Jasmy could be looking to reclaim some lost territory in the short-term. Volume showing clear demand predominance as supply shrinks in the intra-channel pullbacks. Let's see where it goes. I wouldn't hold past 2.0%, being still in a BTC countertrend. It's like climbing a house of paper cards; take the money and run before the windstorm comes. *If you like...

DYDX is retesting the 1.0 Fibonacci boundary, on the cusp of a potential northern expansion. I'm keeping an eye on this one and wanted to post a chart before it (potentially) runs off too far to make it profitable for a cool 10% swing to the 1.618%. If not, it will fall back through microtrend resistance and into the regression trend. I would seriously consider...

LUNC is throwing the gauntlet down once again, inviting intrepid crypto traders to dare step into the moon rocket. It could just be a dud and go nowhere. The bull flag it's trending in seems to indicate otherwise, as large-scale institutional re-adoption seems to be happening -- at least that's what the volume is demonstrating. *Be sure to subscribe for more...

OXT is making a series of advancements as it crawls up microtrend support on its way to the Fib ladder. New demand seems to be emerging as it brushes the 1.0 lower level. Looking for more advancements. Profit/Sell zones between the .272 and .618. (.618 caps out the MacLV1). Good luck. *Like making money on swings? Be sure to subscribe for more dynamic &...

I shared this one with my group yesterday. Ape getting ready to make a move. Volume metrics showing pronounced decreases in supply pullbacks as the price trends symmetrically, with demand slowly increasing to the upside -- that's a formula for a potential markup. Let's see if we can swing this Ape to the 1.618 - 2.0% Fib zones. Get in and out if you can. Last...

ZEN demonstrating volume predominance exhibited as a series of demand tests in the vertical bars. This may -- or may not -- denote a potential markup brewing on the horizon. As usual, take up to the 6.18 if the PA surpasses the first fib zone barrier with continued demand, but be cautious in holding past the 2.0% as we are still on shaky ground with Bitcoin. The...

ATOM is in an all too familiar trading pattern, coming out of an A&E reversal (presumably) and cautiously retesting neckline to establish support. From here we expect a continuation of the markup up into the Fibonacci zones. All subject, of course, to BTC staying on its meds and not dumping. I wouldn't take it further than the 1.618% in a countertrend, which would...

CRV looking to expand out of a similar A&E pattern many alts are currently trending in. Some are popping off before others and are aiming at collecting up to 15% gains short term. I shared this one recently with the group, back when the prelim was .8538 & before yet another expansion attempt. Keep an eye on BTC which can still pull many of these alts back down. ...

Aergo/USD is rising among the numbers and is one of the latest preliminaries sent to the group at .1250. Here we are now at .1278 and things are still looking good. I'm cashing out somewhere between the .618 and 2.0% Fib. Every little bit counts in this countertrend, but please be careful: look for more surprise pullback action with BTC. We're not out of the woods...

API3/USD is exhibiting increased demand volume on the upthrusts and decreasing supply volume on the pullbacks within the ascending channel. This denotes bullishness. Possible 35% gain to the 1.618 Fibonacci if BTC continues to behave. *Not financial advice.

The 30-minute TF shows that the 1.0 Fib has been retested and passed, although nothing is a 100% sure thing in trading. But I'm expecting a further climb up the target ladder now. Look for increasing demand volume to power the PA as it expands to the upper range: to the .272 and beyond. Don't forget to take profit in those areas. All of this, of course, is...

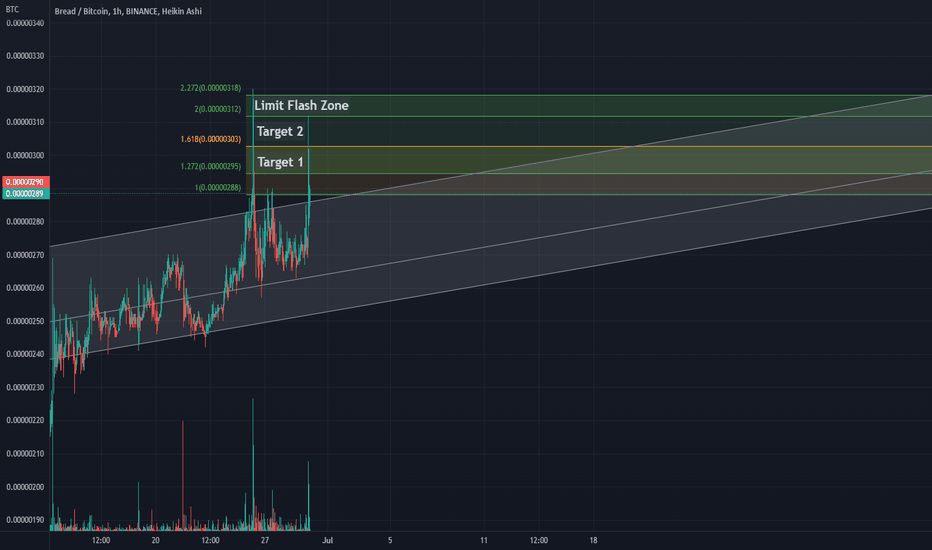

Forensically, BRD (Bread) is gathering strength along the 1.0 Fibonacci in the hopes of making another push up the target ladder. Subscribe for more dynamic swing charts based off VSA and Wyckoff TA. Overall accuracy hitting my profit/sell target ranges average between 80-85%. Check my past charts, then follow me and see for yourself! I'm all about making...

Is Luna Classic waking up? Short term gains are possible. How far it reaches and how long it is sustained still remains to be seen. Wrapped Luna Classic (WLUNC) is still pegged to Terra Luna Classic, which I imagine many still hold defunct in their Coinbase accounts. As I've mentioned to others in my group, hodl the stuff to Kingdom Come if you own it: Who knows,...

Look for a potential retest of 10.4 and further expansion as the PA moves to clear the upper liquidity voids. This is taking into account of course that BTC continues to behave. Bail ASAP if we cut back down below TRM (.9.64). *Be sure to subscribe for more dynamic VSA swing charts based off Wyckoff TA. Accuracy hitting the profit/sell target ranges between...

Karura makes a break for it. Third time's a charm? Let's see how it does now. Take profit at .272 & sell at the .618 while we remain in a countertrend. *Be sure to subscribe for more dynamic Wyckoff VSA swing charts with success ratios averaging between 80-85% to hit the profit zones. Check my past charts, then follow me and see for yourself! I'm all about...

AGLD is looking to head North. I wanted to get this chart up before it ran on us (like Ape & Orca did). My group got in earlier today at the TRM preliminary position (.44), waiting on volume confirmation. I plan on taking profit at the 1.272 and selling at the .618 on account of still being in the midst of BTC's countertrend. Wishing good luck, safe trading to...

Request is showing some upward momentum. Volume reads on the LTFs shows supply decreasing on the pullbacks -- evidence of reabsorption. Invalidate if the PA sinks below .11. *Be sure to subscribe for more dynamic VSA swing charts based off Wyckoff TA. Accuracy hitting profit/sell target ranges between 80-85%. Check my past charts, then follow me and see for...

The PA found the bottom of the regression trend and spawned fresh demand. New upthrust action can drive SYLO up through the channel and possibly wick the upper Fib ratios, such as the .272 & .618. Ringing the golden bell (.618) should net 20% gains from the current price. Not financial advice. DYOR and trade at your own risk.