AUDUSD has moved out of it's ascending wedge and moves back into descension on all timeframes. You are here early as the trend has just commenceth

.........

As you can see this is ground zero. A test of 2018 sloping resistance which imo will happen, takes this to between £23-$26 minimum dependent on timeframe

Drown out daily noise, use it for buy targets. Easy pickings

Nearing the end of latest little pyramid, big pyramid pattern as previously mentioned. Big pyramid takes this down to .55-.53 although there is support in the lower .60's. This pattern should continue and would buy what I can at these levels with big future gains ahead as longer term chart structure remains in tact at these levels

Just published hourly view, 10 pips to the good so far. 4 hour view supports the target and even implies potential 20 pips more to tip of diamond.

GBPUSD is in a descending wedge on the hourly. Potential play to 1.298-1.30 if movement in wedge continues. Coupled with it knocking it's head on 2015 descending resistance most recently and downtrending moving averages on the shorter timeframes. GBPUSD should have a healthy pullback. Long term MAs are still bullish and the daily and weekly 50 is moving up so I...

Currently star of David symmetry has formed on the daily this is within a patented diamond formation. This formation tends to lead to strong gains with the monthly implying an upper end target at 1.39 and a weekly target between 0.75 and 0.80 (all within bounds of diamond). Break of weekly diamond could see the upper end polarity hit home for the longs.

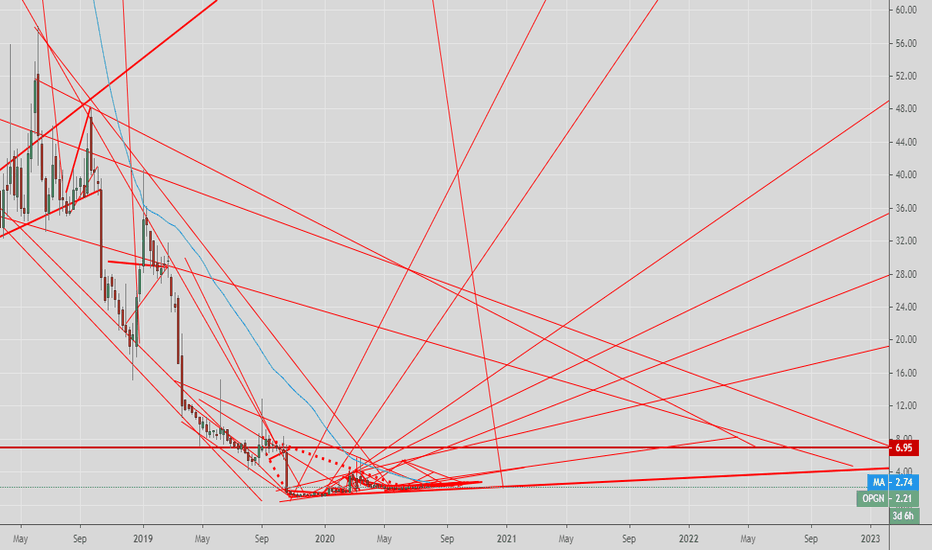

While all short term indicators and indeed weekly and monthly long term points to 1.11. We have seen Ptn has untangled layers of structure with break out after breakout in descending wedge. The most pivotal recently broken. Monthly targets here range from 1.68 - 2.08 but in current structure there could actually be a chance to catapult to $4-$7. I expect this...

Chart movement and OBV supports move to above $4. Sector rotation is starting to occur as money floods into renewables. Watch for a huge run. Movement has already started.

Using OBV as a leading indicator on longer timeframes. The OBV has broken out on monthly and weekly timeframes. Surpassing the OBV at 1.11. In In current movement on monthly and weekly timeframes, this areas has been earmarked as the next area of polarity to pull the price upwards.

GBPUSD is in a descenidng wedge after strong performance to my 1.30 target. Top of weekly ascending wedge. Short term play the descending wedge for 30 pips

Looks to be close to bottom of descending and around the 2019 long term support. Clear skies above and this could realistically be a 10 bagger from here

I already have charted Bitcoin prior to the important break and how we have moved from the long winter to spring/summer. XRP is in same boat after breaking long term descending wedge. It should move to around 0.60 min as my PT1

..if GBPUSD can breach the critical resistance levels seen above at 1.30-1.318 and I have some reason to believe this will happen given current USD state, there will be clear skies ahead for this pair to 1.40's so keep on watch for a strong break of that level. I would go long on a break with conviction of these resistance levels. The moving average curves on the...

As I had previously highlighted, Summer is here or at least spring as Bitcoin moves into permabull territory. Should head to around $17k on this run and we'll see where movement takes it from there.

Given the current paradigm shift and spotlight on stores of value such as precious metals and crypto assets the symmetry ad entanglement on this chart is hard to deny. Big moves coming.