jalapablo

EssentialMATIC back down at range support with re-emerging supply volume is a good indicator of further pullbacks. If it revitalizes and heads back up to TRM (range midpoint), beware of jumping back into another bull trap. Money can be made riding traps, but you better know when to get out. Let the supper supply block be a guidepost. Otherwise, count on more retracements,...

Doge has been showing signs of weakness for some time now, evidenced by a recent break to the downside from a bear symmetrical. Above it looms three supply order blocks; beneath it is a freefall past the 1.272 Fibonacci all the way to the .058 area and throughout it all supply has been the dominant power. Be safe in these markets, be vigilant! **Like making...

Solana still not looking too hot, and understandably so. Imagine picking up some SOL for under ten bucks. Beware of impending bull traps if you're tempted to buy at this pre-drop level. I think a redistribution is coming as supply volume for this trading range still predominates. If SOL is your thing, and you have faith in the rebirth of this coin, it may be wise...

BTC is facing more downside, but this might not come before a series of bull traps. Overwhelming supply predominance within the macro pennant, with isolated demand spikes unable to break trend resistance (upper dotted line). As the price action meanders toward the bear triangle's apex, we see narrowing spread with supply bars steadily building. This means that the...

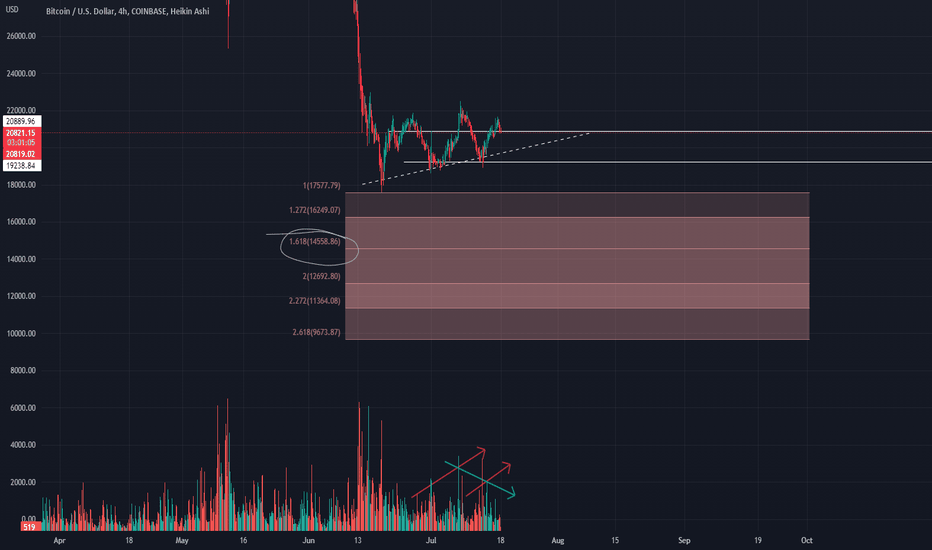

As consistent with the present trading range, supply still dominates. The last effort by demand volume was unable to re-take TSA (range support) from a 1.272% Fibonacci retracement bounce. This indicates the bears are in still in full control, with the next leg down estimated to reach the 12.5-13K zone. I will continue to monitor the volume spread analysis as this...

BTC & ETH are both in rising wedge patterns, which coincides nicely with the VSA (volume spread) reads I've been getting for the last two weeks when analyzing them. As usual, rarely do we see a direct pullback or rally when these biases have been identified; that would be too easy. Instead count on BTC continuing to draw bull investors and pump riders into the...

ALGO has been predictable with demand volume spiking systematically each time the PA bumps into the micro resistance. These spikes, however, have not been enough to flip the lines. We see that after the LVs are mitigated, down the PA goes, back into the channel to retest micro support and prepare for another attempt. I have no doubt the macro liquidity void (#3)...

Ascending wedge pattern emerging for ETH, which coincides nicely with the VSA (volume spread) reads I've been getting for the last two weeks when analyzing this coin. As usual, rarely do we see a direct pullback or rally when these biases have been identified; that would be too easy. Instead count on ETH continuing to draw bull investors and pump riders into the...

Here's a continuation of where I think we are in ETH currently (10/31/22). I am still siding with the bears, even though last week we saw the vital signs of a resurrection. However, I am observing supply is still predominant overall, cancelling out any TR breaks by the price action in overcoming the micro resistance. Until this happens with clear vertical bar...

Supply is predominating in the current trading range for ETH, which denotes a potential redistribution range. And not only predominating but emerging at key junctures where demand should show its cards if a markup were on the books.: areas like TRR (range resistance) and TRM (midpoint 0.5%). It's not clear how deep the distribution can range, but things are (for...

XMR (Monero) is exhibiting a strong falling wedge pattern. Falling wedges are typically textbook bullish continuations, so from here we can reasonably expect more upside after the price finishes bouncing within the wedge's support and resistance band. Look to take position upon breach of resistance and ride the markup to the 1.618% Fibonacci extension. Invalidate...

Here's my current take on where we are with Bitcoin. As it stands, all things point to further distribution. In the first half of the trading range (up to the UTAD), we saw an overall decrease in supply volume as the price action increased: this type of VSA divergence is bearish. In the second half, we are experiencing a pullback as supply volume increases in...

A quick surface analysis of BTC on the daily reveals a common pattern we've been seeing in previous redistribution zones: multiple failures to rally coupled with low demand at upper micro resistance. This is a critical area where we would expect to see demand (buying power) flood in. Instead, we see supply volume systematically crashing the party. Not to mention...

Bluzelle has been on a slow accumulation campaign, being methodically absorbed since the 18th of June by informed interests. Notice demand surging each time the PA touches an important juncture: TRS (range support), TRM (range midpoint), and now at TRR (range resistance). It's also emitting demand tests amidst a sea of low-level supply. All this while it steadily...

Possibility of 14.5K Bitcoin (.618% retracement) or lower if supply keeps expanding on the pullbacks. The repeated failure to rally (FtR) at range resistance is also bit concerning. Be ready either way. Buying power shrinking on the impulse waves intra-range is also something we must heed. Put it all together and we might be getting a good sale on Bitcoin soon!...

I keep getting the feeling Braintrust (BRTST) is marking time & waiting to spring up to close out the macro liquidity void at around 2.35. When that will happen one can only conjecture, but I think it will be soon due to a recent demand test. Set a limit sell order up between the 1.618 and 2.0% Fibonacci levels to get cashed out if it decides to make a run. Just...

TRAC on track for marking up from a symmetrical pattern it's been trending within for days. Climactic demand volume spikes every time the PA touches micro support, while the corresponding supply is staying low. Look for more expansion. 1.272 (20%) is a strong profit-taking zone IMO, and I am looking to get out at the 1.618 (30%) if we prevail in reaching it....

CTSI is flexing demand at microtrend resistance. Normally I would discount this and wait for confirmation but seeing so many of the alts making quick micro rallies up to the .272 - .618 areas, I figured I'd try to cash in on this one before I miss the opportunity. Invalidate if it falls back into the regression trend and beneath channel midpoint -- because who...