jentmr

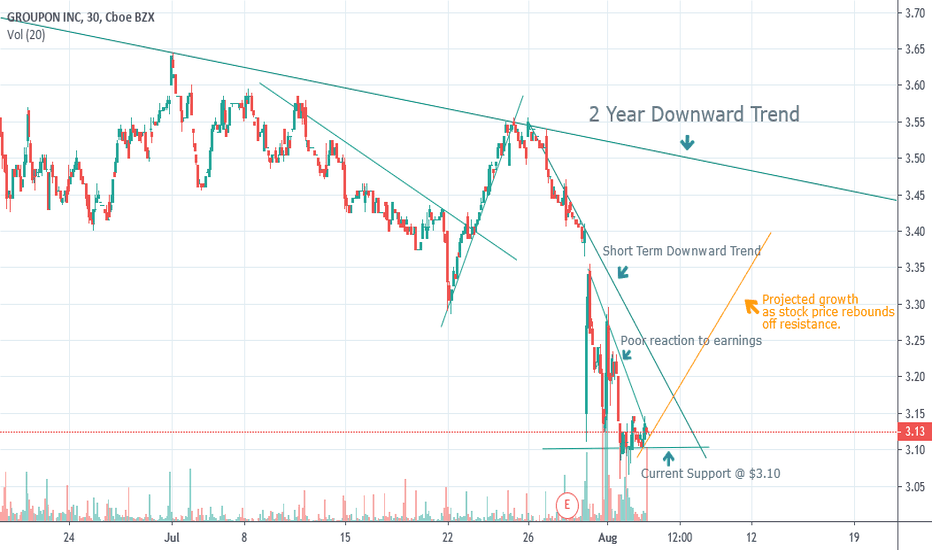

There is a lot going on here visually but if you can see past it I believe there is a nice rebound coming for GRPN as it comes off a week of aggressive consolidation. Currently the stock price is well below 2 year downward trend and has faced steep losses since the earnings report that came out last week. I project that long term the price will continue to fall...

RSI and MA anticipating an uptick in Kroger given that the earnings were in line with last year and the stock is oversold. Investors are likely to see this as undervalued over the next few months. Beware the eventual consolidation that will follow towards the end of the year and as the stock adjust to fall back in line with downward trend.

I was looking at this trying to determine a downward trend for GE but based upon the RSI and MA I am more optimistic that there may be an upward tick coming. I would suggest watching this for the next few weeks as it test the support / resistance barriers. Earning were nothing special but RSI suggest there may be a slight undervaluation here.

Trend analysis showing a long term declining trend for Ford over the last 5-6 years with proven resistance. Potential loss of 12-15% over the next month as Ford stock consolidates. This downward trend is fueled by weak earnings and a slowing market. Suggested purchase of Put Option @ $9 with expiry date of 08/30/19.