing obviously is 100% in (especially in crypto), but the resemblance is uncanny. This relief rally IMO has been unsustainable, so such an outcome shouldn't come as that big of a surprise. I realize this is a 2-hour chart but let's see how it plays out!

Gain-erasing retracements are in the books for BTC, ETH and a host of other altcoins in the form of rising wedges, which act in this case as a type of crooked top. Be sure to take caution in the next few days if you are long in the market. FOMC announcements are expected on Jan 31 which may torpedo the markets based upon the outcome of the meeting. This would...

Let's see how this turns out. Highly manipulated ATM, on the macro I'm bearish. Currently, however, a FOMO pump to 22.8K may be in the cards before this thing goes back to structure & back to bed. Be safe, be strong, be wise :) **If you have patience, strong hands, and like scoring wins, be sure to SUBSCRIBE to this channel. Here's why: I track all USD-paired...

BONE is looking like it may retrace after scoring some nice gains. As I shared with my group: the rising spread is narrowing, volume showing signs of supply build after failures to rally in demand at key micro resistance points. One more potential rally may be in store, but this could be a false one if it breaks structure. Ultimately, I project the price falling...

ETH is showing demand at macro resistance, typically reserved for bull traps when trying to break from a major downtrend structure in a bear cycle. Keep an eye on potential supply block traps hovering outside resistance where smart money seeks to harvest liquidity before sending the PA back into the wedge. Beneath the current PA I've included two anchored VWAP...

High possibility of another liquidity grab before BTC falls back into the macro falling wedge, and back to macrotrend support. Please beware of any rallies after this point, especially those reaching up to the 18-18.3K range. As I teach my group, these are often classic bull traps that occur past the macrotrend resistance, where unsuspecting retail traders are...

Metal currently trending in an AW. I've included DCA points in the event of a distribution. If you have strong hands, patience, and like big wins, be sure to SUBSCRIBE to this channel. Here's why: I track all USD-paired cryptocurrencies on all the major CEXs and seek out the most lucrative swing trades and runners. All my charts are clean, straightforward, and...

SNX is one among many alts currently in redistribution patterns after Bitcoin's last pullback. Supply volume is entering in the vertical bars as the PA attempts to cut through microtrend support. Will it continue to pullback or will it correct back into the wedge, it remains to be seen. I still hold a bearish bias & I'm expecting an eventual mitigation at 1.50 USD...

Macro descending wedge made up of a series of micro rising wedges, which account the bleed-offs we continue to see in the price action. Next stop if we distribute from our current channel is in the vicinity of 13.7K (1.618% Fibonacci retracement), which I am expecting. This may (or may not) come before a FOMO bull trap reaching into 17.5-18K area with full...

Dash may be inching more and more toward a pullback. This is due to a steady climb of higher highs & lows in a wedge-like structure with supply bars entering at the key juncture of microtrend support. If this support is unable to hold, we may be revisiting the Fibonacci retracements as we make our way back down to mitigate the supply LV at 1.618% and possibly the...

Jasmy making a quick momentum play for the Fib range, presumably from an oversold position. .00397 mitigates the liquidity void at the .618 extension. ** If you have strong hands, patience, and like big wins, be sure to SUBSCRIBE to this channel. Here's why: I track all USD-paired cryptocurrencies on all the major CEXs and seek out the most lucrative swing...

Here is the second part of my "There will be blood" chart (check it out below), which accurately forecasted the next redistribution event for BTC. It's becoming a familiar occurrence: an unmistakable ascending wedge pattern emerging with dominant supply expansion in the pullbacks presupposes more downward action to come, but perhaps not before a quick liquidity...

Here's a schematic I drew out replete with some volume spread reads which seem to indicate LTC may be fixing to distribute. If we rally above TRR we must take caution to ensure we are not buying into a liquidity grab before the LPSY dump. If you chose to swing this, the lower retracement levels are ideal profit-taking/selling opportunities; for longer-term hodlers...

It's looking like a bloody retest of 17.5 is in the books. It's no longer a matter of 'if' but 'when', due the way things are developing. If this rising wedge pattern plays out, we can count on some more bloody days ahead. I'm preparing to DCA beginning at 17.5, which would also consummate the lower macro LV, bringing the next leg down for the beginning a proper...

IOTX is awakening after a period of prolonged accumulation. If bullish sentiment remains, we can anticipate a healthy markup. It seems bent on doing its own thing, regardless of where BTC is going. Nevertheless always keep an close eye over your swing assets and be prepared to bail if IOTX's PA falls through the regression trend. *Be sure to subscribe for...

After a series of narrow spread and a shakeout, EGLD is back in range and retesting resistance with demand predominance in the volume. This often indicates a sign of strength (SoS), and if the resistance can be flipped to support, we can expect the resumption of upward price action. Take it up to the 1.272 to the 1.618% Fibonacci zones if this happens and limit...

Maker made it onto my radar by completing the C&H with a successful neckline test. Now it looks like it may be eyeing the next LV mitigation at 1.618%. I've seen these patterns go up sharply from here. Nothing is 100% though, so be prepared to invalidate if the PA falls back beneath the automatic rally point of the range (TRS). *Be sure to subscribe for more...

Similar to Monero, Matic is another cryptocurrency currently trending within a falling wedge bullish continuation pattern I've shared with my group. These are expected to rally to the upper Fibonacci extension targets at some point, though a tactical shakeout may occur first to weed out weak-handed retail traders. I'll jump in at the first breach of upper wedge...