khatantuulbatbayar

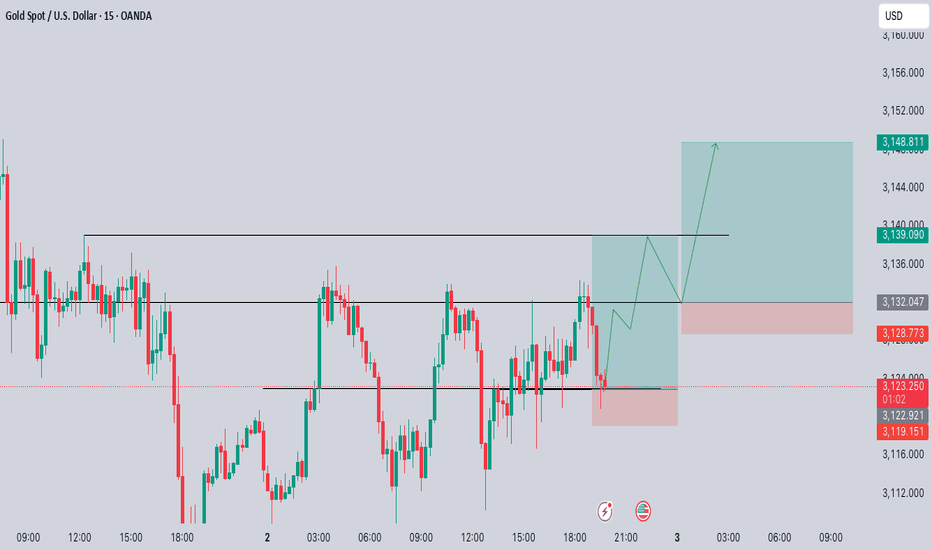

trend goes up. Entry on: 15m-1h TF discount zone 15m OB once the price breach 3130 zone, planning to add buy position on pullback.

Still believing to the swing low. But the price has shown a strong bounce from the monthly CRT. I'll continue to monitor it around the key levels.

There was a nice LQ sweep from a swing high. Currently, an N3 is being built. On the 1 and 4-hour chart, the trend has turned bearish. There is potential for the price to move down to the recent swing low. In the meantime, there should be reactions at the marked key price levels.

Made divergence at 4H timeframe and higher high at 1H timeframe. Planning to open long position around @1893.5, potentially goes to @1953.5

OILUSD chart broke the red support line we were curious about. While it breaks the trend line, may making Head and shoulder pattern. @89.0 support line may got the neckline of the H&Sh pattern. I am planning to make risk entry @92.8 for short position, which will be may pullback on broken trend line.

Nas100 chart still making lower high after break the bold red trendline. Now chart pattern making pullback on neckline of the double top, potentially goes to @12900.

As you know, we planned to open short position when trend line breaks. Still waiting for confirmation for it. Now, the trend line got strong support, so we will wait for bearish pattern on 15M timeframe, after chart breaks the trend line. Target is 152.0

The chart reached the up line of of the bold blue channel while making the bearish pattern in it. Now waiting for reaction on red trend line, (A) if the market structure bounces on that trend line, chart may make the douple top on the up line of the bold blue channel (around 94.0), It will be good risk and reward to open short position. (B) if the market breaks...

if chart can break the trend line of the channel, potentially go down to 150.0

The candle may make bullish pattern. Third touch of the pattern may cross on the support line which is coincide on fibo 61.8. Planning to make risk entry around 4391.0 and probably will scale in around 4459.0 if candle pullback on broken bullish pattern.