jonnieking

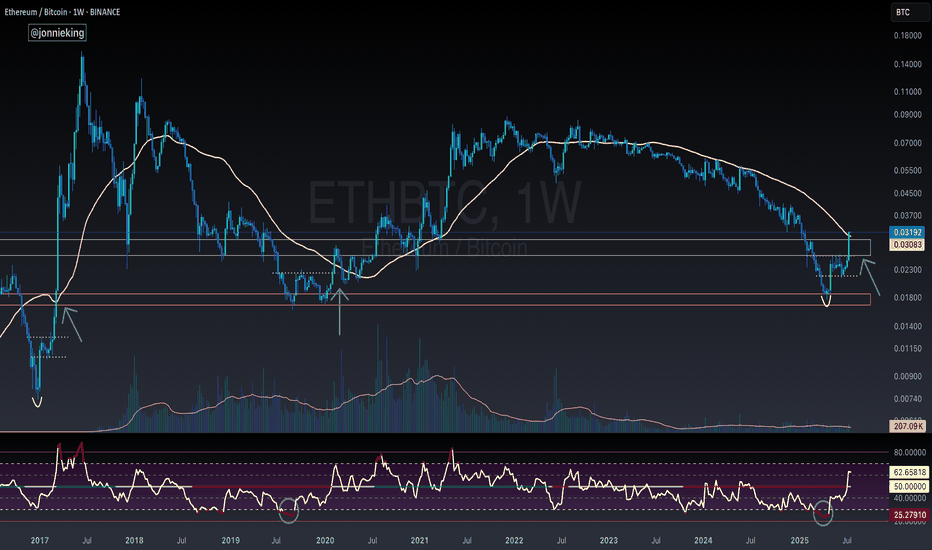

Premium2nd Consecutive Weekly Close above the 50MA for CRYPTOCAP:ETH ✅ Volume to confirm the breakout. ✅ RSI has bottomed. WHAT TO WATCH 👀 ┛Bullish Cross on the 20/50MA to confirm the next leg up. ┛Approaching some resistance ahead at the .236 Fib ┛Expect a small pullback in the next week or two so make sure to get your bids in. Remember the rotation: ✅ BTC > ✅...

Once again, highest Weekly Close on the Crypto CRYPTOCAP:TOTAL Market Cap ever. PA continues to trend above the EMA9 and POI. It’s worth noting Bearish Divergence on this local level. I do not believe this is much to worry about however and have discussed this in prior analysis which I will post in the comments. Strong Volume has shifted in the Bulls...

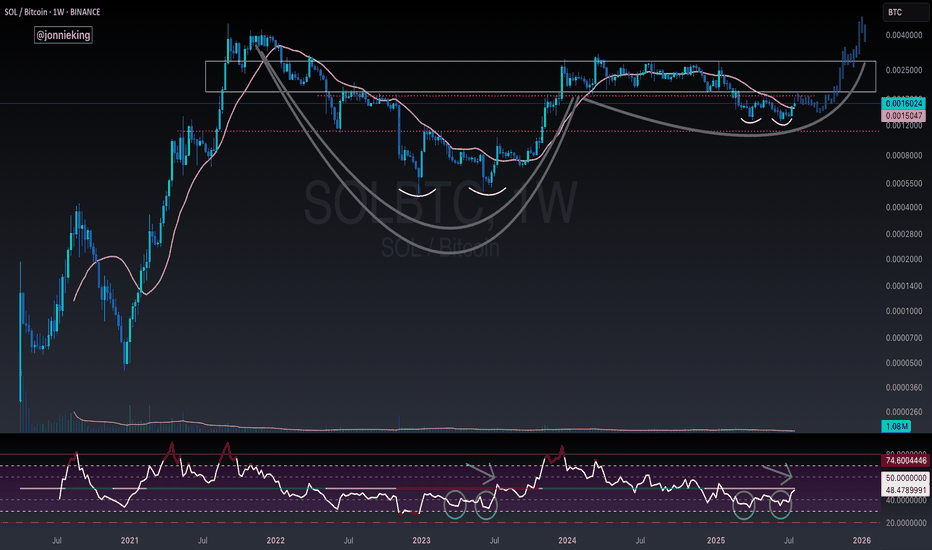

Beautiful cup and handle on the SOL / BTC Weekly chart. Need to break above the neckline and reclaim the POI. Double bottom on the RSI matches just before the rip in July 2023.

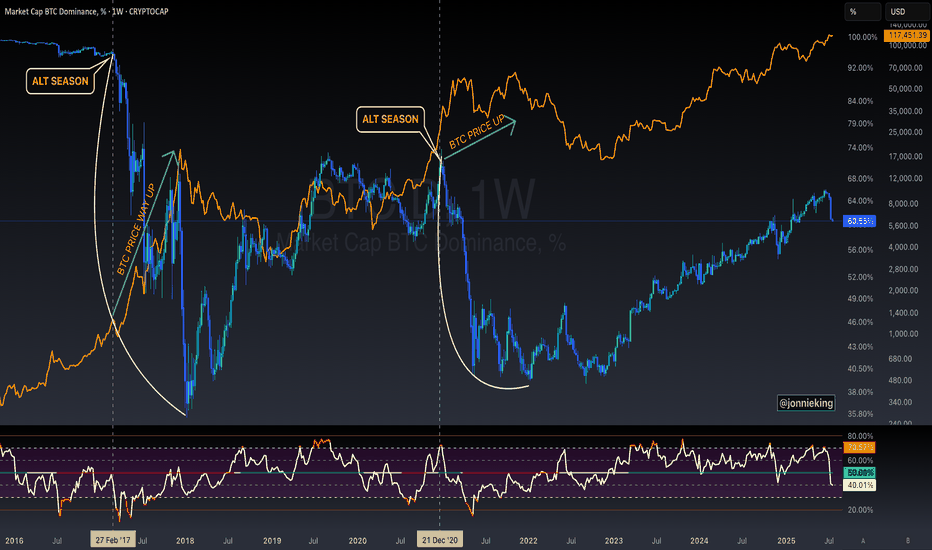

Someone posted on one of my tweets the following: " Jonnie my bro, the only problem for me right now is that btc didnt top yet. You also talked how btc shoud top around 200k range. Alt season can only come when btc reach top" MYTH DEBUNKED ✅ CRYPTOCAP:BTC does NOT need to top in order for Alt Season to commence. Both can and will occur in tandem 🤝

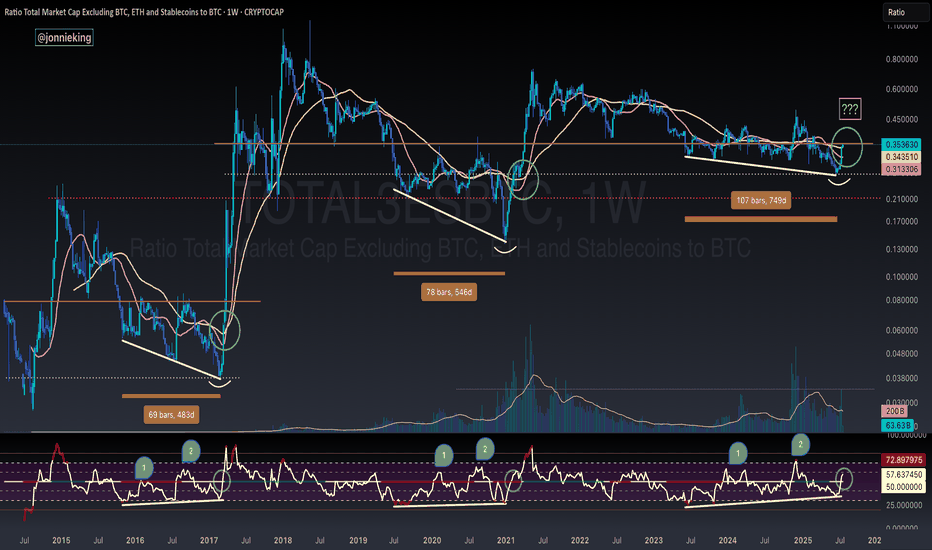

BULLISH DIVERGENCE on CRYPTOCAP:TOTAL3 against CRYPTOCAP:BTC 🏁 You will see every time the RSI passed 50 on the Weekly chart in the post-Halving year it signaled Alt Season 🚀 This coincided with 3 tests of this level at 50, with the 3rd test being the real breakout 🤌🏼 Volume confirms change in trend 🏁 AWAITING CONFIRMATION 🚨 🅾️ Close several Weeks above...

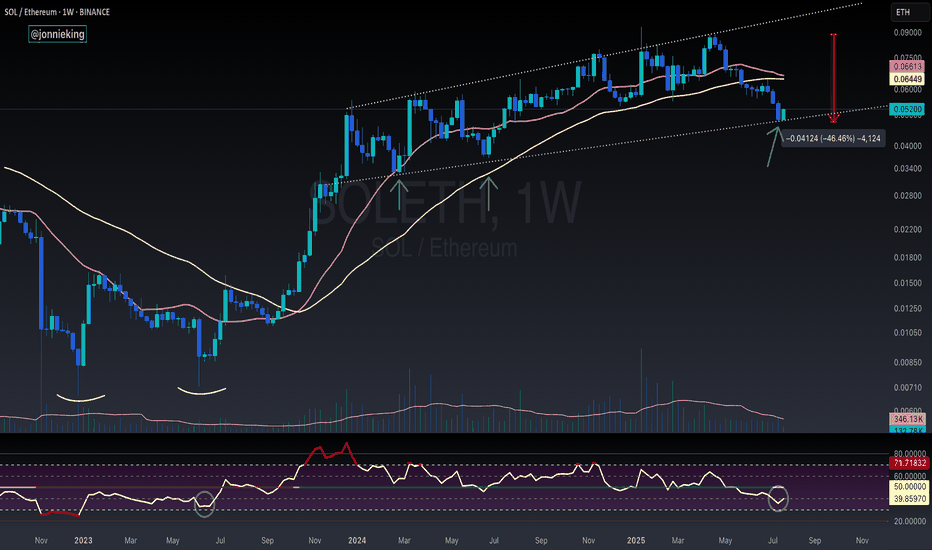

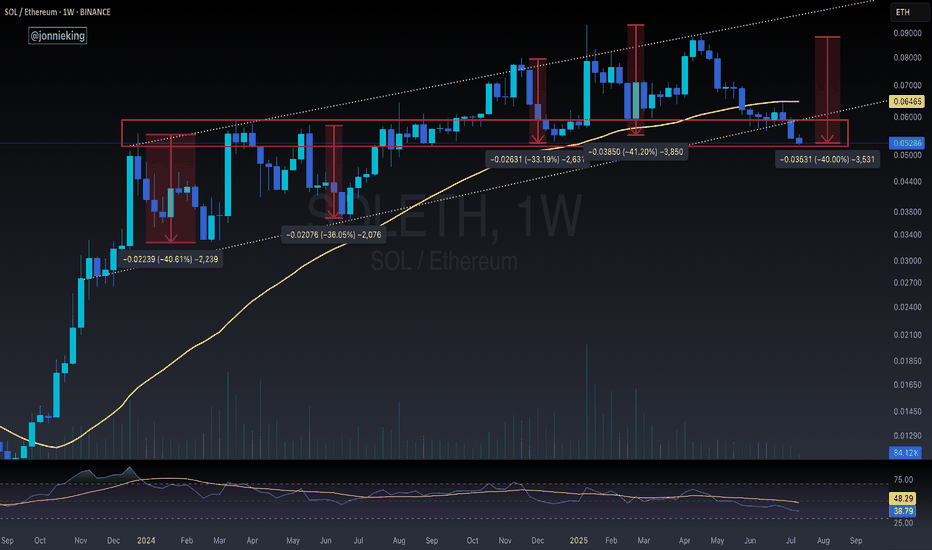

I suspect CRYPTOCAP:ETH has a bit more gas in the tank, but the early signs for the real Alt Season are nearing. RSI on the weekly is nearing the June 2023 bottom which kicked off the massive bull flag formed on SOL / ETH for the next 2 years. Still too early to call at this point tho. Need volume to really burst through in the next week or two. I’d also...

ALT SEASON ALERT 🚨 CRYPTOCAP:ETH Closed the Week ABOVE the 50WMA Historically this has signaled the start of ALT SEASON. *NOTE* 2020 had the pandemic hiccup. This bottoming pattern looks very similar to the 2017 explosion. Also the RSI matches the 2019 bottom. Dare I call it yet bros? 🤓

SOL / ETH loses the 50WMA. Has been trading below it for the past 7 weeks, something we haven't seen since 2021. Has also broken down from the 8 month bull flag / parallel channel. Retesting the key POI I've been eyeing. HOPIUM: We've seen great rallies after CRYPTOCAP:SOL goes down ~40% vs CRYPTOCAP:ETH , which it is at now. We SHOULD see a...

CRYPTOCAP:BTC appears to be headed towards an ABC correction after this impulsive 5-wave move to the upside Would be a great opportunity to fill the CME gap ~$114k Lines up perfectly with the 50% gann level retracement to confirm the next leg don't shoot the messenger.. just sharing what i'm seeing 🥸

Reclaimed the .236 Fib 🔥 Volume to confirm ✅ Bullish crossover on the 20 / 50MA It’s about time!!! CRYPTOCAP:LINK Marines Unite 🪖

What a FILTHY Weekly Close back within the POI 🚀 Bulls are back in biz, for at least the next few weeks. I’m expecting a bit of sideways chop here, and the next leg up the first or second week of August. This is in no way, shape or form a call for “ALT SEASON”, yet. Still need to see what happens in the next few weeks, BUT IT LOOKS PROMISING 🙏

YUUUGE Daily Close today for CRYPTOCAP:BTC Bullish cross on the 20/50MA. Appears to have broken out of a bull flag. Need PA to stay within this POI in order to confirm another leg up.

CRYPTOCAP:BTC closes the Week with a Big Bullish Engulfing candle back within the POI. Should retest ATH soon.

CRYPTOCAP:SOL closes the week with a Bullish Engulfing candle. 50WMA at $170 next target to smash.

₿itcoin Dominance reaches new cycle high tapping 66% If there's one thing I learned this cycle, it's never to sell your CRYPTOCAP:BTC for Alts. If you want to play the casino, play with USD 💯

CRYPTOCAP:SOL closed the day back within the POI. RSI oversold. Should see a retest ~$136 to confirm the local bottom.

Yet again this chart predicted the nuke to the day 💣 I know I shouldn't be surprised at this point, but I'm still fascinated by how accurate technical analysis can be 🤓

What a wild close to the Week for the Crypto CRYPTOCAP:TOTAL Market Cap Closed just above the 50% Gann level within the POI, but failed to close above the EMA9. Strong bounce off the SMA20 still shows bull have some gas left in the tank, but I suspect we go lower with such a massive bearish candle on the week. SMA50 is ~2.8T