jvrfxalerts

PremiumHello traders The Euro is showing signs of bottoming out at the weekly support levels against USD, JPY, CAD and AUD. MOST IMPORTANT: USD: While King Dollar is clearly reigning after the FOMC indication not to expect rate cuts any time soon and solid economic data, the "What If" factor is NFP tomorrow and to a minor extent month end settling. If the NFP print...

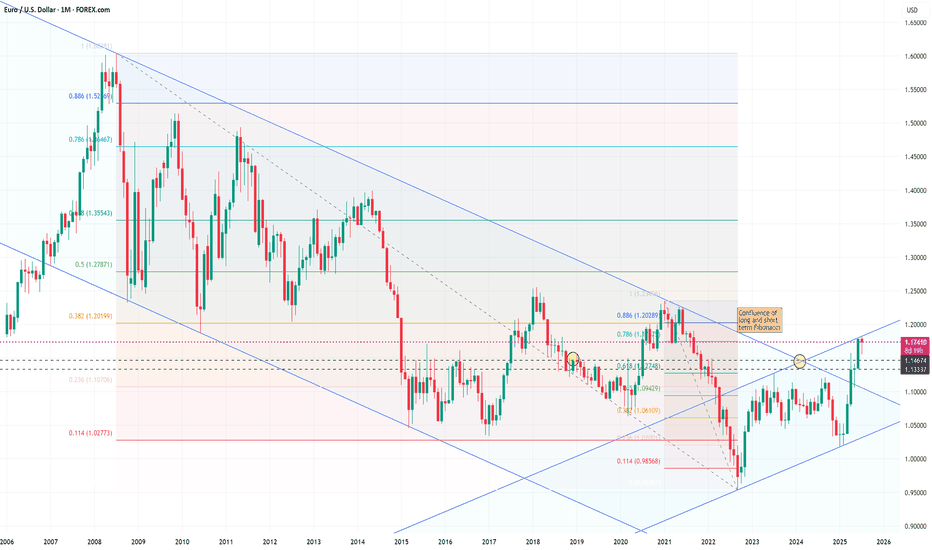

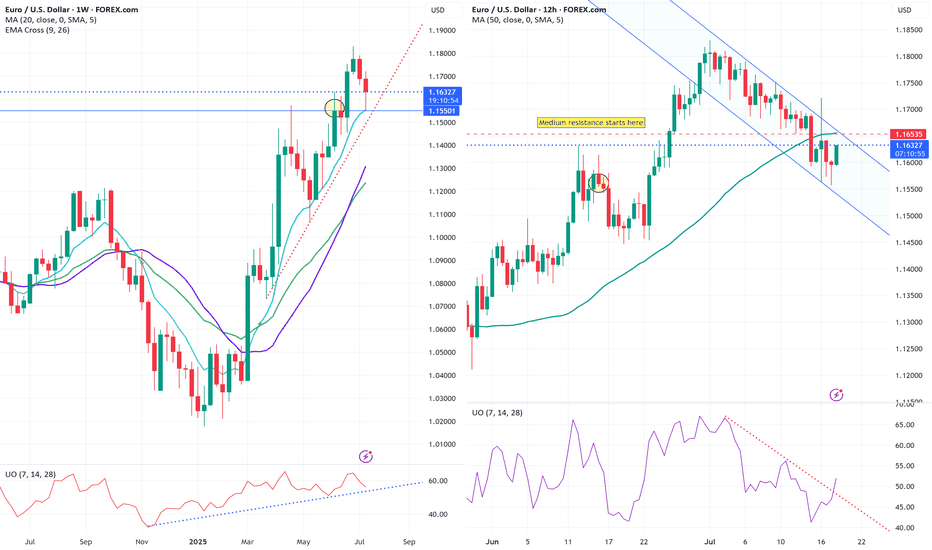

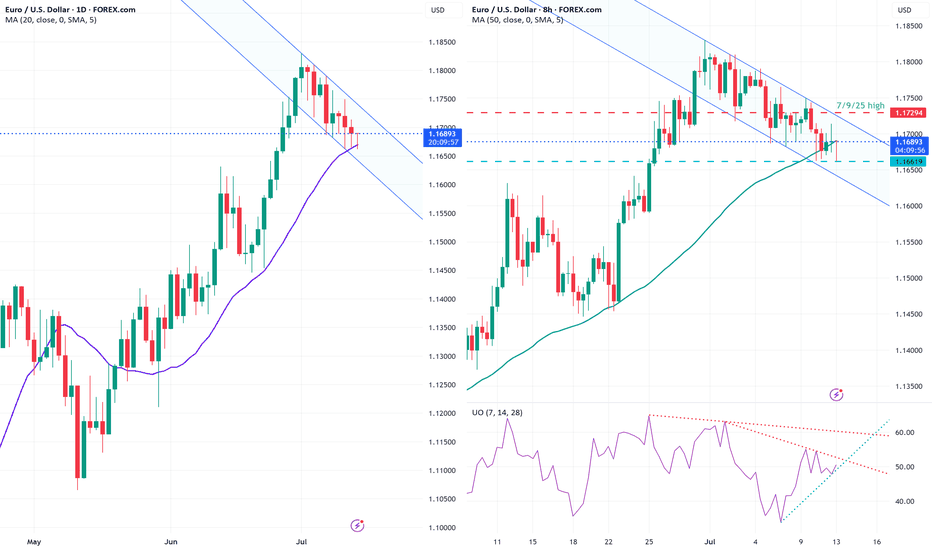

Hello traders I have utilized MTF(Multiple Time Frame) analysis for this idea in addition to the current fundamental environment. The previous weekly levels can often be a good starting point for where this widely traded pair may head next. On these charts, price has failed ahead of the weekly close of 1.1775. So far. Fundamentally, the details of the USA/Euro...

Hello traders My short was short lived and not too damaging. This powerful EUR/USD bounce is not unusual but perhaps a little bit of a head scratcher. No economic data of note. Maybe some positioning before the ECB rate decision? I don't know what time this morning Senator Mike Lee(R) of Utah decided it was a good idea to repost a clearly fake resignation letter...

Hello traders My previous EUR/USD long did not pan out but I am swinging again. My entry order at 1.0563 was filled by the skinny skin of my teeth but so far so good. I'll use a trailing stop for this trade. The pressure on Fed Chair Powell is being ramped up by Trump's attack dogs with allegations of mismanaging Federal funds(gasp :) ) during the FOMC...

Hello traders I have entered into a long position at 1.1665. The charts show a base being built right around that level. DXY is ticking down but US 10Y yield is steady. Bitcoin at an all time high is in my opinion not a sign of risk on but rather USD liquidation in favor of BTC. Gold has just broken above the last daily high. There are rumors making the rounds...

Hello traders I entered into a short GBP/JPY position last week after the contraction in GBP Industrial, manufacturing production and GDP. The United Kingdom is also struggling with their own version of the Big Beautiful Bill. The difference is of course that there is no Republican Congress there who is willing to throw their constituents under the bus by cutting...

Hello traders I have taken a break from trying to trade this chaotic mess we have witnessed over the last few months. Liberation Day, Big Beautiful Bill, the Middle East as volatile as ever, Iranian nukes destroyed, etc. etc. On the domestic USA front we have also witnessed daily headlines of the Trump administration being sued, anti-immigration campaign promises...

Hello traders Clarification: CAD is also referred to as the loonie, a former Canadian one dollar coin. The 50 base point cut by the BoC was expected. The CAD strengthened against the USD and CAD immediately afterwards. Classic knee jerk reaction of buy the rumor, sell the news. Both EUR/CAD and EUR/USD have found support on the 4H chart. The EURO has been on the...

Hello traders I have been sitting on my hands since my last post. Thanks to @InternalTraderNYC to exercise patience. No trades, no harm. But keeping an eagle eye on the daily market chaos. I know this may come across as "told you so" but whatever I post is always with the goal of bouncing ideas and insights off my fellow trading warriors. I mentioned the IEEPA...

Hello traders The allegory of our current global economy and Moby Dick, the rare white whale, hunted by the obsessed Captain Ahab, is not one I am writing about in a light hearted manner. A refresher: Moby Dick(China) bites off Captain Ahab's(USA) leg and is subsequently relentlessly hunted by the obsessed captain who wants revenge. At the conclusion of the novel,...

Hello traders The allegory of our current global economy and Moby Dick, the rare white whale, hunted by the obsessed Captain Ahab, is not one I am writing about in a light hearted manner. A refresher: Moby Dick(China) bites off Captain Ahab's(USA) leg and is subsequently relentlessly hunted by the obsessed captain who wants revenge. At the conclusion of the...

To be, or not to be, that is the question: Whether 'tis nobler in the mind to suffer The slings and arrows of outrageous fortune, Or to take arms against a sea of troubles Hello traders Straight from the Bart's mouth. Should we continue to duck and dive through this chaos and continue trading? Or will we drown in this sea of troubles? Well, I shorted EUR/USD...

Hello traders This is a look at USD and the relationship to other asset classes. DXY: Daily close above the weekly breakout level. Fundamental: CPI ticked down but CME FedWatch tool still shows first rate cut only in June. PPI tomorrow may change the trajectory again. Dollar dumping might reflect international investors selling USA assets. EUR/USD: At the upper...

Hello traders Well, what an exciting but yet predictable week with the tariff turmoil. I have advocated several times in the past to keep an eye on the US 10Y yield but yesterday's price action definitely left me feeling like my head was spinning on my shoulders like Beetlejuice. Fun movie. However, I was on the EUR/USD long side after the rejection lower at...

Hello traders Yesterday's trading was most profitable, riding the high speed elevator up and down with long and short positions throughout the session. The chart seems to favor an upturn in the USD. Why? Maybe because the US10 Y T-note is still one of the most reliable sources of yield. The one risk that we should watch out for is a downgrade of the USA AA+...

Hello traders I did mention in my last idea that I have sidelined the markets but volatility can be very profitable if the correct levels are in play. My entry buy order was filled at the weekly high of 1.0889. I took profit at the 0.786 fib at 1.0990 and switched to a short. However, I will reverse again if 1.0954 holds during this session. My take is simply,...

Hello traders This chart layout is not new. See my original Idea from February 23rd. The wrecking ball is not gaining momentum. It reached supersonic speed yesterday and shattered the illusion that all is well on the blue planet. The United States of America has upended the Global order that took 80 years to establish after WWII and financial markets that...

Hello traders I have mentioned the Trump chaos theme numerous times in my previous ideas. History repeats itself. Once again, the punches come from a different direction on a daily basis. Fundamentally, nothing seems to have changed. Trump vacillates on tariffs daily. The new Canadian PM is threatening to terminate electricity supply to the USA which will affect...